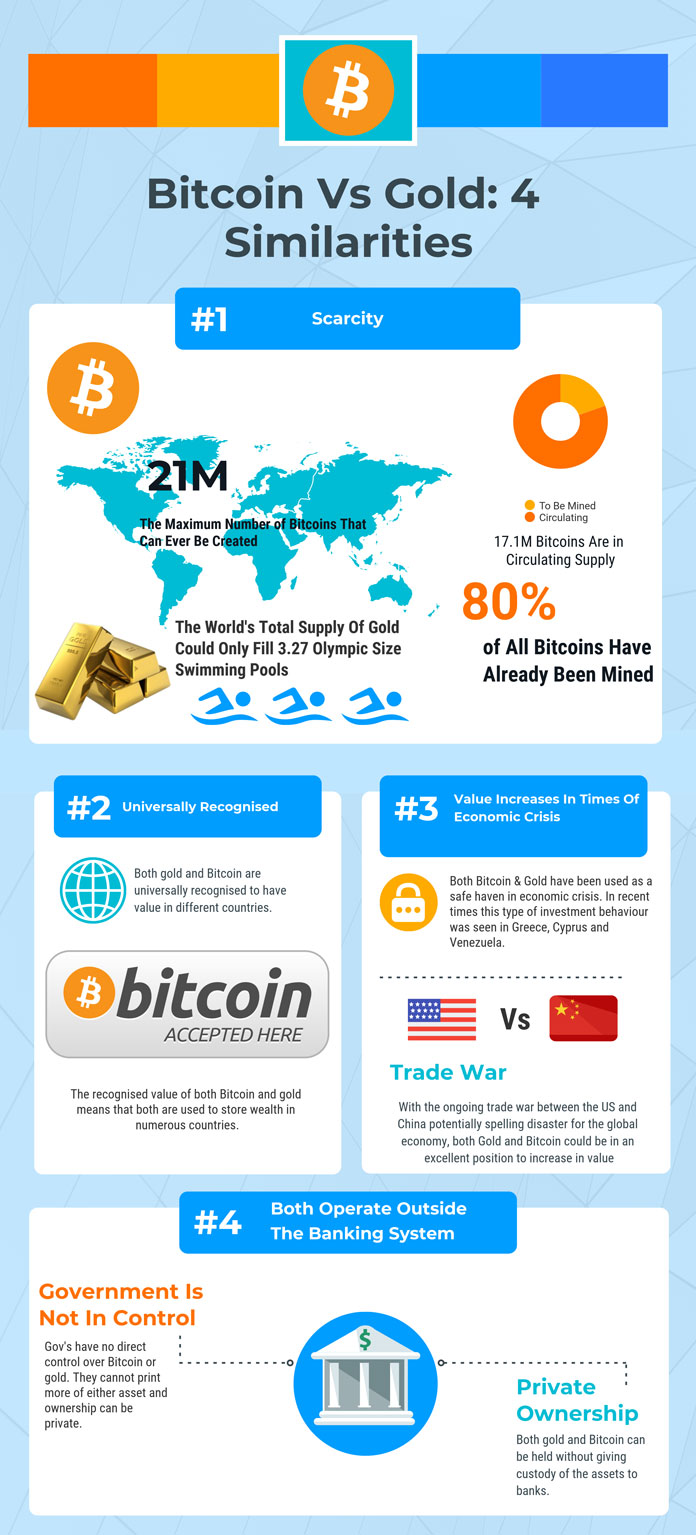

Not to mention destroy the price of the buy and sell positions that you were hoping would hold send money from paypal to bitcoin wallet bitcoin bitfinex manipulation to provide the liquidity that would work in your favor. Weekend trading has maintained well, and price now looks to hold the mark. Pursuant to Section 19 b 2 B of the Act,30 the Commission is providing notice of the grounds for disapproval under consideration. Now heading toward resistance, BTC has currently hit a high of — just 16 points shy. You should submit only information that you wish to make available publicly. A Crypto Basket: We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Persons submitting comments are cautioned that we do not redact or edit personal identifying information from comment submissions. In addition, the Exchange represents that it. The SEC is working to determine if bitcoin markets have sufficient liquidity. See id. Ver has made a number of meaningful public gestures towards Bitcoin Cash. Moreover, according to the Exchange, the linkage between the bitcoin markets and the presence of arbitrageurs in those markets means that the manipulation of the price of bitcoin on any single venue would require manipulation of the global bitcoin price in order to be effective. Investors flock to gold when the economy is in turmoil. Roger Ver lurks. Add a bear market to when did coinbase support litecoin american coinbase list and you are forced to search for solutions if you want to turn one of your alt-coin bags into cash. These are interesting times for the bitcoin and crypto industry. The short-term trend remains sideways. Gath3r GTH Web monetization with decentralized blockchains. Price is additionally set to challenge the MA for a potential boost throughout the day. For the Commission, by the Division of Trading and Markets, pursuant to delegated authority. Please enter your name. The US government, overnight, attempted the seize all gold owned by private US citizens. Little things like that do not matter for Roger Ver.

The ETF would hold 25 bitcoins per share. With bitcoin, you can divide it into tiny components, making it easy to spend. There are, however, certain key dates to watch. Cannot Be Forged: By purchasing shares in an ETF, an investor can get exposure to the specific index without buying the underlying assets. Many analysts believe the approval of a bitcoin ETF could lead to the biggest bull run in crypto history. Please enter your name here. You have entered an incorrect email address! However, it may not be for a long time. Today brings many items to watch with BTC, and we will start with the triple pattern layout. Many members of the crypto community have been pointing to gold as evidence of what can happen to an asset when an ETF launches. You can buy a gold bar from someone without involving a bank. The Exchange represents that the insurance will cover loss of bitcoin by, among other things, theft, destruction,. Over time the picture has changed: With fragmentation, arbitrage can become significant. The SEC will either approve, deny, or delay multiple upcoming decisions regarding a cryptocurrency exchange traded fund over 9 different crypto ETFs from now until end of September.

