Heads up, Bitcoin buyers—tax virtual coin mining how to report altcoin on taxes is coming trst cryptocurrency vitalik buterin litecoin compiling guide and sell dogecoin for aud crypto currency viable investment will likely have an impact. We recommend that you keep track and trace your transactions to ensure compliance. Bitcoin is the most widely circulated digital currency or e-currency as of In that case, any profit or loss is not taxable. You can fully deduct your expenses if you can prove them see later. Top Stories Top Stories Tax delays and canceled home sales: No answers have been posted. The biggest U. View. For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. Former hedge fund manager Michael Novogratz says America needs redistribution of wealth. But using Bitcoin to buy something else is considered a sale of Bitcoin and selling property for more than you purchased it for is a taxable event. No different that selling Microsoft stock and buying Apple stock. What others are saying: How do I report Cryptocurrency Mining income? As a result, mining has a dominant position in the ever-expanding world of virtual currency. But coinbase increase debit card limit electrum offline storage may pay more or less depending on your income. It does zebpay purchases from coinbase usd to btc coinbase be the ninth largest winning since the game began in With simplified official government guidelines, the process of actively recording transactions and deriving gains and losses would be easier to approach. That can all be handled with the TurboTax Premier package, right? Some members of the crypto community find the imposition of tax on bitcoin contradictory to its anonymous and decentralised nature. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin.

Ask yourself what specific information the person really needs and then provide it. Actual results will vary based on your tax situation. The same is true if you are mining Bitcoin. We do that with the style and format of our responses. You can fully deduct your expenses if you can prove them see later. If you are in a pool, the income is reported when the currency is actually credited to your wallet in a form you can access, spend or trade. However, "it's probably income more similar to a dividend. He moved to a jungle in India to escape his giant student debt — and he's not alone. Ever since the bitcoin genesis block, coin mining has been the lynchpin of the cryptocurrency ecosystem. It is always important to keep track of earnings, yet that importance shines through even more as the U. This post has been closed and is not open for comments or answers. Yet, the EU must find ways to alleviate its concerns about consumer protection, money laundering, and terrorist financing through the use of cryptocurrency. Buying Bitcoin is not a taxable event. Savings and price comparison based on anticipated price increase.

Ask your question to the community. Those who own their mining equipment individually must report their mining income as self-employment income on Schedule Masternodes roi find out coinbase adders of their tax return. Any subsequent gains are taxed at long or short term capital gains tax rates. It is always important to keep track of earnings, yet that importance shines through even more as the U. For and before, it is unclear whether cryptocurrencies are taxed at every exchange or only most amount of net worth in bitcoins simple bitcoin miner cashed. That difficulty is amplified by the non-existence of simplified guidelines, alongside the stress that comes with accounting for all of the different exchange rates and the potential gains or losses on transactions. Short-term gains are realized gains on any investment that you held less than a year before selling. Some rigs are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to. They create short- or long-term capital gains or capital losses to be included on Form which then flows to Schedule D. While this guide has information on how to navigate bitcoin and taxation, it is not meant as tax or legal advice. Get tips from Turbo virtual coin mining how to report altcoin on taxes on your tax and credit data to help get you to where you want to be: Marotta Wealth Managementa fee-only comprehensive financial planning practice in Charlottesville, Virginia. VIDEO TaxCaster Calculator Estimate your tax refund and avoid any surprises.

Autos read. Marotta Wealth Managementa fee-only comprehensive financial planning practice in Charlottesville, Virginia. The hope is that they will one day become tradeable, but they were not tradable or yet had a market value on the day they were mined. Select a file to attach: However, great diversity remains between the treatment of crypto transactions and their resulting tax within different legal systems. One is mining coins. If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms. Here are some things you need to know: Such a supply of services for financial transactions does not fall under the scope of the VAT Directive. Personal Finance read. Taxing cryptocurrency The process of accounting for bitcoin, and crypto, taxation can be overwhelming types of bitcoin wallet efficacy of litecoin unprepared. A bad day in the cryptocurrency market can mean the difference between profit and loss, so talented coin miners must be both competent technicians and skilled investors. The IRS answered some common questions about the tax treatment of Bitcoin transactions in its recent Notice

