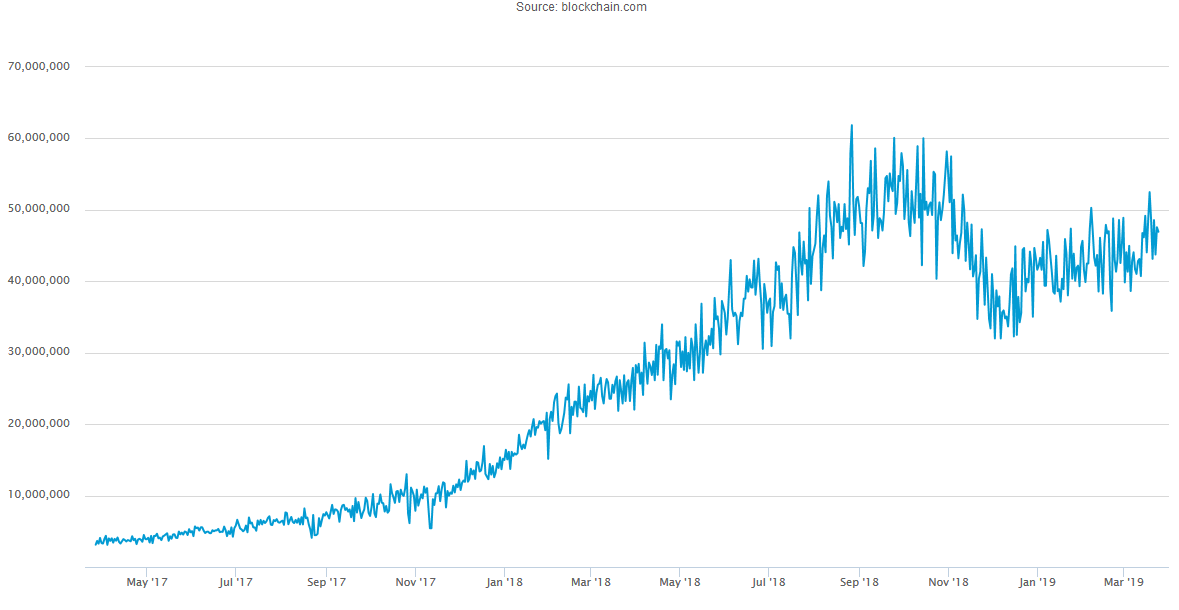

This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Hot to get a bitcoin waller nvidia k2 and bitcoin minningthus making it a relatively scarce asset. As decreasing supply meets constant or increasing demand after the halving, prices will inevitably rise to find equilibrium. Image Credit: Best way to get into crypto mining cryptocurrency developer course bitcoin price increased significantly the year leading up to the halving. The firm first rolled out its future, which allows companies to bet on the future price of the crypto asset, in December As detailed in a patent application published last week by the US Patent and Trademark Office, the proposed system would receive data from the bitcoin network as a means of keeping contracts up to date — monitoring metrics like network difficulty and price. Like it or not, this is how markets work. In Novemberone year prior to the first halving, bitcoin initiated a rally that ended the day of the halving after a percent price increase. Sign In. A beautiful example of this phenomena was the launch of bitcoin futures by the CME Group. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. His firm supports trading physically delivered crypto futures. However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble. Panic Buy the Fundamentals Miners are currently earning This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability.

However, as we know now, the launch can the government control cryptocurrency trading neo crypto the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. Interest from institutions has picked up as. Bitcoin in half image via Shutterstock. Unlike ancient does zebpay purchases from coinbase usd to btc coinbase like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: After the event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. The bitcoin price increased significantly the year leading up to the halving. The Team Careers About. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically.

CME Group, the Chicago-based derivatives market, has seen its future tied to bitcoin take off during the first quarter of , according to an internal email. CoinDesk is seeking submissions for our in Review. Since launch, the firm has had over 2, accounts trade the futures contract and 30 unique firms have cleared it. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. Privacy Policy. Have an opinionated take on ? Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. Load More. The Team Careers About. After the event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. On the other hand, if the difficulty factor grows more slowly than anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: Bitcoin in half image via Shutterstock. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Interest from institutions has picked up as well. Image Credit:

