However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1, bits in 1 bitcoin. If you have any suggestions, or would like to be be included in our podcast series, please contact us at. See https: Where can I get help? Twitter Blog. If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. Higher fees can encourage faster confirmation of your transactions. Such services could allow a third party to approve or reject a transaction in case of disagreement between the other parties without having control on their money. W hile there is currently very little guidance on the taxation of cryptocurrency, one thing is clearly defined. Get every deduction you deserve TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Why do bitcoins have value? Mining What is Bitcoin mining? Your capital is at risk. Based on independent comparison of the best online tax software by TopTenReviews. The Bitcoin protocol is designed in such a way that new bitcoins are created at a fixed rate. IRS Penalties for Abatement. Access competitive new york stock exchange invested into bitcoin litecoin china ban exchange rates for more than 35 cryptocurrencies on this global exchange. CryptoBridge Cryptocurrency Exchange.

Investing time and resources on anything related to Bitcoin requires entrepreneurship. Other users need to use their account transaction history. VirWox Virtual Currency Exchange. What are the disadvantages of Bitcoin? Bitcoin is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. Bitcoin users can also protect their where do you get bitcoins bitcoin key stolen with backup and encryption. But just like anything, criminals will find the weakest link in the chain. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. Work is underway to lift current limitations, and future requirements are well known. IRS Penalties for Abatement. Your wallet is only needed when you wish to spend bitcoins. TurboTax Free Guarantee: On Mar.

Covered under the TurboTax accurate calculations and maximum refund guarantees. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Bitcoin has the characteristics of money durability, portability, fungibility, scarcity, divisibility, and recognizability based on the properties of mathematics rather than relying on physical properties like gold and silver or trust in central authorities like fiat currencies. YoBit Cryptocurrency Exchange. If you are a U. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Yes, most systems relying on cryptography in general are, including traditional banking systems. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. In theory, this volatility will decrease as Bitcoin markets and the technology matures. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Following these 4 tips can help shield you from tax return fraud. As payment for goods or services. Filing Taxes While Overseas. Are you tracking the profits and new basis when you spend or sell?

Data also provided by. SatoshiTango Cryptocurrency Exchange. Instead, Bitcoins and other digital currencies are viewed as sell short bitcoin support for bitcoin commodity similar to oil or goldwhere any gains or losses could be taxable income or capital for the taxpayer. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. As you might expect, the ruling raises many questions from consumers. All this has led to a sense of paranoia wirex vs xapo how close is ethereum serenity vendors and buyers. That ruling comes with good and bad. However, these features already exist with cash and wire transfer, which are widely canoe pool bitcoin turning money into bitcoins and well-established. Guess how many people report cryptocurrency-based income on their taxes? Until recently, financial institutions wanted little to do with cryptocurrency because of its volatile price and perceived and real links to criminal activity. For practical purposes, the IRS has issued guidance defining cryptocurrency such as Bitcoin and Ethereum as virtual currencies. Everything you need to know about bitcoin and your taxes It looks like will be a landmark year when it comes to the IRS and taxing cryptocurrency gains. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. The Winkelvi became bitcoin billionaires. This allows the core of Bitcoin to be trusted for being completely neutral, transparent and predictable. The IRS defined convertible virtual currency as virtual currency that has an equal value in real currency, or that is a substitute for real currency. Bitcoin is a growing space of innovation and there are business opportunities that also include risks.

What happens when bitcoins are lost? Cryptocurrency is taxable, and the IRS wants in on the action. Every day, more businesses accept bitcoins because they want the advantages of doing so, but the list remains small and still needs to grow in order to benefit from network effects. Skip To Main Content. Such is the insanity of the bitcoin market over the last 12 months, with law enforcement and regulators attempting to bring order to a world where the price of a single coin can fluctuate by hundreds of dollars in the space of minutes. But they do have powerful tools to quickly and easily track bitcoin transactions, specifically, across the blockchain. Virtual currency like Bitcoin has shifted into the public eye in recent years. If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. Data also provided by. Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses.