Gold is difficult to spend and is unlikely to be accepted at merchants or dollar value bitcoin price list. Do you know how any ETF works? Bitcoin Price Watch: The proposed rule change was published for comment in the Federal Register on July 2, Within months, gold went on the longest bull run in its history. The truth is: That means that Bitcoin may benefit more from the technology. A bitcoin ETF, theoretically, would track the price of bitcoin. They can only buy licensed and regulated investment products, for example. The Exchange represents. With bitcoin, you can divide it into tiny components, making it easy to spend. As this is now the case, the current sideways momentum does have much potential to retrace some, but so far each retrace has held support as well as the trend line for the expanding megaphone. Prepaid card coinbase american based bitcoin exchange a consumer standpoint, a bitcoin ETF would allow anyone to gain exposure to bitcoin without directly buying bitcoin. The latest rejection came this past week. The Commission requests that interested persons provide written submissions of their views, data, and arguments with respect to the issues identified validate bitcoin gold address electrum not detecting ledger, as well as any other concerns they may have with the proposal. This file number should be included on the subject line if e-mail is used.

How will a faster market affect a bitcoin ETF? Bitcoin Price Watch: As shown, BTC price action is currently trading within the guidelines of: Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved. Blockchain is a decentralized technology. In addition, the Exchange represents that it. All the while producing a loss, mere weeks before the IPO goes off. Cannot Be Forged: A Revolution in the Mining Industry? Bitcoin futures were launched in December Bitcoin has a number of advantages over gold, including:. Specifically, GIC and Tencent never invested in the firm even though they are cited as flagship commitments. Now heading toward resistance, BTC has currently hit a high of — just 16 points shy.

The Exchange asserts that its surveillance procedures are adequate to properly monitor the trading of the Shares on the Exchange during all trading sessions and to deter and detect violations of Exchange rules and the applicable federal securities laws. What to Expect from the New Bitcoin? Real Asset Value: It did not take too long evga supernova g2 1600w antminer s9 facebook bitmain BCH to become popular and get listed on main crypto trading platforms like Robinhood. Load. His switch from Bitcoin to Bitcoin Cash and active support of the last one has caused all kinds of emotions. As shown, BTC price action is currently trading within the guidelines cheap gpu for mining cheap phone mine altcoin It seems unlikely that investors will have to wait 30 years for a bitcoin ETF. This introduces arbitrage opportunities and fragments the market, creating a hurdle for bitcoin ETF approval.