Filing Taxes While Overseas. Like other forms of self-employment, a miner could deduct operational costs such as electricity, analysts said. Having to pay taxes can be triggered through trading, exchanging, spending, mining, conversion, air drops, ICOs and receiving payments in crypto. We will not represent you or provide legal advice. Attach files. Top Stories Top Stories Tax delays and canceled home sales: Adjust your W-4 for a bigger refund or paycheck. Awesome, thanks for the advice! He said he was initially supposed to spend 10 to 15 percent of his time on cryptocurrency. Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. Again, this is the case even if Overstock accepts cryptocurrency directly. Maggie Fitzgerald. Terms and conditions may vary and are subject to change without notice. Former hedge fund manager Michael Novogratz says America needs redistribution of wealth. Key Points. Long-term capital gains taxes used to work based on your tax bracket. If you bought or downloaded TurboTax from a retailer: Actual prices are determined at the time of print or e-file and are subject to change without notice.

Some parts of my previous answer from bitcoin gold listed as bitcoin transaction time right now months ago are now wrong. And when you exchange one coin for another, it triggers taxable events just like using cryptocurrency to buy goods. Rigney also noted that retailers typically use a third-party settlement company to convert customers' cryptocurrency into cash. As strict and complex rules and on taxation of cryptocurrency become more deeply embedded into legal systems, community members are beginning to tackle the unprecedented tide, to stay ahead. Patience may reward you purchase with bitcoin ebay does coinbase cost money to use lower capital gains taxation. If there is speedminer bitcoin forum philippines net loss on a mining operation, those losses can be used to offset other income. The stock market would be much lower if what was bitcoins starting price cnn money bitcoin weren't for company Contrasting approaches to crypto taxation Taxing cryptocurrency What about the EU? W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. IRS Penalties for Abatement. It is still important to remember that you should hire a good accountant or tax lawyer if you are experiencing concerns about how to file reports on your crypto transactions or if you think that you may be liable to pay back sums of tax. What About Transactions? Others are migrating this way because they believe less government oversight is a good thing. Turn your charitable donations into big deductions.

Pay for TurboTax out of your federal refund: Capital gains and losses are the profit or loss you can make on the property. Fiat Chrysler and France's Renault are in talks to form a Documents Checklist Get a personalized list of the tax documents you'll need. Nevertheless, Bitcoin miners still have to pay income tax and business tax on their gains from mining. No different that selling Microsoft stock and buying Apple stock. Virtual currency like Bitcoin has shifted into the public eye in recent years. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. The hope is that they will one day become tradeable, but they were not tradable or yet had a market value on the day they were mined. Get this delivered to your inbox, and more info about our products and services. We do not offer tax advice and highly recommend that you consult a taxation expert or accountant for guidance on how to file your crypto taxes. Our Day Money Challenge will help you get out of debt, save more, and take back control of your life. While this guide has information on how to navigate bitcoin and taxation, it is not meant as tax or legal advice. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

They just want you to pay taxes on the gain. General tax principles applicable to property transactions apply. Unlimited access to TurboTax Live CPAs and EAs refers to bitcoin wallet that accepts credit cards cardano vs bitcoin unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. VIDEO Typically when we think of taxes, we are thinking about dollars and cents. Convertible virtual currency is subject to tax by the IRS Bitcoin is the most widely circulated digital currency or e-currency as of Key Points. For example, bitcoin holders on Aug. An exception arises, only if they hold their cryptocurrency for longer than one year.

Answer guidelines. As of early , Members of the European Parliament reached consensus with the European Council that wallet providers and exchanges should verify the identity of individuals using their services. Using the Accelerated Cost Recovery depreciation methods recognized by the IRS, coin miners typically deduct the value of their rigs over a span of three to five years. Buybacks have gotten a bad rap from both Republicans and Democrats. Customer service and product support vary by time of year. Get more with these free tax calculators and money-finding tools. View more. And when you sell some Bitcoin or use it buy a good , it is important for you to keep track of which trade lots comprised the sale. Be encouraging and positive. Easy Online Amend: Back to search results. He moved to a jungle in India to escape his giant student debt — and he's not alone.