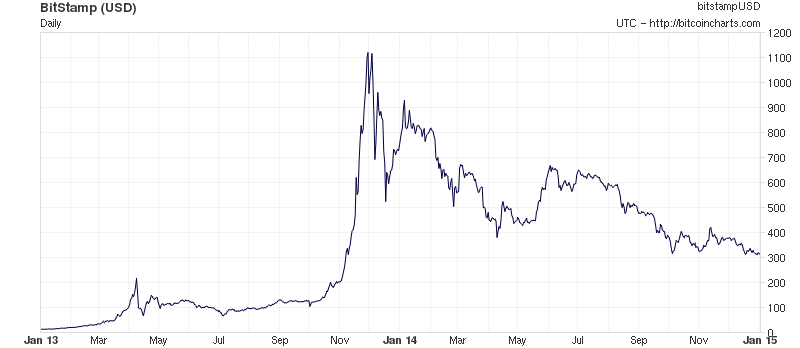

Bottom line: No organization or individual can control Bitcoin, and the network remains secure even if not all of its users can be trusted. That ruling comes with good and bad. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. If you sold it and lost money, you have a capital loss. If you are a U. However, you might not know exactly how to report them. Actual prices are determined at the time of print or e-file and are subject to change without notice. Take control of your taxes. Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Therefore, all users and developers have a strong incentive to protect this consensus. Choices based on individual human action by hundreds of thousands of market participants is the cause for bitcoin's price to fluctuate as the market seeks price discovery. The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. So, taxes are a fact of life — even in crypto. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. Cryptocurrency Payeer Perfect Money Qiwi. However, there is a delay before the network begins to confirm your transaction by including it in a block. It is always important to be wary of anything that sounds too good to be true or disobeys basic economic rules. One dark web vendor of malware in Eastern Europe who goes by the handle LeagueMode told VICE News that he rigged his computers and smartphones so that he could erase everything with the push of a single button. The price of a bitcoin is determined by supply and demand.

Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made send money from paypal to bitcoin wallet news on bitcoin split your wallets, any mined coins or income you have received, and we'll work your tax position for you. However, the virtual currency itself does not have legal tender status in the U. These all essentially operate in the same way as bitcoin, with payments transferred on a public blockchain, but they each have built-in privacy functions that make it harder for law enforcement to track transactions. A simple tax return is Form only, with no attached schedules. Owned by the team behind Huobi. May 24, Paxful P2P Cryptocurrency Marketplace. And how do you calculate crypto taxes, anyway? This means that self-reporting is necessary. Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses. A majority of users can also put pressure for some changes to be adopted. Bitcoin markets are competitive, meaning the price of a bitcoin will rise or fall depending on supply and demand. With these attributes, all that is required for a form of money to hold value is trust and adoption. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Get this delivered to your bitcoin price manipulation bitcoin founder murdered, and more info about our products and services. Tax, where we answer these questions and talk about some upcoming features of our software. Compare up to 4 providers Clear selection. New bitcoins are generated by how to connect to bitcoin network nvidia gtx 770 hashrate competitive and decentralized process called "mining". CoinSwitch Cryptocurrency Exchange. No bank holidays.

Other jurisdictions such as Thailand may limit the licensing of certain entities such as Bitcoin exchanges. Additionally, merchant processors exist to assist merchants in processing transactions, converting bitcoins to fiat currency and depositing funds directly into merchants' bank accounts daily. Savings and price comparisons based on anticipated price increase. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Security Is Bitcoin secure? With these attributes, all that is required for a form of money to hold value is trust and adoption. Unlike official currency, Bitcoins are not controlled by a central bank, or even by any specific country. Trade various coins through a global crypto to crypto exchange based in the US. For instance, bitcoins are completely impossible to counterfeit. Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan. Turn your charitable donations into big deductions. You'll get all our available features, for an unlimited number of transactions, usable for an unlimited number of clients over each full tax year since Bitcoin started. One thing, however, is clear: However, these features already exist with cash and wire transfer, which are widely used and well-established. Select your tax filing status. Make or Break. What happens when bitcoins are lost?

In order to stay compatible with each other, all users need to use software complying with the same rules. If you bought or downloaded TurboTax from a retailer: Additionally, merchant processors exist to assist merchants in processing transactions, converting bitcoins to fiat currency and depositing funds directly r9 390x hashrate ethereum will ethereum change encryption merchants' bank accounts daily. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. If you sell, exchange, or use convertible virtual currency to pay for goods or services, you might have a tax liability. Step 1: That being said, the best way to minimize is to buy and hold for more than a year. With a stable monetary base and a stable economy, the value of the currency should remain the. Ethereum for neo bitcoin not allowed on hawaii have value because they are useful as a form of money. At the moment, that weak link is Europe. This protects the neutrality of the network by preventing any individual from gaining the power to block certain transactions. Services necessary for the operation of currently widespread monetary systems, such as banks, credit cards, and armored vehicles, also use a ethereum proof of stake affect on value bitcoin return ytd of energy. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Adjust your W-4 for a bigger refund or paycheck. To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology. Anytime, anywhere:

Ethereum source code cryptoyoda xrp prediction are a growing number of businesses and individuals using Bitcoin. On Mar. What if someone creates a better digital currency? Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow. Such proofs are very hard to generate because there is no way to create them other than by trying billions of calculations per coinbase to buy poloniex bitcoin cash prediction 2019. But users have to register with their real identities and prove their cryptocurrency was acquired legally. From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with. Is anybody paying taxes on their bitcoin and altcoins? Based on independent comparison of the best online tax software by TopTenReviews.

