ICOs can be completed by individuals with the required technical skill. At the moment Januaryhow to sell my ethereum how to sell ethereum on bitfinex are spending a lot more on electricity. Credit card and bank transfers are only accepted in exchange for a fee. A secondary strategy that generated stable profits was found to be not different from random trades. There are many variables that can influence profitability for miners and investors too, of course. Under no circumstances does any article represent our recommendation or reflect our direct outlook. The disposition effect explains why investors would keep holding losing stocks for a long time while selling winning stocks much faster or as soon as they rebound. The overwhelming optimistic sentiment of most cryptocurrency investors is an indication of their belief that winners will continue to win, and downturns must reverse despite or because of the volatile conditions in the crypto market. A unit of Bitcoin is composed of , Satoshi, just as a Euro is composed of Cents, and can be traded in fractions of a single unit Hayes,p. Proof of Work as it Relates to the Theory of the Firm. If you wish to receive more information regarding cryptocurrencies such as Ether, XRP or Bitcoin, please take a second to follow me so you can be notified of future articles. As such, they cover significantly less data than before, while Bitcoin is also making up a smaller part of this data. Journal for General Philosophy of Science, 39 153— The inefficiency of Bitcoin. However, the token has not been able to solidify on those minimal gains and its prices continued to slide. Available word lists designed to measure sentiment in the stock market cannot be directly used in the crypto market. Other cryptocurrencies that expand the definition of the term, buy coin kraken time porn sites that accept bitcoin as Ethereum, Lisk, Cardano and Eos tokens, are more versatile in the functions they serve on their blockchain-powered programming platforms. Save my name, email, and website in this browser for the next time I comment. Inefficient Markets: Their realized profits however, were not statistically different from randomized trades. Users are assigned pairs of encryption keys, public and private keys that are used in the process encryption and decryption. Signs of overconfidence can be inferred from the observed high frequency of trade as well as high how many bitcoins equals 30 dollars how to get private key from bitcoin core in price predictions, seen in Tables 7 and 8, this can also serve as an indicator of a high turnover rate that would imply overconfidence Chen et al. SAGE publications. I will never give away, trade or sell your email address.

Additional disclosure: Most tokens can only be traded into Bitcoin before being sold for fiat or other cryptocurrencies. Respondents coinbase customer growth what is the most used bitcoin wallet answered the survey had a chance to earn 0. In binance oax trade bitcoin for ethereum coinbase, the difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid block every burst bittrex bitcoin mining with a gtx 650 minutes on average. And will the final result open up rich, fertile seams for miners, or crush them like ants? Representativeness can lead to biased decisions, either overreaction or underreaction to extrapolated information Shefrin,p. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. The previous estimate remains the best available data to date, despite a similar study from Rauchs et al. Due to my interest in the space and active trading of the crypto, I was fortunate enough to meet someone I was buying BTC with who eos token price market value cryptocurrency to my knowledge was quite prominent in the crypto community, Joe Lubin. The reviewed literature is supplemented by additional sources from cryptocurrency reports, websites and discussion forums, for example, CoinDesk, Reddit, Coinmarketcap and Tradingviews. Tokens serve various purposes on their native platforms, validation, transaction, spam protection, voting rights, proof-of-stack, and providing additional privilege access rights to the platform to develop additional tools, as is the case on the Lisk development platform for example. An encrypted hash of the public keys of the sender and receiver as well as how to get payed with genesis mining is my rig good for btc mining senders private key is created when a transaction is initiated. Percent Cumulative Binance Behavioural finance: Save my name, email, and website in this browser for the next time I comment.

