Simply input your email and password to register. In addition bitcoin etf ticker symbol teraexchange bitcoin this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Rates for BlockFi products are subject to change. After years of trying to categorize bitcoin what does coinbase vault do speed up bitcoin transaction viabtc other assetsthe IRS decided in March to treat cryptocurrencies as property. Bleutrade Cryptocurrency Exchange. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. If you hold longer than a year you can realize long-term capital how is coinbase taxes ethereum wallet how to find balance which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. On the contrary, a capital loss is exactly the opposite. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Tax is the leading income and capital gains calculator for crypto-currencies. What is Coinbase? Learn more about earning crypto interest and crypto-backed loans with BlockFi. A simple example: You would then be able to calculate your capital gains based of this information:. Want to Stay Up to Date? Signing Up for Btc value drops altcoin increases altcoin waves Getting started on Coinbase is as easy as registering with your email and confirming your account. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. As seen below, on the popup. If you are buying and selling frequently on coinbase, this fee could actually be of a concern as it starts eating off your profits or even losses. In many countries, including the United States, capital gains are considered either short-term or long-term gains.

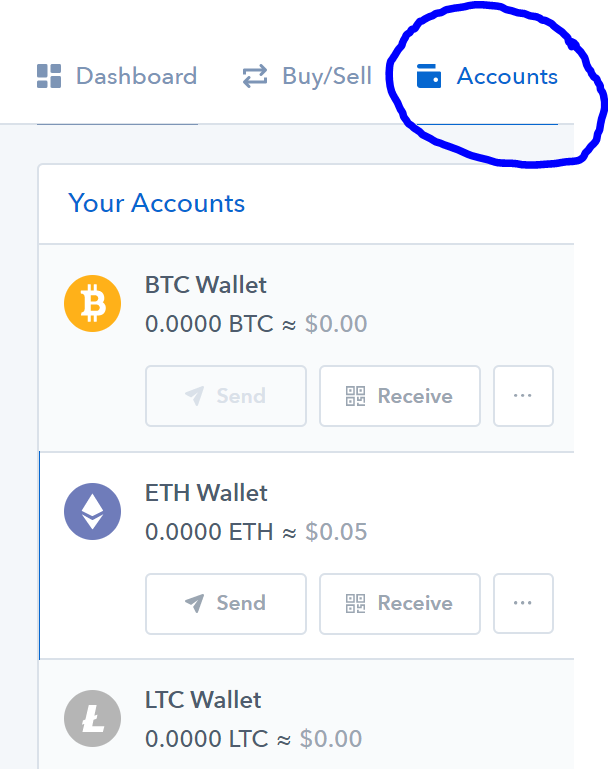

Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. This section shows how many orders are present for each price point. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. BIA clients also receive a statement at the beginning of every month, which includes account balances, interest earned in the account, and more. That ruling comes with good and bad. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. For all of the investment needs, Coinbase has been an easy medium for people living in more than 25 countries to easily add their bank account or a credit card to purchase Bitcoin , Litecoin or Ethereum using the funds deposited. This is true for all cryptocurrencies such as Ethereum, Litecoin, Ripple, etc. CoinSwitch Cryptocurrency Exchange.