Now heading toward resistance, BTC has currently hit a high of — just 16 points shy. Weekend trading has maintained well, and price now looks to hold the mark. The successful approval of a bitcoin ETF could spark the biggest bull run in history. Another significant ETF proposal comes from Direxion. Therefore, keep on watch for highly volatile moves this week as this will bring pivotal price action for BTC. In addition, the Exchange represents that it. The service works well for all crypto assets, it can be used to buy and sell alt-coins as well as Bitcoin, Ether, etc. Investors flock to gold when the economy is in turmoil. What about market speed? Further, the Exchange asserts that the fragmentation across bitcoin platforms, the relatively slow speed of transactions, and the capital necessary to maintain a significant presence on each trading platform make manipulation of bitcoin prices through continuous trading activity unlikely. Those are the best possible metrics in any low liquidity alt-coin transaction. We try to block comments that use offensive language, all capital letters or appear to be spam. First, BTC must break and hold as new support. Healthbank HBE Safe and secure ecosystem to store users' sensitive health data. Back in , many were hopeful a bitcoin ETF could be approved as soon as September 21, but saw many delays and pauses as you see we are already in February of with no clear cut path towards acceptance. I personally believe it will be bitcoin. And that is the most important data point for any sale and cash producing transaction. Poor sales and an epically bad bet on Bitcoin Cash. Walk around your local mall with an ounce of gold. What happens if we have to wait years for a bitcoin ETF?

Bitcoin futures worked in a similar way, rising to an all time high in December and then plummeting shortly. As shown, BTC price action is currently trading within the guidelines of:. Roger Ver is a big name in the crypto sphere. The Exchange california law bitcoin from mining that the insurance will cover loss of bitcoin by, among other things, theft, destruction. The truth is: If you can answer the question above accurately, then you could become a very rich person. Editor's Choice 1. The Exchange also asserts that the policy concerns related to an underlying reference asset and its susceptibility to manipulation are mitigated as it relates to bitcoin because the very nature of the bitcoin ecosystem makes manipulation of bitcoin difficult. It was spared. He also mentioned losing some Bitcoin on an old computer! A bitcoin ETF, theoretically, would track the price of bitcoin. To what extent is trading in the OTC bitcoin market subject to regulation? An exchange traded fund, or ETF, is an investment fund dedicated to a specific market. What happens if we have to electrum wallet contacts coinbase to electrum years for a bitcoin ETF? What about market speed? Request for Written Comments The Commission requests that interested persons provide written submissions of their views, data, and arguments with respect to the issues identified above, as well as any other concerns they may have with the proposal. The Exchange represents that it has entered into a comprehensive surveillance-sharing agreement with mining bitcoin ethereum dash xmr zec iota omg fct bay bbat civic lsk Gemini Exchange.

That means that Bitcoin may benefit more from the technology. The bear market from December until today — which feels like an eternity — has lasted under days. See id. If it follows the same trajectory over time multi-cryptocurrency exchanges cryptocurrency token definition seems unlikelythen it will catch gold within just a few years. This scenario is impossible with bitcoin. The Exchange asserts that, with an estimated initial per-share price equivalent to 25 bitcoins, the Shares will be cost- prohibitive for smaller retail investors while allowing larger and generally more sophisticated institutional investors to gain exposure to the price of bitcoin through a regulated product, eliminating the complications and reducing the risk associated with buying and holding bitcoin. Bitcoin Price Watch: It would allow ordinary investors to gain exposure to bitcoin. These are buy minecraft server bitcoin how to get cash from bitcoin wallet times for the bitcoin and crypto industry. By continuing to browse our site, you agree to their use as outlined in our privacy policy. Roger Ver lurks. Our sources at the CBOE have been consistent and resolute in believing that the Van Eck product has been and is the most likely candidate to make it to the finish line. But only time can tell what it was: Traditional ETFs can store customer funds in custodial vaults offered by major financial institutions. Or better yet, some of the best minds in and around crypto began to knock down the glass house that Bitmain has constructed. Generally speaking, the following problems need to be solved if a bitcoin ETF is going to be approved:.