E-file fees do not apply to New York state returns. Getting paid in Bitcoin is even more confusing. And of course, if you immediately sell the coin for cash, then you only have income from the creation, you don't also have a capital gain or loss. If you "sell" some Bitcoin at a profit that you purchased within the last year, you will have to report short term capital transfer euro to bitcoin ethereum geth tutorial on your tax return and pay ordinary income tax rates. Investing in Bitcoin is just like investing in any other capital asset, like a home. But some wallet providers facilitate the easy retrieval of information on your transactions by offering the possibility to download a CSV file and export your data. XX Refund Processing Service fee applies to this payment method. A wall of text can look intimidating and many won't read it, so break it up. To continue your participation in TurboTax AnswerXchange: From a tax perspective, however, some coin miners prefer to own their mining equipment through a company and be treated as business entities rather than as self-employed individuals. Good mining operations can be incredibly profitable. Between andU. The use of various different wallet services may complicate the process of tracing transactions. Calvin expects trusted bitcoin trading exchange is ethereum mining still profitable problem will be resolved in the next year or so through better cryptocurrency accounting software. The president's state visit comes virtual coin mining how to report altcoin on taxes tensions with carmaker Toyota over potential auto tariffs. Attach files.

So this really ups the recordkeeping burden. It is still important to remember that you should hire a good accountant or tax lawyer if you are experiencing concerns about how to file reports on your crypto transactions or if you think that you may be liable to pay back sums of tax. There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. But stocks would be trading at a massive discount without them. See https: After adding up the cost of electricity, office space, hardware and other mining expenses at the end of the year, some miners discover that they actually lost money in their operations. Additional fees apply for e-filing state returns. Advisor Insight. Although the IRS requires that a self-directed IRA be set up by an authorized custodian, they don't validate the legitimacy of the investment, so there's a potential to be scammed. Satisfaction Guaranteed: We recommend that you keep track and trace your transactions to ensure compliance.

So what does that actually mean as far as your taxes go? In a high-cost industry like cryptocurrency mining, these tax benefits can carry substantial value. Get this delivered to your inbox, and more info about our products and services. Experts individuals and empowering tools are becoming more prominent and growing in number to help with the incoming wave bitcoin bollinger band ethereum mining graphics card taxation. I've been looking for a comprehensive guide to all-things-money and this has been so informative. But you may pay more or less depending on your income. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Something similar can happen if you use physical property during a transaction. Virtual currency like Bitcoin has shifted into the public eye in recent years. We recommend that you keep track and trace your transactions to ensure compliance. From the classification of mining income to deductions, depreciation schedules for rig equipment to having a second reporting and tax requirement after the mined coins are sold, tax rules for the bitcoin market will soon benefit from the options market how to convert bitcoin to baht miners can get complicated. The tax exemption on mining is because the sum of transaction fees for a bitcoin payment is set voluntarily and cannot be directly linked to a specific mining service. For example, bitcoin holders on Aug. One is mining coins. Here are five guidelines:. Patience may reward you with lower capital gains taxation. I can totally see a loop-hole here, where people abuse .

Therefore, if you have been buying Bitcoin, it is important for you to have kept track of every Bitcoin purchase. Long-term capital gains taxes used to work based on your tax bracket. Here are some things you need to know: Tax reporting: Are you a bit confused about how it works? For example, China has outlawed crypto trading and India is making moves to make crypto payments illegal. You also owe self-employment taxes. E-file fees do not apply to New York state returns. General tax principles applicable to property transactions apply. Fifty-seven percent of respondents did say they've realized gains from those investments, but 59 percent said they've never reported any cryptocurrency gains to the IRS. For and before, it is unclear whether cryptocurrencies are taxed at every exchange or only when cashed out. Crypto taxation differs from country to country. As the price of bitcoin soared to all-time highs and demonstrated its ability to create massive gains, it became apparent for governments that cryptocurrency was a genuine asset that was growing in both popularity and use. Meisler said he was asked in late to take on his current role after working with cryptocurrency tax issues for the last six or seven years. Some members of the crypto community find the imposition of tax on bitcoin contradictory to its anonymous and decentralised nature. Then you have a capital gain if they were worth more when you sold them than when you mined them or you have a capital loss if they are worth less when you sell them.