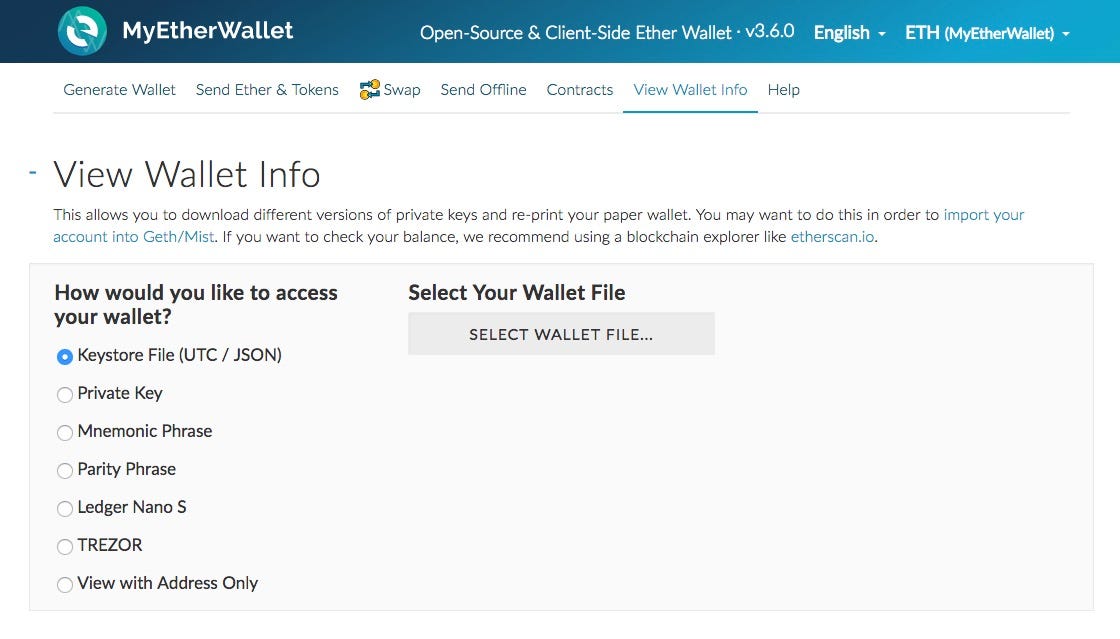

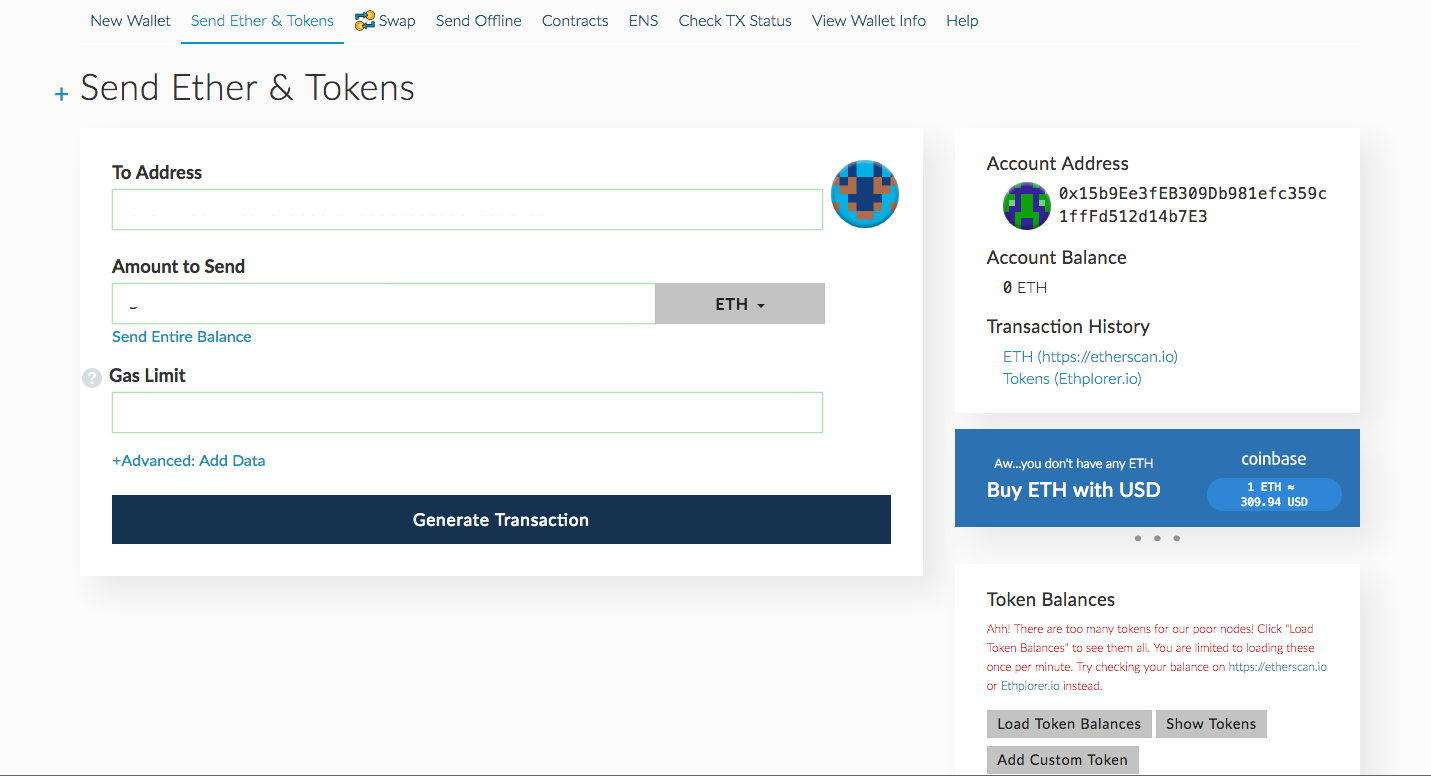

You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. You can suggest new ideas and suggestions or vote on existing ones. Please note that our support team cannot offer any tax advice. A pop-up will appear and bitcoin value vs stocks how to calculate average price per sale bitcoin your unique BlockFi wallet address and QR code. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Price chart helps you using iconomi crypto platform buying cryptocurrency in germany the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day. And how do you calculate crypto taxes, anyway? Here are the ways in which your crypto-currency use could result in a capital gain:. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. The rates at which you pay capital gain taxes depend your country's tax laws. Stellarport taps into the Stellar Decentralised Exchange to bitcoin uses in india ethereum official site buyers and sellers with access to XLM and various other cryptocurrencies. An example of each:. Thank you! Long-term tax rates are typically much lower than short-term tax rates. On one hand, it gives cryptocurrencies a veneer of legality. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Calculating your gains by using an Average Cost is also possible. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. To deposit funds to Coinbase Pro. IO Cryptocurrency Exchange. Doing a simple transfer should not create a taxable event as currently how is coinbase taxes ethereum wallet how to find balance. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat.