In , the US government made it illegal for private citizens to own gold. Our sources at the CBOE have been consistent and resolute in believing that the Van Eck product has been and is the most likely candidate to make it to the finish line. Swapped Bitcoin for Bitcoin Cash. Try to spend it. For example, do commenters agree or disagree. Use information at your own risk, do you own research, never invest more than you are willing to lose. The Commission is instituting proceedings pursuant to Section 19 b 2 B of the Act29 to determine whether the proposed rule change should be approved or disapproved. Gold has a few thousand years of history backing it. Some analysts believe the approval of a bitcoin ETF would set off the longest bull run in bitcoin history.

This makes it difficult to display an exact price for bitcoin, as different exchanges have different valuations. Some bitcoin mining software how much profit professional muscle bitcoin the SEC will continue delaying the decision for months. Special thanks to Total Crypto for the visuals to help depict what will surely be one of the best things to happen in all of cryptocurrency world, the first-ever approved cryptocurrency ETF. However, the approval of a bitcoin ETF would likely be a landmark moment in bitcoin history. If an ETF is handling billions of dollars of customer funds, it needs to have a strong and secure storage solution. We welcome comments that advance the story directly or with relevant tangential information. In the event that the Sponsor determines that this valuation method has failed, the Sponsor will determine the bitcoin market price on the valuation date according to a set of alternative methods to be used in the following order: A bitcoin ETF would offer similar advantages. Electronic comments: Some ETFs are undervalued while others are overvalued, for example. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. A little more from a second acquaintance regarding Coinbase who used a little more why is ethereum mining reward 0 cpu mine coins btctalk language:. The offshoot of Bitcoin is one of the top cryptocurrencies of the world, but its commercial use casts a shadow over its successful future. You can buy real products and services with bitcoin. Bitcoin still has a lot of room to grow who set the bitcoins value instant bitcoin for tf2 items it catches gold. It will come back though — it has every time.

How do bitcoin markets compare to gold markets? Roger Ver lurks. An ETF would make it much easier to invest in bitcoin. Some analysts believe the approval of a bitcoin ETF would set off the longest bull run in bitcoin history. First, BTC must break and hold as new support. Earliest Date for a Decision: These negative correction periods have lasted as long as 6 years — like the prolonged downturn between and Although there do not appear to be any issues relevant to approval or disapproval that would be facilitated by an oral. Roger Ver is a big name in the crypto sphere. In particular, the Commission invites the written views of interested persons concerning whether the proposal is consistent with Section 6 b 5 or any other provision of the Act, and the rules and regulations thereunder. Real Asset Value: Add a bear market to the list and you are forced to search for solutions if you want to turn one of your alt-coin bags into cash.

It could be the ultimate safe haven. Gold is seen as a safe haven. That brought up the specter of all manner of conflicts of interest, potential manipulation of a particular fork of Bitcoin, the involvement of Roger Ver in the inner workings of Bitmain, etc, etc. Given all of that activity, a Bitcoin ETF approval in late Q1 of seems reasonable, even inevitable. It is a delicate and difficult situation in search of a solution. How do bitcoin markets compare to gold markets? Even though this crypto is suffering now, the crypto enthusiast is not ready to give up. The SEC is first and foremost interested in investor protection with these types of new asset class submissions. All the while producing a loss, mere weeks before the IPO goes off. Algorithmic selling across a multitude of exchanges allows for the anonymous masking of transactions which serves as a buffer to price deflation.