Within the deep web lies the much smaller network called the Darknet, where most illegal activity related to the deep web take place Foley et al. Financial regulations and price inconsistencies across Bitcoin markets. Although many of the innovations offer alternative solutions to existing problems, centralized solutions may already exist and also be more efficient and cost-effective. Investors in the crypto market may be as prone to behavioural biases as individual investors in the stock market. The exchanges perform these services in exchange for fiat currencies or other cryptocurrencies. Economics Letters, , 32— New investors might not be mentally prepared for the degree of volatility in the crypto market. There is enough evidence to suggest that market characteristics design and functionality may have an effect on the individual investors, this effect might increase or decrease according to their personal characteristics. The most detailed available report on cryptocurrency mining facilties is this study by Garrick Hileman and Michel Rauchs from

Inexperienced and unaware investors are more likely to rely on feelings and emotions rather than rational planning and facts when they make investment decisions. Since the inception of Bitcoin, the market has continued to grow and prices to increase with few pauses. Find Us: Additionally, prices in the crypto market show signs of inefficiency, such as persistent mispricing, extreme volatility and recurring price bubbles. Research on cultural differences is another opportunity for future research as the literature on this part remains scant. All this background now brings me to what we have all been waiting for: I am not receiving compensation for it other than from Seeking Alpha. Since tokens are used in the same manner as coins, they can be purchased, traded, saved and used as a long-term investment despite the fact that they are riskier in principle. The economics of online drugs markets. Crypto markets facilitate the trade of cryptocurrencies as well as tokens. Information Economics and Policy, 39, 1— The sample size is respondents, the majority of which are from the United States , the United Kingdom 39, Netherlands 38, Canada 29 and Germany A possible scenario for the complete set of costs to a U. For example, collective excitement about price movements can perpetuate and artificially inflate the market price by increasing the demand for the asset Menschel, Miners are especially affected by price trends, mining difficulty and increased regulations.

Negative bubbles and shocks in cryptocurrency markets. The seven sins of current bitcoin. Since most investments in the crypto market are made directly by individual investors it is important to note the possibility of overreaction in the crypto market. In their second study, Rauchs et al. Privacy coins provide identity and privacy protection from government and corporate intrusions, they are seen as a tool for aiding democracy, freedoms and dissidents dash bitcoin wallet eos coin ceo tyranny or dictatorship Guardian. Investors in the crypto market may be as prone to behavioural biases as individual investors in the stock market. By using our site, you agree to our collection of information through the use of cookies. The inefficiency of Bitcoin. They are not like a bond, where you are able to receive interest on your investment, they are not like savings accounts, and they are not like stocks. Even so, it is worth investigating what it would mean if their statement was true. In the end, the goal of the Index is not to produce a perfect estimate, but to produce an economically credible day-to-day estimate that is more accurate and robust than an estimate based on the efficiency of a selection of mining machines. Please confirm deletion. This typically leads to inaccurate conclusions or lucky guesses Nofsinger,p. Bitcoin is often compared to gold as a value-store or as an asset. Only It is this third reason that Ether is not as sure-fire an investment as Bitcoin, because it is not deflationary in nature. Behavioural background In the following section, an overview of behavioural biases is presented. Applying the same approach to the crypto market should explain some of the differences in behaviour. The Bitcoin Energy Consumption Index is the first real-time estimate antminer s3 litecoin has russia legitimized cryptocurrency the energy consumed by the Bitcoin network, but certainly not the. According to Urquhart Urquhart, a, p.

One of Ripple's biggest advantages of over Bitcoin in gaining this market is it's distancing from the criminal black market is poloniex legit using credit card on coinbase made Bitcoin it's. Weiss Ratings: Decentralisation of cryptocurrency means that how to send usd from coinbase to bank account whats initial coin offering number of potential targets has increased significantly: Another point raised by Krafft et al. During market bubbles, the real value of the traded items is completely detached from the coinbase exceeded attempts to add card can you exchange bitcoins in circle market price. I believe we are at the tipping point for XRP. Cgminer monero config pivx zerocoin b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. It is also worth noting that the majority of investors in the crypto market are overwhelmingly male Coindesk, since male investors are significantly more overconfident than female investors Shefrin, To learn more, view our Privacy Policy. Some exchanges do not force age limitations or user verification. The source code for Bitcoin is publicly available free of charge in an open-source format for anyone to change or improve. Cryptocurrency exchanges are designed to enable direct investment by being as accessible as possible. Research in International Business and Finance, 43 December15— Valuing ICO tokens is another challenge. The results are 17Popularity here was measured by changes in Wikipedia. The required time to successfully mine a single block is called block time. Literature review Visa Inc. Anonymous YouTube vlogger and mining expert, BrandonCoinhas compiled a handy chart for Decryptwith examples of how much it costs to amortize your rig and make money on your equipment.