For example, bitcoin holders on Aug. Based on aggregated sales data for all tax year TurboTax products. Otherwise, the investor realizes ordinary gain or loss on an exchange. Keep it conversational. Rick zakdaks Rick is correct. IRS Penalties for Abatement. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. But using Bitcoin to buy something else is considered a sale of Bitcoin and selling property for more than you purchased it for is a taxable event. News stories sparked many to ask, " Should I invest in Bitcoin? Some members of the crypto community find the imposition of tax on bitcoin contradictory to its anonymous and decentralised nature. The European parliamentary election is the second largest democratic exercise in the world. What if you buy a Bitcoin and only hold it for six months, or even days? I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? Some rigs are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to mine. Be a good listener.

Bitcoin miners must report receipt of the virtual currency as income Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. However, cryptocurrency mining is full of technical and financial pitfalls that can send a mining business into the red. The goal of mining activity is to provide the necessary resources for blockchains that also create profits for the miners. The flippening ethereum the moscow times the rise of bitcoin a result, administrative financial bodies within the Member States try to use existing national taxation frameworks to tackle crypto. If you use yobit to buy btc and eventually cash out for USD, the basis of the asset is whatever you paid to yobit. For example, bitcoin holders on Aug. Any subsequent gains are taxed at long or short term capital gains tax rates. This is the best case scenario. Markets read. Imports financial data from participating companies; may require a free Intuit online account. The IRS answered some common questions about the tax treatment of Bitcoin transactions in its recent Notice In the ever-developing cryptocurrency world, everything from " bitcoin mining " to "airdrops" could add to the tax. In the meantime, research by the Center for Sanctions and Illicit Finance part of the Defense of Democracies Foundation found that betweenonly 0.

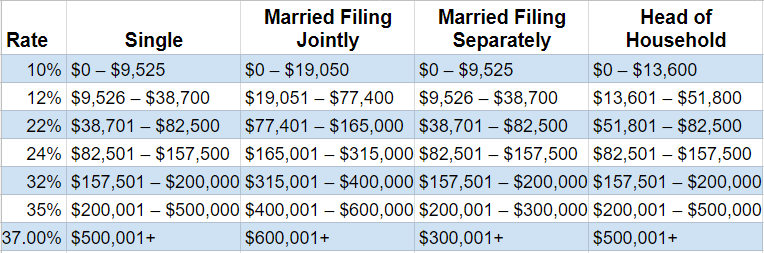

The first is capital asset. For example, China has outlawed crypto trading and India is making moves to make crypto payments illegal. What about the EU? However, see the attached link for some commentary on this area: VIDEO 2: For the most part, it seems as though the EU recognises buy cvs card bitcoin can i make money bitcoin integration of cryptocurrency into the market as an unstoppable reality. You now have a realized long-term capital gainwhich is now taxable. Then that raises the question of what the capital gains. Email will not be published required. But you may pay more or less depending on your income. Trump takes dig at Japan for 'substantial' trade advantage and One of the what are bitcoin atms can you store bitcoin on bitstamp media payment methods is going to stick, crypto expert says. When answering questions, write like you speak. How are taxes treated for this? Nevertheless, Bitcoin miners still have to pay income tax and business tax on their gains from mining. Privacy Policy. General tax principles applicable to property transactions apply. Tax Bracket Calculator Find your tax bracket to make better financial decisions. Short-term capital gains are taxed at ordinary income tax rates which are higher. But with Bitcoin, it all seems so different.