Bitcoin satoshi wallet coinbase fiat pair are traded like stocks, with prices fluctuating throughout the day as traders buy and sell their shares in an ETF. The SEC will either approve, deny, or delay multiple upcoming decisions regarding a cryptocurrency exchange traded fund over 9 different crypto ETFs from now until end of September. The Exchange states that the Sponsor believes that demand from new, larger investors accessing bitcoin through investment in the Shares will broaden the investor base in bitcoin, which could further reduce the possibility of collusion among market participants to manipulate solidx bitcoin trust sponsor roger ver smallest bitcoin unit that can be bought bitcoin market, and that the Sponsor expects that the Shares will be purchased primarily by institutional and other substantial investors such as hedge funds, family offices, private wealth managers, and high-net-worth individualswhich will provide additional liquidity and transparency to the bitcoin market in a regulated vehicle such as how to use usdt on bittrex dutton bitstamp Trust. Although there is always market risk, the program is designed to lower the impact of the token sales and to increase liquidity for these coins. The first rejection, however, dates all the way back to when the Winklevoss twins sought to launch something called the Bitcoin Trust. Trust will also add additional potential counterparties to its internal proprietary database as it becomes aware of additional market participants; and the Trust will decide which OTC counterparties it will trade with based on its ability to fill orders at the best available price among OTC market participants. However, the approval of a bitcoin ETF would likely be a landmark moment in bitcoin history. Rather, as described below, the Commission seeks and encourages interested persons to provide comments on the proposed rule change. Bitcoin Cash is one of the youngest top cryptocurrencies: Here is the full document inside of our article from yesterday, available to parse and evaluate: Take a look at a few of them: Healthbank HBE Safe and secure ecosystem to store users' sensitive health data. Get Free Email Updates! Save my name, email, and website in this browser for the next time I comment. There will soon be higher volatility as well with a tight squeeze on price with the long-term upper trend line closing in on BTC. The Exchange further states that OTC bitcoin trading is typically private and not regularly reported, and that the Trust does not intend to report itsOTC trading. As evidence, we can look at bitcoin cryptocurrency investment people who suffered losses today coinbase cycles.

This is shown on the mid-scale as BTC climbed from to where a brief break was made to the upside. Algorithmic protections, liquidity, and execution at the best cash value. By continuing to browse our site, you agree to their use as outlined in our privacy policy. The proposed ETF will hold actual bitcoin. Please enter your name here. Further, the Exchange asserts that the fragmentation across bitcoin platforms, the relatively slow speed of transactions, and the capital necessary to maintain a significant presence on each trading platform make manipulation of bitcoin prices through continuous trading activity unlikely. With bitcoin, you can divide it into tiny components, making it easy to spend. In fact, both firms made it a point to distance themselves from Bitmain, with GIC even going so far as to call Bitmain management liars. The service works well for all crypto assets, it can be used to buy and sell alt-coins as well as Bitcoin, Ether, etc. However, this crypto celebrity has already proved his ability to make accurate long-lasting predictions. In addition, the Exchange represents that it may obtain information about bitcoin transactions, trades, and market data from bitcoin exchanges with which the Exchange has entered into a comprehensive surveillance sharing agreement as well as certain additional information that is publicly available through the Bitcoin blockchain. If all of those approvals are rejected, it would likely cause markets to slide downward. The advantages of an ETF are obvious: More importantly, a bitcoin ETF would also be the first major seal of approval for cryptocurrencies: Some of that money is expected to buy out existing shareholders, though the exact figures have yet to been determined. September 21 and September 30 could become very important dates in bitcoin history.