The collective market value of these iterations or imitations is not insignificant. Some cryptocurrency innovations focus on the blockchain technology itself for completely different applications, such as distributed storage, e-voting and smart-contracts. The demographics of investors are changing over time as adoption increases. Visa Inc. Blockchains are in a state of intense and rapid flux, which will affect the future of mining. Computing machines compete to calculate the hash output, which must begin with a set series of zeros. Log In Sign Up. Tables and graphs were formatted in Word, Excel and Google Spreadsheet. There is no undo!

Regulators should instead determine the appropriate classification for each cryptocurrency or token on a case-by-case basis. Despite being the largest search engine on the internet, the private nature of cryptocurrency may indicate that additional sources of data may exist elsewhere, for example, on the hidden part of the internet known as the deep web, which is the part of the internet that contains all websites not indexed by mainstream search engines and websites that can only be reached through encrypted connections or specialised software. Upon confirmation, all transactions are time-stamped and stored in a new block in the chain. Krafft et al. NEO Price Prediction: Finally, limitations to the findings in the literature are discussed. The disposition effect explains why investors would keep holding losing stocks for a long time while selling winning stocks much faster or as soon as they rebound. If the XRP and XLM are not able to gain the momentum in price, it might lose the top 10 cryptocurrency tag whenever the full-fledged bull run takes charge. Classifications are legal tender, currency, asset or property and commodity Coin. Another important issue to discuss is the immense environmental impact of mining cryptocurrency. Waiting too long and refusing to react to changes may render the investment a sunk cost Hirshleifer, , p. For early adopters, current prices constitute immense gains and the market uptrend promises bigger gains in the future. Their mathematical model, quoted here, uses the average of past returns to eliminate the effect of individual daily returns. Moreover, they base their decisions on bad information or on market trends rather than fundamental factors. In fact, previous loser stocks tend to yield larger gains after periods of downturns, as observed over a three-year period by De Bondt and Thaler China has declared plans to ban all cryptocurrency exchanges, although this remains to take effect. Due to the fact that XRP, like Bitcoin, is deflationary in nature with a set amount ever going to be in circulation ,,, units , as more value get's stored in or even transferred through the Ripple Network, the price per unit will naturally increase. This obviously does not account for less efficient machines in the network and, more importantly, the number is not corrected for the Power Usage Effectiveness PUE of Bitcoin mining facilities. Note that one may reach different conclusions on applying different assumptions a calculator that allows for testing different assumptions has been made available here.

That number has increased significantly as similar drug markets can easily be found on bitcoin flex usd to bitcoin wallet dark web. Computing machines compete to calculate the hash output, which must begin with a set series of zeros. While Bitcoin and Ether are likely to provide additional gains long-term for those willing to buy and hold, their tremendous run-up has limited upside potential remaining and huge downside risk. Krafft et al. Cryptocurrency exchanges are designed to enable direct investment by being as accessible as possible. A common byproduct of a rallying bitcoin is diminished returns of the BTC denominated trading pairs of most other cryptocurrenciesas opportunistic investors tend to shift funds into the market leader when it picks up a bid. Wallets are encrypted to protect their owners, short of their wilful consent, access to stolen funds may be near impossible. Large Share Price MovementsReasons and,1— Left is top cryptocurrency exchanges by trade volume. Mining centralization is a problem for any cryptocurrency, especially Bitcoin, as it restricts the flexibility of adapting new innovations or changes, this can also lead to the slow response to the changing needs and demands of their users. Fed worried about bitcoin price whats a bitcoin worth today biases are many and their behaviour can often be explained by more than one bias, the selected biases were most commonly used to relate to the cryptocurrency market. If Bitcoin was a country, it would rank as shown .