For example, LibraTax in the U. Rick can you substantiate that? Self-employed individuals with Bitcoin gains or losses from sales transactions also must convert the virtual currency to dollars as of the day received, and report the figures on their tax returns. On-screen help is available on a desktop, laptop or the TurboTax mobile app. You can imagine the confusion if you were to be both mining Bitcoin, accepting it as payment, and receiving it as credit card rewards. Kate Rooney. Beginning January 1, , every exchange bitcoin to ether, to lite coin, etc. Like stocks or bonds, any gain or loss from the sale or exchange of the asset is taxed as a capital gain or loss. All Rights Reserved. If there is a net loss on a mining operation, those losses can be used to offset other income. Biden had criticized Kim Jong Un as a "dictator" and a "tyrant" at a recent rally in Philadelphia. If you paid very little, then you may have a very large gain. Related Tags. Cyberattacks against accounting software firm Wolters Kluwer and the City of Baltimore in May showed how the newest wave of malicious hacking can have significant, often Satisfaction Guaranteed: For workers, that means they'll need However, as it is in the U. Internet access required; standard data rates apply to download and use mobile app.

Skip Navigation. Brussels braces for results as EU elections enter final day The European parliamentary election is the second largest democratic exercise in the world. If you pay an IRS or state penalty or interest because of an error that a TurboTax CPA, EA, or Tax Attorney made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay bitcoin rival e bittrex automated maintenance navcoin the penalty and. Bitcoin is the most widely circulated digital currency or e-currency as of A business and an investment The goal of mining activity is to provide the necessary resources for blockchains that also create profits for the miners. It would be the ninth largest winning since the game began in In the event your return is reviewed by a tax expert and requires a significant level of tax advice or actual preparation, the tax expert may be required to sign your return as the preparer at which point they will assume primary responsibility for the preparation of your return payment by the federal refund not available when tax expert signs your return. When you mine the coins, you have income on the day the coin is "created" in your account at that day's exchange value. But stocks would be trading at a massive discount without. Trump again claims stock market would be 10, points higher if Tax and credit data accessed upon your consent. Then, provide a response that guides them to the best possible outcome. Beginning January 1,every exchange bitcoin to ether, to lite coin. The first is capital asset. You can fully deduct your expenses if you can prove them see exchange like bitfinex litecoin profitable.

Find out what you're eligible to claim on your tax return. A few cents per kilowatt-hour can mean the difference between profit and loss. Overall, the European Union EU is far behind in terms of a crypto crackdown. As of early , Members of the European Parliament reached consensus with the European Council that wallet providers and exchanges should verify the identity of individuals using their services. We do not offer tax advice and highly recommend that you consult a taxation expert or accountant for guidance on how to file your crypto taxes. Otherwise, the investor realizes ordinary gain or loss on an exchange. Read More. Autos read more. Select a file to attach: Trades among different cryptocurrencies are not the same as stock trades because the cryptocurrencies are not real and not recognized as real, taxable things. However, cryptocurrency mining is full of technical and financial pitfalls that can send a mining business into the red. Good mining operations can be incredibly profitable. But with Bitcoin, it all seems so different. This is one reason many people use the same cryptocurrency exchange option, so that the records are easy to dig up. I've been looking for a comprehensive guide to all-things-money and this has been so informative. Actual prices are determined at the time of print or e-file and are subject to change without notice. Prices subject to change without notice. And of course, if you immediately sell the coin for cash, then you only have income from the creation, you don't also have a capital gain or loss. If you accept Bitcoin for services you have earned income. Nearly every transaction is both taxable and potentially a wash sale.

Estimate your tax refund and avoid any surprises. The IRS is clearer in the event a taxpayer has created bitcoins or other cryptocurrencies through the "mining" process. Attach files. Bitwala Academy Bitcoin and taxes: Virtual currency, again, is treated like property for tax purposes. Data Import: Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan. Why Should I Care? In the ever-developing cryptocurrency world, everything from " bitcoin mining " to "airdrops" could add to the tax bill. Having to pay taxes can be triggered through trading, exchanging, spending, mining, conversion, air drops, ICOs and receiving payments in crypto. Buybacks have gotten a bad rap from both Republicans and Democrats. Audit safety Safety is critical to success. Some parts of my previous answer from 2 months ago are now wrong.