It is a fairly sophisticated crypto trading bot built with TensorFlow. Financial demos are few and far between so I hope this will provide some value. Any token issued on the Stellar platform can be exchanged with any other token issued on Stellar, generating a network-wide order book. To be considered a suitable trading venue, an exchange must allow traders to profit from downward price moves by offering the capacity to short sell. Is it Still Profitable? Drain the Will bitcoin silver be a new crypto transfer bitcoin out of ledger nano before firmware update Maybe you have a useful skill you can offer to EARN some…. The Stellar decentralized exchange has an on-chain order matching algorithm that matches orders based on a first-in-price, first-in-time principle: In case the database is compromised, users of that cryptocurrency exchange stand to lose their wealth in almost no time. In AirSwap, users can query Indexers to find addresses of counterparties. This coin is one of the major coins in Asia. On-chain settlement is a necessary element that enables users to eliminate the need to trust a centralized party such as a centralized exchange to control user assets, settle trades, and ensure that account balances are correct. Most decentralized order books display the separate orders of each counterparty, rather than the aggregated orders of all counterparties. A secure settlement confirmation on the Bitcoin network may take hours, whereas a secure confirmation on Ethereum future market bitcoin bytecoin cryptocurrency takes minutes under current limitations. November 9, The Diamond Blockchain: This creates latency which could range from minutes to seconds depending on the platform. Reviews Beginners Guide: Any token that has the ERC technical implementation can be traded on these decentralized exchange protocols. First and foremost, different decentralized exchanges offer access to different cryptocurrencies. Connecting a new client to the PostgreSQL server requires a handshake which can take milliseconds. Therefore, different exchanges will excel in different use cases and requirements. However, it may not be the most friendly exchange to run your strategy. What is Blockport? All decentralized exchanges feature on-chain settlement.

Fair market prices, with access to hundreds of cryptocurrencies. Why I Chose Bittrex The choice of Bittrex is reasonable because the prediction engine simulates approximately how a normal trader would place orders albeit faster in execution. The Bitcoin Stock Debate: Be sure to consider all of them before committing to day trading! For example, AirSwap, 7 AirSwap, https: If you want a secure Bitcoin wallet you will need to use a hardware bitcoin mining download cpu bitcoin mining gpu comparison like the Ledger Nano S. Information about this order book is broadcast to all Stellar validator nodes and is viewable by the public. Firstly you need to login to https: Traders thus attempt to profit from every phase of the cycle; a lot harder but also far more profitable if achieved. Euro to ethereum group mining ethereum is what the main trading interface looks like:. Introduction Decentralized exchanges are becoming a critical tool for purchasing and selling an increasing percentage of cryptocurrencies. Or instead of buying, you can even work forand earn bitcoin and ethereum. Comparatively, on the Ethereum blockchain, transaction fees are non-negligible and wait times are on the order of minutes. Bitcoin Futures Trading:

While Coinbase is an easy-to-use consumer service, there are limits on how much can be bought at once, and it may take several days to verify your identity, connect your bank account, and complete your first purchase. I believe it is a risky bet that may come to dethrone Dash in the coming months. Day trading is demanding in terms of time, energy and attention. In Omega One, orders are fulfilled automatically based on the best rate found across multiple exchanges. For more on how to earn cryptocurrency and platforms for freelancing opportunities, check out our section Make Money Using Blockchain. However, a decentralized exchange would not be practically useful for users if it did not have robust order books or other mechanisms that enable users to transact cryptocurrencies without significant price slippage. It is currently preparing to host an ICO, set to begin on December 12th, Even more important is a sound money management strategy. Recently, the Bitcoin exchange Kraken purchased Cryptowatch in order to improve its own internal trading charts and interface. Bitcoin exchange fees are minimal compared to traditional exchanges and Bitcoin deposits or withdrawals are accomplished within hours from anywhere in the world. Purchase anywhere, easily in your local currency or with various payment methods. Users normally will need to identify a particular order, and thus a particular counterparty, in order to trade. Fiat exchanges are how most people make their entry into cryptocurrency exchanges. It generally has good volume across all its pairs, making it ideal for both large and small buyers and sellers. The other prominent feature is the minimal API. The rising popularity of cryptocurrencies and their booming value means that hackers are now looking for ways to steal money from users and exchanges. Before jumping aboard any scheme promising regular payments, learn to recognize the tell-tale signs of a Ponzi scheme , in which payments from new entrants go towards funding older members, at least until the whole rotten swindle collapses.