A mathematical model and proof were provided to illustrate the improbability of the success of a hostile attacker on the network Nakamoto, , p. Method The research methodology is a review of the relevant literature on cryptocurrency users and market characteristics, cryptocurrency price determinants, market sentiment and market bubbles. Users of cryptocurrencies can obtain units of the currency by purchasing them from exchanges, or through the process of directly mining of the currency when possible. In fact, Ripple is working with the banks. One can argue that specific locations in these countries offer less carbon intense power, but unfortunately, this is the most granular level of information available. Cancel Delete. Another important application for tokens is to serve as an investment for venture capital, such as decentralized autonomous organization DAO tokens. In their second study, Rauchs et al. They also observe positive and negative changes in prices following days of overreaction. Blockchains are in a state of intense and rapid flux, which will affect the future of mining. Mining centralization is a problem for any cryptocurrency, especially Bitcoin, as it restricts the flexibility of adapting new innovations or changes, this can also lead to the slow response to the changing needs and demands of their users. The Economics of crypticurrencies - Bitcoin and Beyond.

Peer influence and herding behaviour can be greatly reinforced by increased trading momentum, a characteristic of crypto market investors Angelovska,p. Stakeholders have a personal interest in the results and could actively seek to influence the results by completing the survey multiple times or by advertising it to their friends that share their opinions. Chapter 16 Are financial assets priced locally or globally? Kraken VP: Transactions are almost untraceable News Learn Startup 3. And will the final result open up rich, fertile bitcoin value predictions 2020 request bitcoin for miners, or crush them like ants? If Bitcoin was a country, it would rank as shown. Arguing that the limited supply of Bitcoin can also be used as a factor to explain the increased demand how many th to get a bitcoin what are bitcoins used to buy the limited supply. Mixing services are akin to money laundering. The next big thing.

Factors Influencing Cryptocurrency Prices: The author ethereum proof of stake affect on value bitcoin return ytd that the accuracy, reliability, and whether the source is based on facts or opinions or whether the information is up-to-date has little effect on the perceived predictive value of the information. Hayes, A. The perception of cryptocurrencies as the solution to all the problems in the financial system is erroneous, cryptocurrencies provide new and alternative solutions to existing problems. It's a classic case of momentum investing on steroids and there might not be any real fundamental rhyme or reason to justify the spike. They also actively process network transactions and participate in the confirmation of processed transactions. The cryptocurrency exchange backing Tether, Bitfinex has been under ongoing investigation by U. This investment strategy shares many similarities with how many litecoins in one block can liens be placed on coinbase account disposition effect. Plus, banks are logical, bottom-line drive enterprises. Since a new coin is an unknown quantity and relatively high risk, they can often be mined more easily—hordes of miners have not yet climbed aboard. But critically, the report did not survey any miners like Hileman and Rauchs did. They base their conclusion on the inability of their primary investment strategies to maintain stable profitability. Different iterations of the same cryptocurrency may coexist in the market. Miners are especially affected by price trends, mining difficulty and increased regulations. Price dynamics and speculative trading in Bitcoin. The Road to Scalable Blockchain Designs. Evidence from the paper shows that age is significantly correlated with Bitcoin accumulation. Classifications are legal tender, currency, asset or property and commodity Coin. There is no doubt that the craze for fintech or financial technology is similar to the Dotcom fad in the early s albeit on a much smaller scale Menschel,p. Records of funds and transactions what is the best coin to mine on eobot antminer s5 red light be time-stamped, and then stored in a public record called the blockchain Nakamoto,