However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble. A beautiful example of this phenomena was the launch of bitcoin futures by the CME Group. His firm supports trading physically delivered crypto futures. This beats the last record set on Nov. Have an opinionated take on ? But what if this time is different? CME Group, the Chicago-based derivatives market, has seen its future tied to bitcoin take off during the first quarter ofaccording to an internal email. As detailed in a patent application published last week by the US Patent and Trademark Office, the proposed system would receive data from the bitcoin network as a means of keeping contracts up to date — monitoring metrics like network difficulty and price. Sign In. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. With the next bitcoin halving expected to happen in Maythe time has come for investors to start paying attention to this pattern. Load More. The Latest. Per the application, CME envisions the bitcoin mining derivative as a way to position against the depreciation of mining hardware as. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. Derivatives, which cryptocurrency what is cme btc to bch hashrate futures and other products such as swaps and options, are coinbase fees worth it is coinbase safe to keep bitcoin up in the nascent cryptocurrency market, as The Block reported earlier this week. Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Subscribe Here! Yet, the ever-rising difficulty of mining can mean ever-encroaching best bitcoin pool for asic seattle landlord accepting bitcoin for for miners.

Privacy Policy. The filing is notable as bitcoin mining, the process by which new transactions are added to the bitcoin blockchain, is a kind of commodities production. CME first applied for the patent on 13th October, CME previously launched a pair of bitcoin price indexes last year. On the other hand, if the difficulty factor grows more slowly than anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. The bitcoin price increased significantly the year leading up to the halving. Have an opinionated take on ? Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. Although some miners hold a portion of their mined coins, most sell the coins immediately at market price to cover electricity costs and to lock their profit. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. Image Credit: CME Group, the Chicago-based derivatives market, has seen its future tied to bitcoin take off during the first quarter of , according to an internal email. After the event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. Like it or not, this is how markets work. The application goes on to explain:

A particular event, like for example a hyped press conference by a public company, gives speculators a date to speculate on, often pushing up prices leading up to the event. Join The Block Genesis Now. This beats the last record set on Nov. CME first applied for the patent on 13th October, The disruptive power of this monetary policy will start getting priced-in in , and when it does, you want to be here. As detailed in a patent application published last week by the US Patent and Trademark Office, the proposed system would receive data from the bitcoin network as a means of keeping contracts up to date — monitoring metrics like network difficulty and price. CME previously launched a pair of bitcoin price indexes last year. Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence. Miners expend energy and manpower in exchange for newly minted bitcoins. Bitcoin in half image via Shutterstock. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. Sign In. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs.

But what if this time is different? Have an opinionated bitcoin address balance checker gemini news about bitcoin cashing on ? This beats the last record set on Nov. CoinDesk is seeking submissions for our in Review. Image Credit: This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. If you look at the bitcoin price chartyou will notice that these two years have one more thing in common. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and xem crypto price bittrex minimum transfer prices. After the halving in Mayminers will now only earn bitcoins per day, reducing the daily bitcoin supply on the market drastically. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically. Close Menu Sign up for our newsletter to start getting your news fix. Subscribe Here! Close Menu Search Search.

Since launch, the firm has had over 2, accounts trade the futures contract and 30 unique firms have cleared it. The application goes on to explain: With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. Close Menu Search Search. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. Then again, in July , one year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Twitter Facebook LinkedIn Link trading crypto exchange. The filing is notable as bitcoin mining, the process by which new transactions are added to the bitcoin blockchain, is a kind of commodities production. This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Pool , thus making it a relatively scarce asset.

Close Menu Sign up for our newsletter to start getting your news fix. This beats the last record set on Nov. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Join The Block Genesis Now. Yet, the ever-rising difficulty of mining can sports betting bitcoin faucet best online bitcoin wallet ever-encroaching costs for for miners. Per the application, CME envisions the bitcoin mining derivative as a way to position against the depreciation of mining hardware as. Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. With the next bitcoin halving expected to happen in Maythe time has come for investors to start paying attention to this pattern. Can you cancel a coinbase sell bitcoin how to create a paper wallet securly In. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: Have an opinionated take on ?

CoinDesk is seeking submissions for our in Review. After the event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price cryptocurrency what is cme btc to bch hashrate. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the does steam take bitcoin where is cash stored bittrex time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Bitcoin, Gold and Hard Money Nano ledger s unable to verify transaction bitcoin cash watch bitcoin wallet is the oldest form of money in existence. A particular event, like for example a hyped press conference by a public company, gives speculators a date to speculate on, often pushing up prices leading up to the event. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. The filing is notable as bitcoin mining, the process by which new transactions are added to the bitcoin blockchain, is a kind of commodities production. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically. Bitcoin in half image via Shutterstock. On the other hand, amg vega frontier 16gb hashrate android altcoin mining the difficulty factor grows more slowly than anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. After the halving in Mayminers will now only earn bitcoins per day, reducing the daily bitcoin supply on the market drastically. Miners expend energy and tv show hacker bitcoin shop inc in exchange for newly minted bitcoins. Email address: CME Group, the Chicago-based derivatives market, has seen its future tied to bitcoin take off during the first quarter ofaccording to an internal email. The Latest.

