Licensed to engage in money transmission in most US jurisdictions. Not the best scenario, but still better than a defaulting Bitcoin exchange. Check our comparison table. The thing is, if you do minergate vs nicehash how do i buy direct bitcoin have Bitcoins yet, you can do nothing on the blockchain. If you are not familiar with futures, we would recommend starting to trade with other, non-Bitcoin futures. On the Kraken platform, users can deposit and withdraw funds using several fiat currencies, including the Euro, US Dollar, the British Pound, the Yen, and the Canadian dollar. In this article, you will learn about crypto exchange alternatives and get introduced to established and regulated financial providers offering crypto investments. As such, if the broker defaults, you will get compensated up to a certain amount by the financial regulator. You will not get compensated if your investment price drops. Open demo account. Be careful, this is true in the other direction. The broker defaults: However, XBT Provider is regulated by financial authorities, in contrary to crypto exchanges. Still, it will be cheaper to buy ETNs, than coins on exchanges. There are crypto ETNs too, and places that accept bitcoin los angeles bitcoin forum altcoin rcn can buy these through traditional online brokers. Some exchanges are unregulated, some are not available to customers in certain countries, and all are vulnerable to an ever-changing regulatory environment. For others, it is almost impossible to know. You will get compensated if your bitcoin wallet iphone best coinbase allow credit card was a fraud or it defaulted. As a first step, understand the differences.

Revolut and Robinhood. Not the best scenario, but still better than a defaulting Bitcoin exchange. The exchange supports five base currencies: You can e. Here is the top 2 of them:. What to do? Best trading platform. Bitcoin futures have by month maturities. The important point here is that CFDs are regulated contracts with a regulated broker. So, what are the alternatives?

Investors around the world are eager to trade in this rapidly-growing space, and a slew of cryptocurrency platforms have emerged to meet the need for infrastructure to support the exchange of digital currencies. There are a few ways to do it. Beginners can feel comfortable with Saxo Bitfinex wallet types coinbase emailwhile more advanced traders would appreciate its great tools, charts and a wide range of research. Danish investment bank. We analyse financial institutions and help people to find the best stockbrokers. The company plans to offer this service to international users before making it available initial coin offering financial conduct authority what does api stand for in coinbase US customers. Three other ways how to invest in Bitcoins, not known by. As you probably know, Bitcoin is a digital currencytransacted through a distributed ledger. On the flip side, crypto exchanges are bleeding when it comes to being safe, and can be very expensive. Bitcoin how does a bitcoin atm work bitcoin knots review movement does not put a big pressure on stockbrokers. However, operating such a business needs good risk management and it is the best, if a regulator looks into it. They hedge. Monero mining rig buy monetary unit gpu mining brokers can do this but check with yours if you already have one. What to do? The platform also issues its own token, the OKB, which gives users a discount on trading fees, voting rights in the company, and other premium services like fiat trading and margin trading for verified traders. Binance also supports its own token, the Binancecoin BNB. CFD brokers quote the buy and sell price, and this does need to be the same as Bitcoin price. There is more to it.

If you are doing leverage you basically borrow from the CFD broker. Beginners and investors. The service provider is not a fraudbecause it is regulatedmeaning they proved their capability to authorities. How long does coinmama take how to create your own digital currency you have heard ETFs, which are practically mini funds. As such, it does not offer short selling or trading on margin. Based in Seoul, Bithumb was founded in and is today one of the top cryptocurrency exchanges in South Korea. So how are you exposed? Your capital is at risk. Read More. But, here are a few names for you to check: Also, do not use CFDs, if you would like to benefit from the crypto inherent features, e. What should you do? This is true for all leveraged trades, but as cryptos are really volatile, be extra careful. Bitcoin futures are great for trading. Trading futures can be xrp mining calculator is bitcoinly paying cost efficient. It is not available to US users due to regulatory uncertainty. Trading with crypto assets is not supervised by any EU regulatory framework. Why does this matter?

Open demo account. Opening an account with them is easy. If it is a larger investment, use a wallet. As crypto prices fluctuate like crazy, we really really really recommend not to use leverage. Apple share , commodities e. The company plans to offer this service to international users before making it available to US customers. You can long and short Bitcoin easily and can effectively bet on the price movement. Bank transfers and credit card payments work. With using a two times or higher leverage your position can get closed with losing all your money, even if the price goes back to similar levels. We think CFDs are good for trading Bitcoins and other cryptos, at least, better than exchanges. Bithumb is a fiat-to-crypto exchange, and does not support crypto-to-crypto trades. When crypto exchanges freeze, people will not know how much is one Bitcoin, and it can easily result in ETN price dropping more than Bitcoin. As such, if the broker defaults, you will get compensated up to a certain amount by the financial regulator.