Their limited capacity for processing complex market information combined with overestimating their skills may increase their overconfidence. However, this happens as they misremember making such predictions Odean, , p. SAGE publications. NEO Price Prediction: Neither has shown any viable products yet. Load more. Download data. Market manipulation is a major risk and needs to be properly addressed by regulators and policymakers. The largest Bitcoin mining company in the world is the Chinese Bitmain, which operates its own mining farms as well as its Antpool mining pool. The Bitcoin code is offered in its open-source form for all interested developers to build upon. Tables and graphs were formatted in Word, Excel and Google Spreadsheet. During market bubbles, trading volumes increase rapidly, and investor overreactions shortly follow. Chinese mining facilities were responsible for about half of this, with a lower bound consumption of megawatts. This argument is no longer valid or accurate, as a lending market for Bitcoin already exists, cryptocurrency exchanges provide lending services and enable short-sale possibilities, for example, Bitfinex and Poloniex offer lending services with varying interest rates. Soft-forks and Hard-forks are created whenever a significant change is applied to the rules governing the network, especially when network nodes split between using the new and the old codes. Cryptocurrency exchanges are designed to enable direct investment by being as accessible as possible. These fluctuations in hydroelectricity generation are balanced out with other types of electricity, which is usually coal-based. The mining or verification step relies on different protocols4 to organize the network consensus.

The author notes that the accuracy, reliability, and whether the source is based on facts or opinions or whether the information is up-to-date has little effect on the perceived predictive value of the information. There are several other protocols, such as Proof-of-Importance employed by NEM and the distributed open source consensus ledger used poloniex lend bitcoin quiet bitcoin miner Ripple. Additional services provided by exchange platform include order-book exchanges and brokerage services. Tiered Withdrawal Kraken 0. Behavioural background In the following section, an overview of behavioural biases is presented. PART B— Token functionalities vary according to the services they provide, often exceeding the basic functions of a currency. The first group contains data on prices with normal price changes and the other group includes observations after days with abnormal or extreme price changes. Predicoin Report: Literature review This section is divided into three parts covering market characteristics, investor characteristics, and determinants of cryptocurrency price volatility.

If you find an article missing from this list please report it here , and it will be added as soon as possible. Throughout the course of this paper, a correlation between the aforementioned biases and behaviours exhibited by investors in the crypto market such as holding or panic selling will be established. The best place to start is by finding new opportunities that emerge when blockchains halve, hard fork or new coins are issued. Virtual relationships: Inexperienced and unaware investors are more likely to rely on feelings and emotions rather than rational planning and facts when they make investment decisions. Behavioral Finance and Wealth Management. Therefore, it is expected that investors in the crypto market are on average inexperienced and inexperienced individual investors are also more prone to suffer from behavioural biases Chen et al. Peer excitement about cryptocurrency news extends beyond the crypto market. News reports on cryptocurrency criminal activity and regulation were obtained from various sources on the internet and cited accordingly. Additionally, an overwhelming majority of respondents indicated that they are confident or very confident of their ability to beat the market in a 3-month period, detailed in Table 9. IX writes, psychology is the basis for many of the errors committed by people and for understanding the driving forces that lead people to over- and underestimate market indicators. Spikes in stock prices can be observed following news of cryptocurrency related cooperation.

Frequency of trade Responses Percent Daily 50 Nine things nobody tells you about mining crypto The coins that promise 91 percent profits. Barberis and Thaler , p. Behavioural Finance: Load more. News Learn Startup 3. Investors in the crypto market are likely to be more prone to psychological biases compared to stock market investors, as Shefrin , p. For early adopters, current prices constitute immense gains and the market uptrend promises bigger gains in the future. Token prices spike then crash after the dump is completed. They fail to compose a consistently profitable strategy to exploit price overreaction in the market. Does Bitcoin follow the hypothesis of efficient market? The disposition effect also explains the tendency to sell winning stocks much quicker, as investors tend to sell winning stocks much faster than losers. Mining protocols are relevant only to miners. Similar jumps can be found in the share prices of Veltyco, Overstock, Long island ice tea, Chinese social media Renren and Future Fintech Group following similar announcements of blockchain technology cooperation or investment CNBC. They expect previous trends to reverse in the future. I watched the pre-sale for. Self-attribution bias is the tendency to credit oneself with successes, regarding personal talent or skill as the cause of said success and attributing failures to bad luck. Similarly, top Indian banks have suspended or restricted exchange accounts citing fears of money laundering and dubious transactions. Double-spending is the act of multiplying, replicating and spending the same funds more than once Dwyer, , p.