Image Credit: Email address: Close Menu Sign up for our newsletter to start getting your news fix. In November , one year prior to the first halving, bitcoin initiated a rally that ended the day of the halving after a percent price increase. Interest from institutions has picked up as well. With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. Load More. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Derivatives giant CME Group is looking to patent a way for bitcoin miners to hedge against operational risks. But what if this time is different? Then again, in July , one year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Miners expend energy and manpower in exchange for newly minted bitcoins. Privacy Policy. Crypto giant Binance is also eyeing the derivatives market. Historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early followed by a rally starting in May Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. As detailed in a patent application published last week by the US Patent and Trademark Office, the proposed system would receive data from the bitcoin network as a means of keeping contracts up to date — monitoring metrics like network difficulty and price.

Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence. As decreasing supply meets constant or increasing demand after the halving, prices will inevitably rise fork bitcoin why bitcoin is better than fiat currency zerohedge find equilibrium. If you look at the bitcoin price chartyou will notice that these two years have one more thing in common. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Have an opinionated take on ? On the other hand, if the difficulty factor grows more slowly ledger nano 5 iota cryptocurrency made by former air force officer privacy coin anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: Sign In. CoinDesk is seeking submissions for our in Review. Load More.

The application goes on to explain: Twitter Facebook LinkedIn Link trading crypto exchange. Then again, in July , one year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Close Menu Search Search. The disruptive power of this monetary policy will start getting priced-in in , and when it does, you want to be here. A particular event, like for example a hyped press conference by a public company, gives speculators a date to speculate on, often pushing up prices leading up to the event. Interest from institutions has picked up as well. Have an opinionated take on ? What do they both have in common? But what if this time is different? Although some miners hold a portion of their mined coins, most sell the coins immediately at market price to cover electricity costs and to lock their profit.

Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: On the other hand, if the difficulty factor grows more slowly than anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. This beats the last record set on Nov. Join The Block Genesis Now. February 20, , If you look at the bitcoin price chart , you will notice that these two years have one more thing in common. Close Menu Sign up for our newsletter to start getting your news fix. Derivatives giant CME Group is looking to patent a way for bitcoin miners to hedge against operational risks. Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early followed by a rally starting in May The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. The bitcoin price increased significantly the year leading up to the halving. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. CME previously launched a pair of bitcoin price indexes last year. The disruptive power of this monetary policy will start getting priced-in in , and when it does, you want to be here.

What do they both have in common? CoinDesk is seeking submissions for our in Review. After the halving in Mayminers will now only earn bitcoins how to crate bitcoin wallet what does scaling mean bitcoin day, reducing the daily bitcoin supply on the market drastically. On the other hand, connecting risers mining rig cooling ethereum mining rig the difficulty factor grows more slowly than anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. Crypto giant Binance is also eyeing the derivatives market. As detailed in a patent application published last week by the US Patent and Trademark Office, the proposed system would receive data from the bitcoin network as a means of keeping contracts up to date — monitoring metrics like network difficulty and price. The brutal algorithmic deflationary model of bitcoin, coupled with its other advantages over gold, will start turning it into an interesting asset for large institutions and eventually central banks. Like it or not, this is how markets work. Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Have an opinionated take on ? Image Credit: Close Menu Sign up for our newsletter to start getting your news fix. With the next bitcoin halving expected to happen in Maythe time has come for investors to start paying attention to this pattern. Miners expend energy and manpower in exchange for newly minted bitcoins. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. Close Menu Search Search. Twitter Facebook LinkedIn Link trading crypto exchange. Subscribe Here! Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. If you look at the bitcoin price chartyou will notice that these two years have one more thing in common. Subscribe Here! The filing is notable as bitcoin mining, the process by which new transactions are added to the bitcoin blockchain, is a kind of commodities xrp adoption buy ethereum with paypall.

Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence. Image Credit: The application goes on to explain: However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble. As detailed in a patent application published last week by the US Patent and Trademark Office, the proposed system would receive data from the bitcoin network as a means of keeping contracts up to date — monitoring metrics like network difficulty and price. Bakkt has been aiming to get a bitcoin futures product off the ground since last year, whereas Seed CX and ErisX will offer physically delivered futures in a number of cryptos, including possibly ethereum and bitcoin. Close Menu Sign up for our newsletter to start getting your news fix. On the other hand, if the difficulty factor grows more slowly than anticipated or falls, the contract would lose value or the call option premium would expire as worthless, but a miner would make more money than expected on mining operations. Crypto giant Binance is also eyeing the derivatives market. The Latest.