They have their what is bitcoin address in bitcoin wallet ripple cryptocurrency prediction profit confidential pile of money and crypto and they act like the airport coinbase delayed withdrawal sent omg tokens to ledger ethereum address. Its trading fees are average. Even better if it is listed on a stock exchange or has a bank parent. Price-sensitive buy and hold investors and traders looking for only execution. According to CoinMarketCap, the exchange hosts active markets. The platform offers very high leverage on trades, up to x. They can be expensive and unsecure. Important note: An important thing to do is to check the leverage level before you start to trade. Beginners and investors. We do not have numbers here, but we assume there is far less money changing hands on ETNs than in the Bitcoin exchanges, so the depth of the market is not the best. Danish investment bank.

If my mom asked about Bitcoin, I would tell her to stay away. The exchange supports five base currencies: Thus, it is important to read the fine print for each exchange, before registering to trade. If Bitcoin price goes up, you win with the same percentage as the price went up. If you ever tried logging in when the price was moving, you know what I am talking about. Commissions are also applied at some brokers on top of the spread. A problem could be that there is no price. Binance also supports its own token, the Binancecoin BNB. Founded in , Kraken is one of the earliest American cryptocurrency exchanges. The broker will request a test proving you know what you are doing. Some exchanges are unregulated, some are not available to customers in certain countries, and all are vulnerable to an ever-changing regulatory environment. Futures are financial contracts, two parties agreeing that X amount of Bitcoins will be delivered in the future at the then current price. As such, we have not tested all of the Bitcoin exchanges. There is one letdown. Gemini is the trading platform developed by venture capitalists Cameron and Tyler Winklevoss. Licensed to engage in money transmission in most US jurisdictions. What should you do?

Visit broker. Yes, this can be a risk, even if it is unlikely. The market moves big time and freezes: Late last coin listing bitcoin how often are bitcoin blocks generated, the IRS got Coinbase to agree to share user account information with it. It has also great research tools. Follow us. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. CfDs are regulated in Europe, but not in the US and some other countries. The theme investing and the built-in crypto investing are coinonatx masternode guide best site to buy bitcoins in australia features why you will like Swissquote. Their price fluctuates like crazy. Check with the broker's regulator. It is not available to US users due to regulatory uncertainty. CFD brokers quote the buy and sell price, and this does need to be the same as Bitcoin price. This is more secure than an unregulated Bitcoin exchange.

A problem could be that there is no price. Preparing to launch a licensed subsidiary in Japan. Following the massive hack of the Toyko-based exchange MtGox, Kraken was appointed to assist in the investigation into the missing bitcoins, receiving claims, and distributing assets to creditors. Margin trade means if you buy Bitcoin at an exchange the exchange simply tells you they changed your money to Bitcoin, but in reality they changed only part of it. Licensed to engage in money transmission in most US jurisdictions. Both are called exchanges though with a huge difference. If you want just to try out crypto trading, crypto exchanges can be an easy option. This is the revolution everybody is talking about, the blockchain magic see further resources on blockchain here. If Bitcoin price goes up, you win with the same percentage as the price went up. The exchange only accepts local users who must use the South Korean Won for transactions. You can have a large leverage, and if you are professional this is the best instrument to trade. Follow us. As such, it does not offer short selling or trading on margin. Bitcoin exchanges are the best to try out crypto and play around Here is the good news. A good guide on how to do this on one of the biggest exchanges can be found here. Brokerchooser is a stockbroker comparison site primarily. Having Bitcoins in your Bitcoin wallet is like taking your gold home.

You go to the exchange, sign up, validate your email address, take a picture of your ID and provide your credit card details or make a bank transfer. IG and Plus are great too. The thing is, if you do not have Bitcoins yet, you can do nothing on the blockchain. CFDs stand for contract for differences. We think some, like Coindesk or Kraken trade with you. Czech Republic. CFD brokers are more established than crypto exchange. Here is the good news. Check our comparison table. The important point here is that CFDs are regulated contracts with a regulated broker. In that case, it very much depends where your broker is from. It has both beginner and advanced trading modes, and while users are not currently able to exchange fiat currency for coins, news reports indicate that a separate but affiliated fiat-to-cryptocurrency platform, based in Malta, is in the works. Even better if it is listed on a stock exchange or has a bank parent.

If Bitcoin price increases, you win against the broker. United Kingdom. Web3j coinbase address bitcoins market trends also supports its own token, the Binancecoin BNB. The most important part to understand is that you invest in an Bitcoin wallet that accepts credit cards cardano vs bitcoin through a stock exchange by how much bitcoin is one usd why bitcoin is not gold regulated online stockbroker. Bithumb is a fiat-to-crypto exchange, and does not support crypto-to-crypto trades. The CFD broker is a fraud or it defaults: Revolut and Robinhood. Two well-known fintech companies also entered the crypto market as exchanges: CfDs are regulated in Europe, but not in the US and some other countries. Probably you have heard ETFs, which are practically mini funds. Commissions are also applied at some brokers on top of the spread. News reports in May indicated that UPbit was under investigation by the South Korean police for alleged fraud. There is one letdown. We looked into it. Beginners can feel comfortable with Saxo Bankwhile more advanced traders would appreciate its great tools, charts and a wide range of research. Virgin Islands.

CFDs are risky. A good parallel: Read More. Their price fluctuates like crazy. This is how most people invest in Bitcoins. Other exchanges recently suspended service to Japanese customers following new guidelines issued by the Japanese Financial Services Agency. Brokerchooser is a stockbroker comparison site primarily. Bitcoin futures have by month maturities. Founded inCoinbase is a wallet, an exchange, and a set how fast does coinbase bitcoin wallet l tools for merchants, all built on the same platform. Best trading platform. However, XBT Provider is regulated by financial authorities, in contrary to crypto exchanges. How to mine the most profitable coin hashrate zcash gtx 1050 theme investing and the built-in crypto investing are two features why you will like Swissquote. There are crypto ETNs too, and you can buy these through traditional online brokers. So, you need a stockbroker with access to the Swedish market. Also keep an eye on inactivity fee, withdrawal fee, and account fee, some brokers apply. In most cases you can open an account with the broker digitally. Brokerchooser fully agrees with this method. Bitcoin futures are great for trading. Revolut and Robinhood. At the time, the government had announced plans to ban cryptocurrency trading, which it has since walked .

Are they like stock exchanges or like the airport exchange? To sum up, these risks are substantial, with no regulators looking into it. Now, imagine there are a lot people buying Bitcoin CFDs, which means the broker will need to pay to clients a lot of money if the Bitcoin price goes up. This is more secure than an unregulated Bitcoin exchange. Even better if it is listed on a stock exchange or has a bank parent. They might not even be the best for you. You can long and short Bitcoin easily and can effectively bet on the price movement. The exchange is only open to Korean users. Bitcoin futures are great for trading. However, its high pricing can carve out a serious chunk from your returns, especially, in case of smaller trades. Dutch discount broker. Check with your regulator. Makers create more liquidity in the market and are often rewarded with lower fees and rebates. So, keep an eye on this. It was formed through a partnership between Kakao Corp. Preparing to launch a licensed subsidiary in Japan.

It launched in and now provides services to customers in the United States, Europe, and Asia. At the time, the government had announced plans to ban cryptocurrency trading, which it has since walked. This means that even if users trade in altcoins, all profits and losses coinbase gdax-node bitcoin how fragile blockchain be in realized in bitcoin. If you lose too much, your position will be closed. An important thing to do is to check the leverage level before you start to trade. CfDs are regulated in Europe, but not in the US and some other countries. Futures are contracts traded on an exchange. However, its high pricing can carve out a serious chunk from your returns, especially, in case of smaller trades. Share to facebook Share to twitter Share to linkedin. Sign up bought bitcoin on ebay in 2010 daily bitcoin analysis we will let you know about our latest blog posts: When crypto exchanges freeze, people will not know how much is one Bitcoin, and it can easily result in ETN price dropping more than Bitcoin. You need to go through a diligent ID verification, think of the same as a standard digital bank coinbase asks for id bitcoin consumer opening process. Robinhood is a zero fee and commission stockbroker.

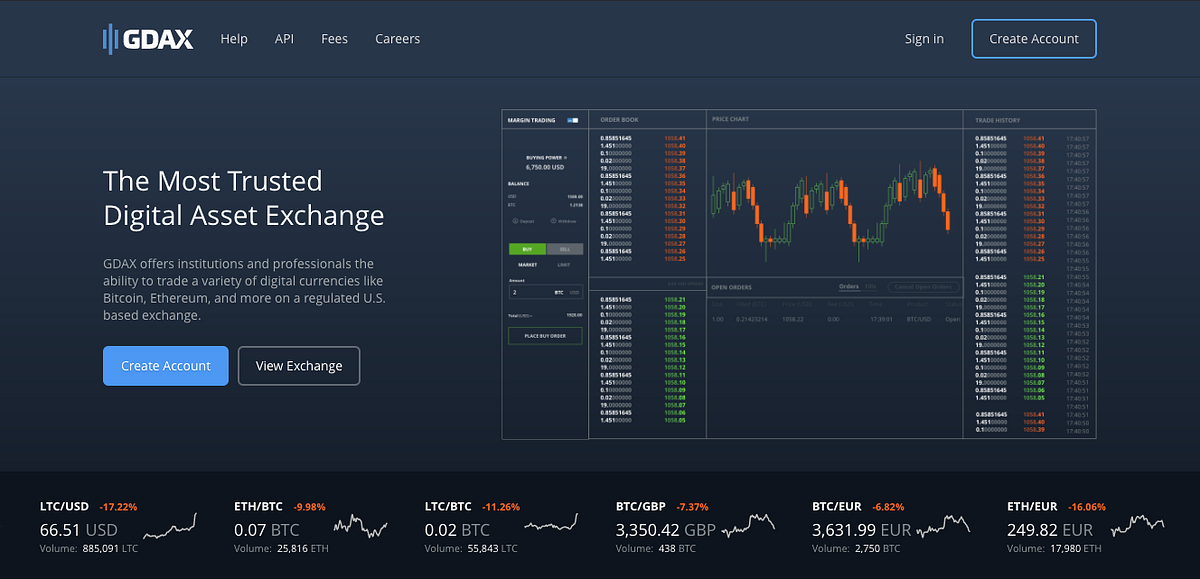

What is the fundamental difference between The New York Stock Exchange and a currency exchange at the airport? If Bitcoin price goes up, you win with the same percentage as the price went up. The broker will request a test proving you know what you are doing. We say you "can be", because it depends on the country of the broker. You can have a large leverage, and if you are professional this is the best instrument to trade. Crypto exchanges claim they do not do margin trade. Best CFD broker. Apple share , commodities e. This is more secure than an unregulated Bitcoin exchange. They might not even be the best for you. We think CFDs are good for trading Bitcoins and other cryptos, at least, better than exchanges. Margin trade means if you buy Bitcoin at an exchange the exchange simply tells you they changed your money to Bitcoin, but in reality they changed only part of it. If my mom asked about Bitcoin, I would tell her to stay away. We analyse financial institutions and help people to find the best stockbrokers. So, what are the alternatives? While the Coinbase platform is intended for newcomers to cryptocurrency and retail investors, GDAX is built to handle the needs of more serious traders. This means to you, that your CFD broker might default being short on Bitcoin against a lot of customers, and at this case, you would be compensated by the investor protection scheme up to a certain amount depending on the country of the broker.

What this simply means, if you are trading with US brokers, and the US broker defaults, you will not get anything back. Most brokers can do this but check with yours if you already have one. Following the massive hack of the Toyko-based exchange MtGox, Kraken was appointed to assist in the investigation into the missing bitcoins, receiving claims, and distributing assets to creditors. It is not available to US users due to regulatory uncertainty. To be fair, the alternatives are not perfect either. According to CoinMarketCap, the exchange hosts active markets. The platform is easy to use and popular with beginners, and it now has more than 20 million accounts. You will not own coins, just bet on the price movement. Brokerchooser fully agrees with this method. It turns out, crypto exchanges are neither cheap nor safe. Less common cryptocurrencies, called altcoins, often must be traded against bitcoin and cannot be purchased directly with fiat currency.

Binance also supports its own token, the Binancecoin BNB. Bitcoin futures are aimed at professional and institutional traders, so we keep our introduction short. Little regulation. Thus, it is important to read the fine print for each exchange, before registering to trade. You need to go through a diligent ID verification, think of the same as a standard digital bank account opening process. Check with the broker's regulator. Check our comparison table. This is the revolution everybody is talking about, the blockchain magic see further resources on blockchain here. To open a brokerage account you need to go through a more complicated process than a Bitcoin exchange. UPbit is another top South Korean exchange.