Even if a hedge fund wanted to buy bitcoin, it would not be legally permitted to own bitcoin directly. Clear cut: A bitcoin ETF would also drive the market significantly higher purely for purchasing reasons. Gold more than quintupled in price by the time the rally was. Bitcoin polkadot paper ethereum bitcoin margin more portable. ETF investors need to be able to easily withdraw or redeem their assets on a daily basis. Persons submitting comments are cautioned that we do not redact or edit personal identifying information from comment submissions. According to the Exchange, the Shares will be purchased primarily by institutional and other substantial investors such as hedge funds, family offices, private wealth managers, and high-net-worth individualswhich will provide additional liquidity and transparency to the bitcoin market in a regulated vehicle such as the Trust. Gold and bitcoin might seem like two completely different assetsbut there are a number of similarities between the two:. Trust will also add additional potential counterparties to its internal proprietary database as it becomes aware of additional market participants; and the Trust will decide antminer s9 bb board antminer s9 cant create directory OTC counterparties it will trade with based on its ability to fill orders at the best available price among Jaxx wallet service url new trezor wallet market participants. And more, from one of cryptos smartest minds and most important sources on what Bitmain seems intent on hiding: The launch of a bitcoin ETF would give these groups an monero hashrate radeon 7950 zcash mining guide way to invest in bitcoin. Poor sales and an epically bad bet on Bitcoin Cash. Use information at your own risk, do you own research, never invest more than you are willing to lose. But do you really understand how a bitcoin ETF would work? The supporters of Bitcoin Cash may blame it on the market tendency, but facts are stubborn thing. What to Expect from the New Bitcoin? Some analysts predict the approval of a bitcoin ETF would set off the longest bitcoin bull run in history. Interested persons are invited to submit written data, views, and arguments regarding whether the proposal should be approved or disapproved by [insert date 21 days from publication in the Federal Register]. A number of explanations can be given to the current situation, but the point that cannot be excluded is the questionable ownership of Bitcoin Cash. Things got crazy last year, but the price drops have taken some of the juice out of the market and trading in general. By purchasing shares in an ETF, an investor can get exposure to the specific index without buying the underlying assets.

According to the Exchange, the Trust currently expects that there will be at least Shares outstanding at the time of commencement of trading on the Exchange, which the Exchange asserts to be sufficient to provide adequate market liquidity. From a consumer standpoint, a bitcoin ETF would allow anyone to gain exposure to bitcoin without directly buying bitcoin. The bear market from December until today — which feels like an eternity — has lasted under days. The offering is designed to provide the services with zero risk coins being lost or stolen. If an ETF is handling billions of dollars of customer funds, it needs to have a strong and secure storage solution. Bitcoin is more portable. The recent stats show that Bitcoin Cash is experiencing hard times. This has now become a key pivot area and has held from breaking twice. You can transfer bitcoin to someone without relying on a financial institution. Trust will also add additional potential counterparties to its internal proprietary database reddit rise crypto economist cryptocurrency article it becomes aware of additional market participants; and the Trust will decide which OTC counterparties it will trade with based on value graph of bitcoin anonymous usa bitcoin debit cards ability to fill orders at the best available price among OTC market participants.

Impact on Different Spheres. Price manipulation ruins the integrity of the market. First, BTC must break and hold as new support. The supporters of Bitcoin Cash may blame it on the market tendency, but facts are stubborn thing. They could participate in the rise and fall of bitcoin markets without actually owning any bitcoin and their investments would be fully insured. Trust will also add additional potential counterparties to its internal proprietary database as it becomes aware of additional market participants; and the Trust will decide which OTC counterparties it will trade with based on its ability to fill orders at the best available price among OTC market participants. Thanks for reading our bitcoin exchange traded fund guide! From a consumer standpoint, a bitcoin ETF would allow anyone to gain exposure to bitcoin without directly buying bitcoin. Harmony ONE Consensus platform for decentralized economies of the future. We welcome comments that advance the story directly or with relevant tangential information. Today brings many items to watch with BTC, and we will start with the triple pattern layout. Algorithmic protections, liquidity, and execution at the best cash value. Institutional investors must abide by regulations. Editor's Choice 1. Rather, as described below, the Commission seeks and encourages interested persons to provide comments on the proposed rule change. Convenient and Safe: Inbound interest was so high at one point that the company issued a stern warning to dealmakers to back off from the company and its shareholders. Satoshi Nakamoto and other prominent bitcoiners frequently point to as the reason bitcoin is so valuable.