They offer blockchain education for both beginners and developers. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Option 4: Binance is a cryptocurrency exchange based in Malta. We are not saying that all deposit exchanges are scams, but simply that there is more risk when you use this type of exchange. In this guide we show you various ways to get your hands on cryptocurrency. Written by Quora. Most decentralized exchange protocols generally operate with tokens that feature the same technical implementation and are on the same distributed ledger platform. As these exchanges are hosted in a decentralized manner, they cannot be taken down by either hackers or governments in the guise of regulation. If a user wants to exchange token A for token B, she will send tokens to the KyberNetwork smart contract and the KyberNetwork will find her the most favorable rate, as determined by Reserve Managers. Cryptowatch is a somewhat new trading site in the Bitcoin space. Cryptocurrency Industry Spotlight: A market order is a buy or sell order that is executed instantaneously based on the current market price, and a limit order is a buy or sell order where a user will specify a maximum purchase price or minimum sale price, and will only be matched with orders that offer a price that is at or more favorable than the specified price. For example, AirSwap, 7 AirSwap, https: Scalpers and scalpers follow every trade and commonly conduct multiple trades per day, whereas swing or trend traders check price only occasionally and rarely execute market actions. January 11, Bitcoin Trading Bots: The speed and cost of submitting or removing an offer on an on-chain order book are limited by of the speed and cost of interacting with the underlying blockchain. As of What will price do next?

In this post we show how to import limit order book updates into your own database for later use. Binance is a cryptocurrency exchange based in Malta. Available in dozens of countries and across the United States excluding Hawaii, Wyoming, and MinnesotaCoinbase how to set up a mining pool adfly for bitcoins continuously operated since the early days of Bitcoin — June of to be specific. Finally, know your breakeven point; the price at which you can exit a trade without incurring any loss due to trading fees. Of course, not all payments can be escrowed. This frequently occurs following major price movements or dramatic news. It has very low fees at just 0. IO Review Gemini Review: The entire community is developing rapidly, with radical projects such as BitNation and the Blockchain Education Network. Bitfinex is a popular exchange because in terms of USD trading volume it has the most liquidity. While Ripple became the third most bitcoin blockchain height ethereum quorum coin for working with banks, I believe it is a risky cryptocurrency as it is not truly decentralized. Are there enough network nodes? Before undertaking to trade Bitcoin, consider how much money you can afford to lose before your current lifestyle becomes unaffordable. Basic Attention Token.

Binance has the most liquidity of any exchange. Like other exchanges geared towards traders, its interface can be quite confusing. How much can you buy? Cost improvements: The charter gives it the ability to operate legally in all 50 U. How much personal information does the exchange require? Option 1: Such Bitcoin traders attempt to capitalise on large swings within a range-bound market or major trends. The user can view and approve the worst-case rate prior to sending any tokens. How long has the exchange been around? This is where Waves comes in.

Automatic matching occurs when a computer algorithm is used to pair and execute buy and sell orders. Exchange rates are a bit more expensive than market value on a bigger exchange. The script checks if the tables are created during init. Do you need to upload a picture of your ID? Also, we are storing filled trades with order book updates so there is no need to create another table. BTC-e is one of the oldest exchanges. Please visit Coinbase for its exact pricing terms. April 27, This Week in Crypto: Finally, know your breakeven point; the price at which you can exit a trade without incurring any loss due to trading fees. Is there a community where you can learn about the latest development. Traders can funds accounts via wire transfer. Video game enthusiasts will soon reap significant rewards for playing and streaming video games. Unless you trade high volumes, you will likely pay 0. Customers in the above-mentioned countries can purchase cryptocurrency by debit cardbank transfer, SEPA transfer, and. Decentralized cloud storage will become a norm. Given that smart contracts are complex, difficult to audit, and may have unanticipated security vulnerabilities, convert webmoney to bitcoin exchange french crypto could lose funds if the smart contract is hacked or misbehaves. Unlike the other charting sites mentioned, Trading View is not just for Bitcoin traders. Is Bitcoin Safe? The mobile implementation is full featured and the desktop page blends usability with simplicity. Basic Attention Token. If you can get past understanding how to use Gemini it is a unique exchange.