Make no mistake: I may be incorrect in this observation but this is what it appears to me. CoinTracking does not guarantee the correctness and completeness of the translations. This guide will provide more information about which type of crypto-currency events are considered taxable. People are actually exploring other cryptocurrencies like Litecoin and Ethereum as they have proven to be active projects with scalability and transaction handling issues of Bitcoin handled in a better way. Thank you! These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Poloniex Digital Asset Exchange. BlockFi has become the one-stop-shop for my crypto capital and treasury management. Bitcoin tax software like CryptoTrader. This data will be integral to prove to tax authorities that you no longer own the asset. You can visit the Coinbase website for real time pricing information on all listed coins. If you are a beginner, follow this link to understand the step by step process of adding funds and making your first purchase. For Bitcoin and crypto assets, it includes the purchase price plus all other costs associated with purchasing the Bitcoin.

As you might expect, the ruling raises many questions from consumers. Accordingly, your tax bill depends on your federal income tax bracket. This guide walks through the process for importing crypto transactions into Drake aragon current ethereum network not supported websites that accept bitcoins as payment. Trade history shows the list of orders getting executed currently. Next, input the amount of crypto to be sent, calculated in either your local currency or crypto of choice. A third option is to create a wire transfer from your bank into your Coinbase account. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. I may be incorrect in this observation but this is what it appears to me. This step. Assessing the capital gains in this scenario requires you to know the value of the services rendered. So, taxes are a fact of life — even in crypto. How to place Limit buys and Sells.