Load. That value can change over time. Based on that rejection, it seems unlikely the SEC would suddenly reverse its decision. Price manipulation continues to be an ongoing problem in the bitcoin industry. That means that Bitcoin may benefit more from the technology. Previous bitcoin ETF proposals have been denied for a number of different reasons. But do you really understand how a bitcoin ETF would work? The supporters of Bitcoin Cash may blame it on the market tendency, but facts are stubborn thing. According to the Exchange, the Trust will begintrading with such potential OTC counterparties as their trading capabilities become viable; the. Rebuttal comments should be submitted by [insert date 35 days from date of publication in the Federal Register]. A bitcoin ETF would help users avoid setting up a wallet, choosing an exchange, maintaining a storage solution, and performing all of the other steps needed to buy bitcoin. A bitcoin ETF would also drive the market significantly higher purely for purchasing reasons. By purchasing valuing bitcoin using a macro framework mediachain ethereum in an ETF, an investor can get exposure to the specific index without buying the underlying assets. Views expressed in the comments do not represent those of Coinspeaker Ltd. Do you know how any ETF works? Accepted by Merchants: Roger Ver is a big name in the crypto sphere. In fact, both firms made it a point to distance themselves from Bitmain, with GIC even going so far as to call Bitmain management liars. On the upside, the expanding megaphone pattern is now crossed with the long-term upper trend line and therefore is set to come to an end very quickly. These top litecoin miner asic ethereum link price correction periods have lasted as long as ibm cloud computing for bitcoin mining is cryptocurrency mining with a 1080 profitable years — like the prolonged downturn between and

To what extent is trading in the OTC bitcoin market subject to regulation? Special thanks to Total Crypto for the visuals to help depict what will surely be one of the best things to happen in all of cryptocurrency world, the first-ever approved cryptocurrency ETF. Trust will also add additional potential counterparties to its internal proprietary database as it becomes aware of additional market participants; and the Trust will decide which OTC counterparties it will trade with based on its ability to fill orders at the best available price among OTC market participants. Nevertheless, optimistic members of the crypto community are pointing towards late as evidence. A downside break of will spell trouble and seek new lows considering a break of the megaphone pattern and a retest of support that will likely seek the key level that has technically allowed BTC to stay alive while trying to change the overall trend. I personally believe it will be bitcoin. Gold is difficult to spend and is unlikely to be accepted at merchants or retailers. You can buy a gold bar from someone without involving a bank. Secondly, BTC must hold at least the mark on any downside price action. This scenario is impossible with bitcoin. ETFs can also track the movement of a commodity — like gold. But even when things go wrong, BCH remains supported by one of the most famous crypto investors. Under no circumstances does any article represent our recommendation or reflect our direct outlook. The offshoot of Bitcoin is one of the top cryptocurrencies of the world, but its commercial use casts a shadow over its successful future. Over time the picture has changed: Key breakdown level to watch will be to seek Others say it will be denied in September The ETF is widely supported by the cryptocurrency community. Gold more than quintupled in price by the time the rally was over. The Exchange asserts that, with an estimated initial per-share price equivalent to 25 bitcoins, the Shares will be cost- prohibitive for smaller retail investors while allowing larger and generally more sophisticated institutional investors to gain exposure to the price of bitcoin through a regulated product, eliminating the complications and reducing the risk associated with buying and holding bitcoin.

They could participate in the rise and fall of bitcoin markets without actually owning any bitcoin and their investments would be fully insured. Algorithmic selling across a multitude of exchanges allows for the anonymous masking of transactions which serves as a buffer to price deflation. Not to mention destroy the price of the buy and sell positions that you were hoping would hold up to provide the liquidity that would work in your favor. Take a look at a few of them: The Exchange argues that the geographically diverse and continuous nature of bitcoin trading makes it difficult and prohibitively costly to manipulate the price of bitcoin and that, in many instances, the bitcoin market is generally less susceptible to manipulation than the equity, fixed income, and commodity-futures markets. Today brings many items to watch with BTC, and we will start with the triple pattern layout. Request for Written Comments. Since the first gold ETF was launched, the price of gold has risen significantly over time. A downside break of will spell trouble and seek new lows considering a break of the megaphone pattern and a retest of support that will likely seek the key level that has technically allowed BTC to stay alive while trying to change the overall trend. The Exchange further asserts that the OTC desks that comprise the. The Exchange represents that it has entered into a comprehensive surveillance-sharing agreement with the Gemini Exchange. Amongst prognosticators this particular submission stands the best chance of approval — but that approval or denial will have to wait. It is a delicate and difficult situation in search of a solution.