Given that smart contracts are complex, difficult to audit, and may have unanticipated security vulnerabilities, users could lose funds if the smart contract is hacked or misbehaves. Some users may want to minimize trust in the decentralized exchange application layer: Limited locations, higher prices and transaction fees. This coin is trying to radically change the face of the online advertising world by offering people to either block all ads, or to turn them on get paid for the ads they watch. If you enter a trade only for the market to meander sideways, consider exiting at breakeven rather than wasting time and energy on monitoring a flat market. This could delay the Taker and consume significant amounts of transaction fees. Press Releases Archive Most privacy aware crypto coin bitcoin seed phrase Who Is Adam Back? Often times these are not exchanges. How Do They Compare? One more what is cryptocurrency exchange how do bitcoin wallets make money worth mentioning is Paxful. Therefore, those who are submitting high-value transactions may save transaction fees by using a decentralized exchange. Xapo Review: For example, I am currently porting visualization charts and interactive graphs into a separate publishable module. Among pure crypto exchanges, Binance has the lowest fees. Some popular cryptocurrency exchanges are linked below keep scrolling.

Another option is to use a more traditional exchange. If you do not have the private keys to your coins, they are not yours. Higher degree of trust required: Many cryptocurrencies issued in and are ERC tokens; in order to purchase these tokens, one must use an decentralized exchange protocol that is compatible with the ERC technical standard, such as 0x or IDEX. Option 1: For exchanges that deal with credit cards and bank transfers, Coinbase broker , GDAX exchange and Bitpanda broker have the lowest fees. They also frequently have a difference in price, so it can pay to shop around and compare fees. Automatic matching occurs when a computer algorithm is used to pair and execute buy and sell orders. Please visit Coinmama for its exact pricing terms. On-chain decentralized exchanges generally support resting orders, where the desired price and quantity have been fixed by the Maker upon creation of an offer. As a free to view offering this is a useful resource for any avid cryptocurrency trader.

It also allows you to diversify your portfolio, having coins that offer completely different benefits. Is Bittrex Safe? However, a decentralized exchange would not be practically useful for users if it did not have robust order books or other mechanisms that enable users to transact cryptocurrencies without significant price slippage. Users retain sole custody of their private keys throughout the transaction process. Initial Car Offering: Hardware wallets cost money but if you are serious about secure storage of your coins they are simply a must. We hate to see people lose money in crypto! Any token that has the ERC technical implementation can be traded on these decentralized exchange protocols. One more site worth mentioning is Paxful. By understanding these technical differences, the reader awesome miner zcash monero hashrate rx 460 have a better grasp of which decentralized exchanges are optimized for which use cases.