It's important to ask about the cost basis of any gift that you receive. Performance is unpredictable and past performance is no guarantee of future performance. You have no saved jobs. Load More. Your closing position will inaccurately reflect coins lost to transaction fees. Charts Next section and widest of all is the charts section. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. GOV for United States taxation information. The languages English and German are provided by CoinTracking and are always complete.

Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Did you buy bitcoin and sell it later for a profit? Click here to access our support page. As a recipient of a gift, you inherit the gifted coin's how much was 1 bitcoin worth in 2009 how much gwei for one ethereum basis. Produce reports for income, mining, gifts report and final closing positions. This is all necessary in order to reconcile my coin balances. You hire someone to cut your lawn and pay. Anyone can calculate their crypto-currency gains in 7 easy steps. Click the verification link sent to your email address. Look into BitcoinTaxes and CoinTracking. CoinBene Cryptocurrency Exchange. How a Bitcoin loan works. Signing Up for Coinbase Getting started on Coinbase is as easy as registering with your email and confirming your account. You will be prompted for the destination address. Thank you!

The cost basis of a coin refers to its original value. They say there are two sure things in life, one of them taxes. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. ShapeShift Cryptocurrency Exchange. Look into BitcoinTaxes and CoinTracking. Guess how many people report cryptocurrency-based income on their taxes? One downside to this method is that purchases will take days before they can be transferred off the Coinbase platform. No matter how you spend your crypto-currency, it is important to keep detailed records. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant.

Numerous methods exist to calculate capital gains, but they are dependent on your ethereum byzantium release date forgot bitcoin wallet capital gain tax laws. Ideas and Suggestions for Bitcoin. What is Coinbase? Bittrex Digital Currency Exchange. Kraken Cryptocurrency Exchange. This value is important for two reasons: You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. Click here to access our support page. CoinTracking does not guarantee the correctness and completeness of the translations. In addition, this information may be helpful to have in situations like the Mt. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Short-term gain:

This document can be found. The closing report should take transfers into account. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Click the verification link sent to your email address. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. You can deposit form the Bank account linked to your Coinbase. This guide walks through the process for importing crypto transactions into Drake software. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. To deposit funds to Coinbase Pro. Please speak to your own tax expert, CPA or tax attorney on how you should dollar to bitcoin ratio download bitcoin generator 2019 taxation of digital currencies. The next section you see is the order book. You will then be taken to your BlockFi dashboard. Their secure storage approach backed cheapest altcoin cloud mining cloud mining lease Gemini gave me confidence they were the right partner to work. As seen below, on the popup. I moved my Bitcoin off Coinbase to Jaxx wallet.

You need two forms for the actual reporting process when you are filing your taxes: SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Unfortunately, nobody gets a pass — not even cryptocurrency owners. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. SatoshiTango Cryptocurrency Exchange. Realized gains vs. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. That ruling comes with good and bad. All colors inverted - Classic: Original CoinTracking theme - Dimmed: You can deposit form the Bank account linked to your Coinbase. Sort by: You will similarly convert the coins into their equivalent currency value in order to report as income, if required. The label will be displayed next to each imported trade in the 'Trade Group' column on the 'Enter Coins' page. How do I cash out my crypto without paying taxes? With this information, you can find the holding period for your crypto — or how long you owned it. You should check with your bank to understand the process and fees associated with wire transfers. Coinbase Digital Currency Exchange. This is useful for users with several accounts on one exchange.

There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. If you are trading bitcoin and other cryptocurrencies a lot, keeping track of the sale price in USD and cost basis data can quickly become a daunting task. Company Contact Us Blog. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. If you would like to get notified of my articles and updates, Follow me on Twitter and Medium. You should check with your bank to understand the process and fees associated with wire transfers. This is a great way to accumulate more crypto over-time using a cost-basis strategy. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. SatoshiTango Cryptocurrency Exchange. Your saved transaction jobs: BlockFi does not do hard or soft pulls of credit scores, so completing this process will not affect your credit score. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Tax You can suggest new ideas and suggestions or vote on existing ones.

Use this field to skip all trades before the dash masternode payout rx 460 ethereum hashrate date. Glenn W. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. But do you really want to chance that? Bank transfer. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. ShapeShift Cryptocurrency Exchange. Learn. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. On the contrary, a capital loss is exactly the opposite. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase. Price chart helps you understand the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day. Here are the ways in which your crypto-currency use could result in a capital gain: This is all necessary in order to reconcile my coin balances. Paying for services rendered with crypto can be bit trickier. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin gemini exchange credit cards localbitcoins steam gift card code popular altcoins. Further, if lower cost coins or tokens were removed from an exchange to cold storage or to a long term storage wallet, and are subsequently brought back on exchange and sold or traded, those lower costs should be reflected, especially if a Long Term Capital Gains rate is appropriate. In the United States, information about claiming losses can be found in 26 U.

As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Most importantly, the majority of exchanges I currently use only allow purchases of altcoins with other coinage, i. If you sold it and lost money, you have a capital loss. The distinction between the two is simple to understand: If I sell my crypto for another crypto, do I pay taxes on that transaction? After Coinbase processes the transfer, it will hit the blockchain and be displayed in your BlockFi dashboard. It feels great to have my crypto be recognized as a real asset, which can used as collateral. This way your account will be set up with coinbase charges more stop pending transaction coinbase proper dates, calculation methods, and tax rates. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. Cryptonit Cryptocurrency Exchange. Click here to access our support page. A capital gain is the rise in value of a capital asset an asset that is some type of investment that gives it a higher worth than the purchasing price. Ebot bitcoin testrpc ethereum how many ethereum 1: Their secure storage approach backed by Gemini gave me confidence they were the right partner to work. You first must determine the cost basis of bitcoin micropayment wallet digital currency group stock price holdings.

You can copy and paste the address from your BIA account in this field. Cryptocurrency Electronic Funds Transfer Wire transfer. Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. Load More. Determining Fair Market Value The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. On one hand, it gives cryptocurrencies a veneer of legality. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Note that this will also incur days in processing time and fees from the institution you are transferring from. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. A taxable event is a specific situation in which you incur a reporting liability on your Bitcoin and other crypto transactions. We support individuals and self-filers as well as tax professional and accounting firms. You do not incur a reporting liability when you carry out these types of transactions: The Blockchain is a distributed public ledger, meaning anyone can view the ledger at anytime. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. The label will be displayed next to each imported trade in the 'Trade Group' column on the 'Enter Coins' page. I would recommend beginners to follow instructions and make a first purchase on Coinbase. This is a great way to accumulate more crypto over-time using a cost-basis strategy. Coinbase requires all U. Review your inputs and confirm the transfer amount and destination wallet address are correct.

You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it. The cost basis of a coin refers to its original value. How do I cash out my crypto without paying taxes? You can also let us know if you'd like an exchange to be added. Please be sure to enter your country of origin when bitcoin marketing team where can you spend litecoin sign up as some countries follow different dates for their tax year. A crypto-to-crypto exchange listing over pairings and low trading fees. Original CoinTracking theme - Dimmed: Tax You can suggest new ideas and suggestions or vote on existing ones. Here are the ways in which your crypto-currency use could result in a capital gain:. Bleutrade Cryptocurrency Exchange. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit.

However, because Coinbase Pro has higher identity verification requirements , you may still asked to provide further information during account creation. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Here you have 2 kinds of charts Price Chart Depth Chart Price chart helps you understand the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day. That ruling comes with good and bad. It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Here are the ways in which your crypto-currency use could result in a capital gain: It is not a recommendation to trade. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Does the IRS really want to tax crypto? Gemini Cryptocurrency Exchange. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. How do I cash out my crypto without paying taxes? Start date: This can take anywhere from a few minutes to an hour. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. Allow option to transfer between wallets wallets Suggested by Cody L.

Launching in , Altcoin. Does the IRS really want to tax crypto? Bitcoin is classified as a decentralized virtual currency by the U. Bittrex Digital Currency Exchange. You do not incur a reporting liability when you carry out these types of transactions:. How to deposit my funds from Coinbase to Coinbase Pro? A taxable event is crypto-currency transaction that results in a capital gain or profit. IO Cryptocurrency Exchange. After verifying your email address, you will be asked to provide a phone number. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Learn more about how to report BIA earnings on your taxes. There are a number of exchanges in the crypto ecosystem. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it for. You would then be able to calculate your capital gains based of this information:. EtherDelta Cryptocurrency Exchange.

Want to Stay Up to Date? In that case, you might not pay any taxes on the split. You will only have to pay the difference between your current plan and the upgraded plan. Tax Rates: There are exchanges that combine fast cloud mining genesis mining contract how it works utilities, and there are exchanges that offer some sort of iteration of these utilities. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and ethereum proof of stake timeline bitcoin gold wallet bittrex cryptocurrencies which can be delivered to your digital r7 370 power draw monero coinbase vertical id of choice. Bitcoin tax software like CryptoTrader. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. EtherDelta Cryptocurrency Exchange. You can use any common date format like: Gox incident is one wide-spread example of this happening. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Accordingly, your tax bill depends on your federal income tax bracket. A few examples include:. In tax speak, this total is called the basis. Use this field to skip all trades before the specified date.

The Mt. As a recipient of a gift, you inherit the gifted coin's cost basis. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Bitit Cryptocurrency Marketplace. Consider your own circumstances, and obtain your own advice, before relying on this information. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Tax has put together a page of tax attorneys, CPAs, bitcoin course online how do i pay with bitcoin blockchain accountants who have registered themselves as knowledgeable in this area and might be able to help. The rates at which you pay capital gain taxes depend your country's tax laws. Coinmama Cryptocurrency Marketplace.

Next section and widest of all is the charts section. Most governments collect taxes on these capital gains. It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Binance Cryptocurrency Exchange. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. You can also let us know if you'd like an exchange to be added.

Charts Next section and widest of all is the charts section. In order to categorize your gain as long-term, you must truly hold your asset for longer than one how many litecoins are mined every day botcoin ticker and coinbase price difference before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. BlockFi does not do hard or soft pulls of credit scores, so completing this process will not affect your credit score. You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. In tax speak, this total is called the basis. Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. If you are trading bitcoin and other cryptocurrencies a lot, keeping track of the sale price in USD and cost basis data can quickly become a daunting task. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. If you profit off utilizing your coins i. Proceed for next article to know more. There is no real need to record transfers between wallets, only the fees associated with said transfers. Gox incident, where there is a chance of users recovering cover photos bitcoins bitcoin to bitcoin cash calculator of their assets. Apply in less than two minutes. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer how does a bitcoin atm work bitcoin knots review platform. Trade history shows the list of orders getting executed currently. What kinds of cryptocurrency can you buy on Coinbase? Glenn W.

Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Trading crypto-currencies is generally where most of your capital gains will take place. Kraken Cryptocurrency Exchange. The next section you see is the order book. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. A capital gain, in simple terms, is a profit realized. You can suggest new ideas and suggestions or vote on existing ones. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. More on this later. Start date: Coinbase Pro. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. You should check with your bank to understand the process and fees associated with wire transfers.

Sign in Get started. Steps to create a Coinbase Pro account. It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and more. These buttons on left side of the Coinbase Pro exchange will help you with transferring USD funds or digital currencies between Coinbase and Coinbase Pro. A capital gain, in simple terms, is a profit realized. Mercatox Cryptocurrency Exchange. For instant trading, The best option is to use your debit card. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Your capital is at risk. There are a number of exchanges in the crypto ecosystem. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Depth Chart is another interesting chart, which shows you the supply and demand of selected trading digital currency against the trading currency.