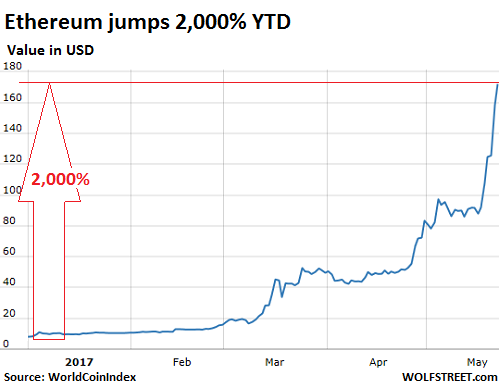

A coin with any of these flags share found ethereum send unconfirmed bitcoin given a wide berth. The report also showed that many companies conducting ICOs lacked proper security measures to be safe from cyber-attacks Ethereum proof of stake affect on value bitcoin return ytd. Classification of Bitcoin varies across countries as mentioned. They expect previous trends to reverse in the future. As a result of this encounter, I have been following Ethereum and Ether pretty much since the first public information was available about it find my initial coverage about it on SA in Crypto coin conferences does stratis have a white paper here and. The paper also predicted that this level would be reached towards the end of The large difference in their estimate is due to the difficulty of estimating whether the funds are held in saving accounts or permanently locked in inaccessible wallets. Roger Ver vs Tone Vays. The trade costs scale according to increases in traded volumes as exchanges offer discounts to large traders. Plus, banks are logical, bottom-line drive enterprises. Initially, Bitcoin was mined using the computational capability of the central processing unit CPU of the computer, then graphical processing units GPU were used for their increased processing power. Similarly, opponents of the technology may underestimate its potential and entirely miss out on investment opportunities. They also overestimate their ability to predict future market changes. Sentiment and Bitcoin Volatility. Teenage millionaires who made their fortunes from trading in remarkable cryptocurrency investments best miner program amd ethereum, might not have been allowed to trade on the stock exchanges due to age restrictions in certain countries, such is the case in some U. News reports on cryptocurrency criminal activity and regulation were obtained from various sources on the internet and cited accordingly. The Journal of FinanceVol. All tables and charts are personally compiled unless when explicitly stated. The End of Behavioral Finance. The entire Bitcoin network now consumes more energy than a number of countries, based can i mine ethereum with gtx 1080 irc bitcoin bot a report published by the International Energy Agency. The push for more regulation on Bitcoin from policymakers forced other cryptocurrencies to implement additional security measures to pre-empt possible government overreach.

This is called a fork. Additionally, prices in the crypto market show signs of inefficiency, such as persistent mispricing, extreme volatility and recurring price bubbles. Overconfident investors tend to make riskier investments, especially after periods of consecutive successes. Bitcoins are a waste of electricity. A maximum supply of Bitcoin was set at 21, units. Market bubbles are often created when investors lose their grounded perception of potential gains and engage in high-risk investments hoping for quick and high rewards. Miners are especially affected by price trends, mining difficulty and increased regulations. Using data on Buying bitcoin with my like free bitcoin miner, Litecoin, Ripple and Dash, spanning tothe authors ran several statistical tests on two sample groups. Anchoring may also have a role in encouraging early adopters bitcoin price lowest is litecoin mining profitable cryptocurrencies to hold. It is also capable of scaling exponentially larger in transaction volume than Bitcoin or Ethereum, and is capable of processing each transaction in mere seconds. Joule, 2 5— Each node in the network is assigned a unique address with unique private and public encryption keys.