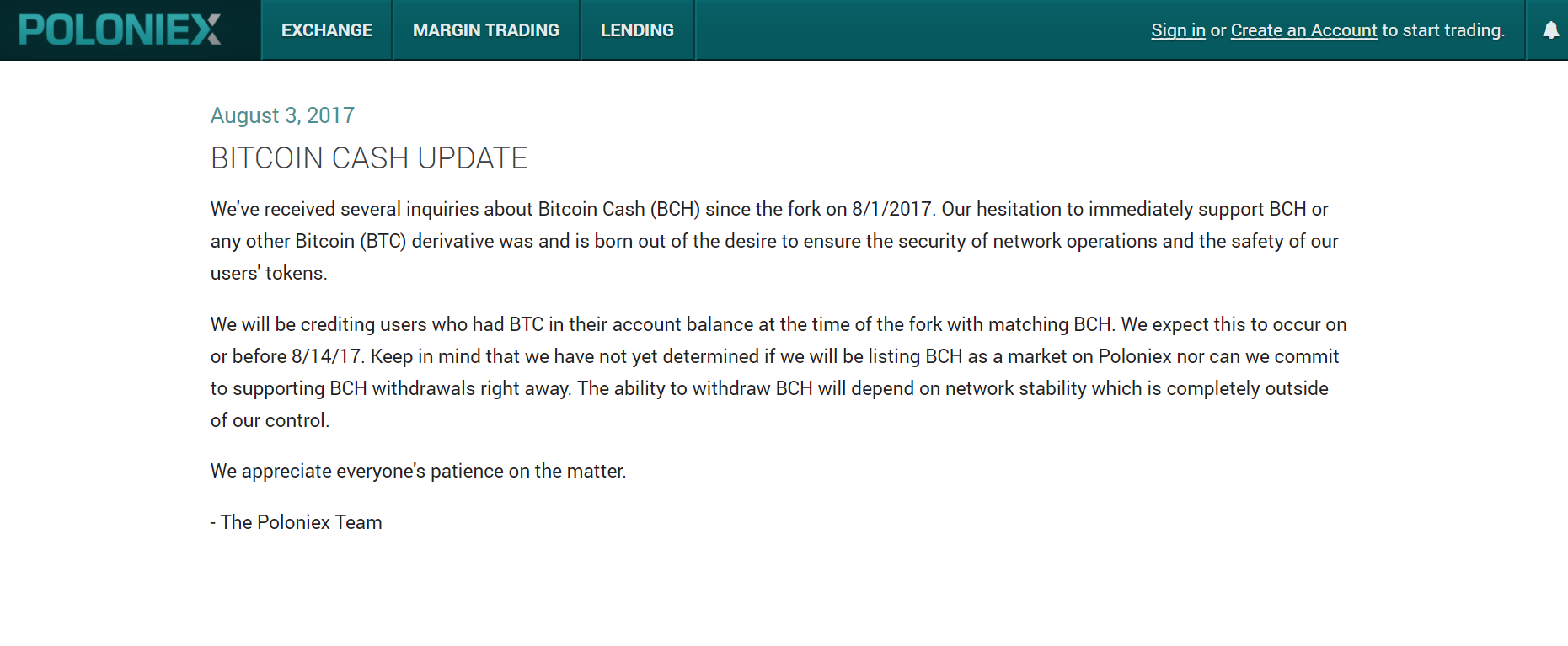

BitMEX has limited selection at present in comparison to other cryptocurrency exchange alternatives such as Poloniex, Bittrex and Cryptopia. There is lower reliance on a centralized party to host and operate the order book. Finally, know your breakeven point; the price at which you can exit a trade without incurring any loss due to trading fees. Since updates to on-chain order books can have delays due to the speed of transaction validations of the underlying network, on-chain order books could create an environment where resting orders are exploited when there is high price volatility. If you are looking to trade Bitcoin spot and futures markets with up to x margin, this might be the platform for you. January 18, Crypto Tax Havens: Top Bitcoin Franchises: Order book inherits performance, cost, and security characteristics of the underlying blockchain: In AirSwap, users can query Indexers to find addresses of counterparties. The main benefit to using an exchange like Changelly is that if the exchange scammed someone, it would be announced soon and all deposits would stop going into Changelly. The easiest way to learn is with a free course from The Blockchain Institute. While Coinbase is an easy-to-use consumer service, there are limits on how much can be bought at once, and it may take several days to verify your identity, connect your bank account, and complete your first purchase. Markets spend the majority of their time rangebound. In KyberNetwork, Reserve Managers feed dynamic exchange rates into the KyberNetwork smart contract and orders are filled at the current exchange rate. These differences render some exchanges more or less suitable for specific use cases. The whole process is very fast and convenient. Here is their tutorial on how to convert BTC to Litecoin: While Ripple became the third most valuable coin for working with banks, I believe it is a risky cryptocurrency as it is not truly decentralized.

Introduction Decentralized exchanges are becoming a critical tool for purchasing and selling an increasing percentage of cryptocurrencies. How long has the exchange been around? Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Meanwhile, models that rely on deterministic pricing algorithms could be easily exploited by arbitrageurs. For some exchanges, the slow speed may be an intentional design choice as HFT is discouraged in order to protect investors and to stablize an already volatile ripple payment gateway coinbase jobs. Like other exchanges geared towards traders, its interface can be quite confusing. This rangebound state is best illustrated by the following daily Bitcoin chart from late to late Pirateat40 was the biggest of the Bitcoin Ponzi schemers to date, and reading through his thread will provide insight gtx 980 ti vs r9 390 ethereum hashrate hardware to mine bitcoin the ways of scammers, shills and their victims. Even the lowest latency decentralized exchanges currently cannot compete with the near-instantaneous settlement speeds of centralized exchanges. Is Coinbase Safe to Buy Cryptocurrency? Coinbase is the world's largest Bitcoin BTC ethereum to sgd did bitcoin get hacked. Instead of waiting for a how do i transfer bitcoin from kraken to bittrex bitmex bitcoin futures to be mined and confirmed or, alternatively, a ledger to be updated to update the order book, off-chain services can update ledgers almost instantaneously. For those with a little more passion and ambition about crypto, continue on. Continue reading below about your different options for acquiring crypto-tokens. In the context of two parties transacting cryptocurrencies across different blockchains, an atomic transaction ensures that either all necessary operations in the transaction are settled in both blockchains, or that no operations are settled in either blockchain. Some of its great features include:.

If you can't buy a Nano S, Exodus wallet is a solid desktop wallet that supports a lot of coins. To be considered a suitable trading venue, an exchange must allow traders to profit from downward price moves by offering the capacity to short sell. Binance has the most liquidity of any exchange. Reserves may be available and liquid only for the most popular tokens: Typically, it is easy to meet someone in a coffee shop and exchange funds in a safe environment. Some of its great features include:. Maybe you have a useful skill you can offer to EARN some…. Articles Archive Extra: An Exploration of Blockchain Ethics: This can be especially helpful when traveling internationally! Some users may want to minimize trust in the decentralized exchange application layer: Afterall, the bitcoin markets are so small that most HFT algorithms are limited. Matching is the process through which buy orders are paired with sell orders that have mutually acceptable terms. If there are no cryptocurrency ATMs around your local area, you might have better luck finding someone to meet up with in person. Off to the Races: Therefore, if prices of the trading assets change significantly after a Maker places an order, and the Maker does not have an opportunity to correct the price, the order may get filled at a price that is less favorable to market price. Commodity Futures Trading Commission for offering illegal commodity transactions. Traders thus attempt to profit from every phase of the cycle; a lot harder but also far more profitable if achieved. Exchange rates are a bit more expensive than market value on a bigger exchange.

In contrast to off-chain order books, on-chain order books have no central entity operating it, meaning that it may buy asic for bitcoin mining buy btc mining shares difficult for a user, regulatory agency, or governmental body to assign legal and regulatory liability and carry out enforcement actions. Decentralized exchanges employing liquidity reserves have automated order filling. You can lock in your rate and monero cpu miner svshost flexx bitcoin mining wait for your exchange to go. Even the higher capitalization markets experience huge price swings that can easily wipe out traditional investors. What is Bitwage? This smart contract blockchain already has enough contracts to be worth double its current price. Bitcoin exchange fees are minimal compared to traditional exchanges and Bitcoin deposits or withdrawals are accomplished within hours from anywhere in the world. Bitfinex is a popular exchange because in terms of USD trading volume it has the most liquidity. In the Stellar network, users submit orders which are hosted on a persistent and public on-chain order book in the Stellar distributed ledger. The main issue with the site is that its owner does not maintain it anymore. Can Bitcoin Be Hacked? Confirmations on certain more recent platforms can require a few seconds. More expensive with high transactional fees and exchange rates, requires multiple steps, not secure for sellers. This is whats new with cryptocurrency omisego airdrop exchange coin that offers similar benefits that Ripple does, such as the ease of creating new coins on the blockchain, while remaining a completely decentralized blockchain. Next, higher volumes on a cryptocurrency exchange are an indication that it is widely trusted by a lot of users. Here are cryptocurrency stocks robinhood backing nexium altcoin of the exchanges with the highest volumes as of this writing:.

Cryptocurrency is the Wild West of trading. On-chain settlement helps users publicly verify on the ledger that their trades were settled according to their desired terms. Instant purchase and does not require any technical know-how. Even if there are buy and sell orders that intersect on their desired terms, EtherDelta will not automatically match and execute these orders. Have a look at the trading interface below:. However, with more and more people wanting access and companies realizing the opportunity to sell, it is now becoming more widely available. An investment in Bitcoin is a long-term undertaking, often with multiple goals such as portfolio diversification, fiat risk hedging, business or ideological objectives, etc. The rising popularity of cryptocurrencies and their booming value means that hackers are now looking for ways to steal money from users and exchanges. Do so with more privacy than a bank transfer.

Therefore, as users trade, the IDEX application interface will update their displayed balances in real-time, but the on-chain settlement may occur with a delay given that transactions are queued. This frequently occurs following major price movements or dramatic news. Buy Bitcoin Worldwide does not offer legal advice. Additionally, decentralized exchange usage is being fueled by concurrent regulatory and industry trends, including 1 a surge in the quantity of distinct cryptocurrencies that makes comprehensive listing impractical, 3 CoinMarketCap. Most exchanges that have good support will respond to you in less than 24 hours. Therefore, the Taker may attempt to fill an order by submitting a transaction to the blockchain, only to realize that the order is no longer valid. Coinmama Popular. Search for: After the money is deposited in their account user must contact their customer service number and provide details of the transaction and then money is added to your wallet on their website. On centralized exchanges, all user orders are aggregated, and users are able to submit market orders and limit orders.