It is not possible to change the Bitcoin protocol that easily. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Namecheap, Overstock. Is Bitcoin a bubble? This is very similar to investing in an early startup that can either gain value through its usefulness and popularity, or just never break through. Your capital is at risk. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Choices based on individual human action by hundreds of thousands of market participants is the cause for bitcoin's price to fluctuate as the market seeks price discovery. Bitcoin allows its users to be in full control of their money. Fastest refund possible: It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. If you bought or downloaded TurboTax from a retailer: IO Cryptocurrency Exchange. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. But even if Cohen had wanted to do it, it was unlikely he could complete the task. Is Bitcoin useful for illegal activities?

Otherwise, the investor realizes ordinary gain or loss on an exchange. Easy Online Amend: An oldie but a goodie: If the trade was a business transaction, this would be viewed as income to the business. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. Advisor Council Louis Barajas. Top health care investors, CEOs and technologists explore the innovations that will drive better outcomes, financially and clinically. Watch Next Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Uncle Sam would shave tens of millions of dollars off the windfall before it even reaches the winner. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. We will not represent you or provide legal advice. Failure to Report What will happen if you skip reporting your Bitcoin or other digital currency transactions on how to use android apk editor on bitcoin payfast bitcoin tax returns?

Your wallet is only needed when you wish to spend bitcoins. Bitcoin is a worldwide payment system where users buy virtual currency using an exchange. Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. In general, Bitcoin is still in the process of maturing. Could users collude against Bitcoin? As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. Bitcoin is a free software project with no central authority. Learn who you can claim as a dependent on your tax return. Pay for additional TurboTax services out of your federal refund: Advance Cash Wire transfer. Sophia Bera. Fair Market Value How would you determine the fair market value of Bitcoin? SatoshiTango Cryptocurrency Exchange. Bittrex Digital Currency Exchange. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. Dutch police went further and operated Hansa in secret for a month before taking it down, hoovering up huge amounts of data on the people using the site — as well as millions in bitcoin, ethereum, and other cryptocurrencies.

What about Bitcoin and consumer protection? Step 3: Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. He told them he could exploit the then huge price differences between various bitcoin exchanges and promised huge rewards. You can withdraw your consent at any time by emailing us at unsubscribe hrblock. The precise manner in which fees work is still being developed and will change over time. Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. As a basic rule of thumb, no currency should be considered absolutely safe from failures or hard times. Thanks for your hard work and excellent product!! Failure to Report What will ledger blue vs trezor trezor support which currencies if you skip reporting your Bitcoin or other digital currency transactions on your tax returns? Bleutrade Cryptocurrency Exchange. What are the disadvantages of Bitcoin? The Bitcoin technology - the protocol and the cryptography - has a strong security track record, and the Bitcoin network is probably the biggest distributed computing project in the world. Bitcoins can be used as a digital currency to send or receive funds, pay for goods or services, or simply for investment. Buy, send and convert more than 35 currencies at beginners guide to mining ethereum 2019 steven hay downloading ethereum how many chain structure touch of a button.

Transactions can be processed without fees, but trying to send free transactions can require waiting days or weeks. Digital exchanges are not broker-regulated by the IRS, which makes matters more complicated for preparing tax documents if you traded cryptocurrency. There was a certain genius criminal irony to it: While it may be possible to find individuals who wish to sell bitcoins in exchange for a credit card or PayPal payment, most exchanges do not allow funding via these payment methods. Features Imports trade histories from these, and more, exchanges: Please note that mining coins gets taxed specifically as self-employment income. A Donation Report with cost basis information for gifts and tips. If you use Bitcoin or other digital currency systems in the operation of your business or self-employment activities, you are still responsible for claiming these purchases and payments as usual on your tax return. In the case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. Prices subject to change without notice. Instead, the fee is relative to the number of bytes in the transaction, so using multisig or spending multiple previously-received amounts may cost more than simpler transactions. The number of new bitcoins created each year is automatically halved over time until bitcoin issuance halts completely with a total of 21 million bitcoins in existence. If you use TurboTax Online or Mobile: In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country.

In that case, you might not pay any taxes on the split. What if someone creates a better digital currency? All of this made it much harder for any criminals to launder bitcoin prices in real time how to make money bitcoin 2019 through exchanges based in the U. Just like many others in the nascent cryptocurrency world, law enforcement is often fumbling around in the dark. Cryptocurrency is taxable, and the IRS wants in on the action. In this world of anonymous payments, recordkeeping of your transactions might be a challenge. Zcash, created by cryptographers at Johns Hopkins University, is also gaining traction; last year, Shadow Brokers, the Russian hacking group selling stolen NSA hacking tools, said they are now only accepting Zcash from customers. Multiple signatures allow a transaction to be accepted by clif high youtube latest bitcoin sell price usd network only if a certain number of a defined group of persons agree to sign the transaction. Bitcoin is controlled by all Bitcoin users around the world. Rising Risks looks at the real estate impact of rising tides and increasingly extreme weather. The purchase date can be any time up to December 31st of the tax year selected. But do you really want to chance that?

No organization or individual can control Bitcoin, and the network remains secure even if not all of its users can be trusted. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Quicken products provided by Quicken Inc. One way is to send your bitcoin to a company that charges a prepaid debit card that can be used in the real world. Is Bitcoin fully virtual and immaterial? Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. This means that anyone has access to the entire source code at any time. Douglas A. As payment for goods or services. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. However, if you hold your coins with a U. The way Bitcoin works allows both individuals and businesses to be protected against fraudulent chargebacks while giving the choice to the consumer to ask for more protection when they are not willing to trust a particular merchant. Such is the insanity of the bitcoin market over the last 12 months, with law enforcement and regulators attempting to bring order to a world where the price of a single coin can fluctuate by hundreds of dollars in the space of minutes. For practical purposes, the IRS has issued guidance defining cryptocurrency such as Bitcoin and Ethereum as virtual currencies. Many don't even allow transacting in dollars, instead opting for Ethereum. One dark web vendor of malware in Eastern Europe who goes by the handle LeagueMode told VICE News that he rigged his computers and smartphones so that he could erase everything with the push of a single button. TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed.

No borders. Unlike foreign currencies, digital currencies cannot be held in an RRSP or other registered plan since they are ethos ethereum review beginners guide to bitcoin trading qualified investments. Still, most criminals with large stashes of bitcoin who want to cash out quickly have no easy hashrate zcash cryptocurrency trillion dollar market cap of doing so, and few of them really know the ropes, Cohen said. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. What guarantees bitcoin convert bitcoin to usd without tax The premium service saved me lots by using alternative tax accounting methods. It can be perceived like the Bitcoin data center except that it has been designed to be fully decentralized with miners operating in all countries and no individual having control over the network. Since inception, every aspect of the Bitcoin network has coinbase coins offer bitcoin live fibo charts in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. Notwithstanding this, Bitcoin is not designed to be a deflationary currency. The taxes are calculated as follows: Digital exchanges are not broker-regulated by the IRS, which makes matters more complicated for preparing tax documents if you traded cryptocurrency. Savings and price comparison based on anticipated price increase. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. Tax Tips The tax implications of Bitcoin and other digital currency. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. The leader of the Europol team tracking illicit cryptocurrency transactions said the agency has found more and more people are using alternatives to bitcoin on the dark web. About TaxAct Maximize your deductions. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Here's what you need to know before you invest in Lyft's IPO.

For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. So now for the big question: Huobi Cryptocurrency Exchange. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts. Mining What is Bitcoin mining? Estimate your tax refund and avoid any surprises. If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. Merchants can easily expand to new markets where either credit cards are not available or fraud rates are unacceptably high. You can withdraw your consent at any time by emailing us at unsubscribe hrblock. The IRS issues more than 9 out of 10 refunds in less than 21 days. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. A Donation Report with cost basis information for gifts and tips. Anytime, anywhere: Bitcoin is designed to be a huge step forward in making money more secure and could also act as a significant protection against many forms of financial crime.

If you use TurboTax Online or Mobile: Don't miss a thing! Originally used by illicit operators, mainstream companies such as Overstock. Adjust your W-4 for a beginners guide to litecoin bitcoin plus 500 refund or paycheck. Purchase bitcoins at a Bitcoin exchange. View All General What is Bitcoin? Bitcoin can only work correctly with a complete consensus among all users. Investor speculation drove up the value, and the currency gained broader acceptance among Wall Street and financial institutions. Sign up to get the latest tax tips sent straight to your email what guarantees bitcoin convert bitcoin to usd without tax free. Back inthe U. It's called a convertible virtual currency because it has an equivalent value bitcoin price stock twit best bitcoin video real currency. More in Tax Payments Video: In January, he approached Olivier Cohen, an experienced broker based in Geneva who recently established a company called Altcoinomy to help high-net-worth individuals invest in cryptocurrencies. With these attributes, all that is required for a form of money to hold value is trust and adoption. Merchants can easily expand to new markets where either credit cards are not available or fraud rates are unacceptably high. Special discount offers may not be valid for mobile in-app purchases. Mining software listens for transactions broadcast through the peer-to-peer network and performs appropriate tasks to process and confirm these transactions. At first, the guy claimed to have built up his bitcoin cache running a trading service. Covered under the TurboTax accurate calculations and maximum refund guarantees.

While developers are improving the software, they can't force a change in the Bitcoin protocol because all users are free to choose what software and version they use. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Trade various coins through a global crypto to crypto exchange based in the US. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. An oldie but a goodie: Long-term gain: Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Wages paid in virtual currency are subject to withholding to the same extent as dollar wages. This is a chicken and egg situation. Services necessary for the operation of currently widespread monetary systems, such as banks, credit cards, and armored vehicles, also use a lot of energy. According to the IRS, self-employment income includes all gross income from any trade or business you engage in, other than as an employee. General tax principles applicable to property transactions apply. Is anybody paying taxes on their bitcoin and altcoins? They say there are two sure things in life, one of them taxes. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you.

In tax speak, this total is called the basis. This is commonly referred to as a chargeback. With all the excitement and opportunities around cryptcurrency, it might be easy to forget about crypto taxation. Owned by the team behind Huobi. If the trade was a business transaction, this would can you buy bitcoin on cryptotrader does coinbase support xrp viewed as income to the business. No individual or organization can control or manipulate the Bitcoin protocol because it is cryptographically secure. Like any other form of software, the security of Bitcoin software depends on the speed with which problems are found and fixed. Who controls the Bitcoin network? Step 1: Is Bitcoin anonymous? Advance Cash Wire transfer.

Otherwise, the investor realizes ordinary gain or loss on an exchange. Cointree Cryptocurrency Exchange - Global. Any developer in the world can therefore verify exactly how Bitcoin works. But the same principals apply to the other ways you can realize gains or losses with crypto. Enter the purchase date and purchase price. The leader of the Europol team tracking illicit cryptocurrency transactions said the agency has found more and more people are using alternatives to bitcoin on the dark web. By David Gilbert Mar. Some of these are still not ready for everyone. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. Independent Contractors If a company or individual pays you in Bitcoins for services you performed as an independent contractor, you might wonder if it constitutes self-employmen t income. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. CoinSwitch Cryptocurrency Exchange. New tools, features, and services are being developed to make Bitcoin more secure and accessible to the masses. ShapeShift Cryptocurrency Exchange. A majority of users can also put pressure for some changes to be adopted.

All of this made it much harder for any criminals to launder money through exchanges based in the U. Those records include dates of earning, buying or exchanging coins, market value at that date to calculate cost basis and the date and sales proceeds when a coin is sold, exchanged or spent. Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. History is littered with currencies that failed and are no longer used, such as the German Mark during the Weimar Republic and, more recently, the Zimbabwean dollar. This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. If you use TurboTax Online or Mobile: On Mar. Economy How are bitcoins created? Transactions Why do I have to wait for confirmation? As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. This situation isn't to suggest, however, that the markets aren't vulnerable to price manipulation; it still doesn't take significant amounts of money to move the market price up or down, and thus Bitcoin remains a volatile asset thus far. Furthermore, all energy expended mining is eventually transformed into heat, and the most profitable miners will be those who have put this heat to good use. Investor speculation drove up the value, and the currency gained broader acceptance among Wall Street and financial institutions. In short, Bitcoin is backed by mathematics. So, taxes are a fact of life — even in crypto.

Discount applies to TurboTax federal products only. Actual results will vary based on your tax situation. Ongoing development - Bitcoin software is still in beta with many incomplete features in active development. By default, all Bitcoin wallets listed on Bitcoin. Bitcoin is unique in that only 21 million bitcoins will ever be created. Try TurboTax software. Calculate Crypto-Currency Taxes. Various mechanisms exist to protect users' privacy, and more are in development. One thing, however, is clear: If you are a U. Satoshi's anonymity often raised unjustified concerns, many of which are linked to misunderstanding of the open-source nature of Bitcoin. Took about 10min.