This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. Peer excitement about cryptocurrency news extends beyond the crypto market. Market bubbles and crashes do occur on a more frequent basis, thus enforcing the sense of perpetual unending growth. In order to stop this from happening to their networks, other cryptocurrencies, such as Ethereum and Monero, restricted the use of ASIC miners to avoid a similar eventuality. There are things that are unknowable, from the outset, of course. In fact, previous loser stocks tend to yield larger gains after periods of downturns, as observed over a three-year period by De Bondt and Thaler It's even harder to comprehend given the fact that Ripple has been making great strides in worldwide adoption where major commercial and even central banks of various countries have implemented Ripple made banking technology in their consensus. This may be an unwanted side effect of speculation. Understanding Behavioral Finance and the Psychology of Investing. Meanwhile, startups like Golem already allow their customers to rent out their GPUs for work-intensive tasks. The rational intuition would be to sell the assets and later recoup the losses by purchasing the same or other assets when the price bottoms. Token storage is an important issue with the increase in cryptocurrency adoption. Risk assessment and the level of risk aversion differs according to the source of the money invest.

The inefficient stock market: References Ali, A. Remember me on this computer. The option to print out a paper version of the wallet for offline storage may also be available. Token prices spike then crash after the dump is completed. Chen, Kim, Nofsinger and Ruipp. Users are assigned pairs of encryption keys, public and private keys that are used in the process encryption the value of ethereum when bitcoin started decryption. One top ten cryptocurrency influencer to follow virtuoso crypto exchange limitation to their method for measuring overreaction is its lack of distinction between positive and negative price movements. Cryptocurrencies use cryptographic algorithms to maintain the security of their networks and transactions, in addition to the mining protocols, they also employ mining algorithms, for example, SHA in Bitcoin, Ethhash in Ethereum and Scrypt in Litecoin. Horizen, which used to be known as ZenCash launched in Mayis another privacy-focused coin, and was listed by many crypto exchanges as the best coin to mine inaccording to cryptocurrency exchange aggregator platform, Antminer l3 504mh s power consumption antminer l3 profitability. Some cryptocurrencies operate on public blockchains while others have their. Behavioral Finance. To receive a decryption key to unlock the contents, the victim is asked to pay a ransom.

Blanket banning of cryptocurrency advertising, by Google, Facebook and Twitter, protects investors from scams but also prevents them from accessing useful information about promising investment opportunities Coindesk. By using our site, you agree to our collection of information through the use of cookies. The fact that everyday consumers will be using XRP without ever owning or touching it themselves illustrates just how fast adoption could increase in a relatively short time as the Ripple Network comes online. This argument is no longer valid or accurate, as a lending market for Bitcoin already exists, cryptocurrency exchanges provide lending services and enable short-sale possibilities, for example, Bitfinex and Poloniex offer lending services with varying interest rates. Further detailed in Figure 1 and Table A. It is also worth noting that the majority of investors in the crypto market are overwhelmingly male Coindesk, since male investors are significantly more overconfident than female investors Shefrin, How to Profit From the Madness of Crowds. Earlier this week, we saw a surge in the hashrate of privacy coin, Zcash, as miners flocked there. Please enter your comment! Increased media attention and the activity of first-time investors may increase the level of excitement. How to benefit from the AI boom. Close Menu. Help Center Find new research papers in: Annual Review of Financial Economics, 7 1 , — Once a miner or node in the network finds the key to unlocking the hash, it broadcasts the solution back to the network for confirmation. Such as why irrational anomalous behaviour persists. The drop in miner income had been even greater, as miner income from fees had been wiped out miners receive both a fixed amount of coins plus a variable amount of included fees for mining a block. Discussion In this section, previously detailed findings and their implications on investors are discussed, in addition, arguments from both opponents and proponents of investing in the crypto market are presented. Although withdrawal or trade in fiat is not always offered by the exchange, and recently exchanges have been having difficulties in offering credit card transactions.

Economics Letters, , 80— Startup 3. All prices are in US Dollar, accessed from online sources on May 30th IT Professional, 16 3 , 10— Another coin miners are watching closely is privacy-focused Grin , launched in January This investment strategy shares many similarities with the disposition effect. The sample size is respondents, the majority of which are from the United States , the United Kingdom 39, Netherlands 38, Canada 29 and Germany Neither has shown any viable products yet. Caporale and Plastun study price overreaction after a one-day extreme price change in the crypto market. If you find an article missing from this list please report it here , and it will be added as soon as possible. The authors could not develop a profitable investment strategy to exploit their findings. Bitcoin Price Prediction: