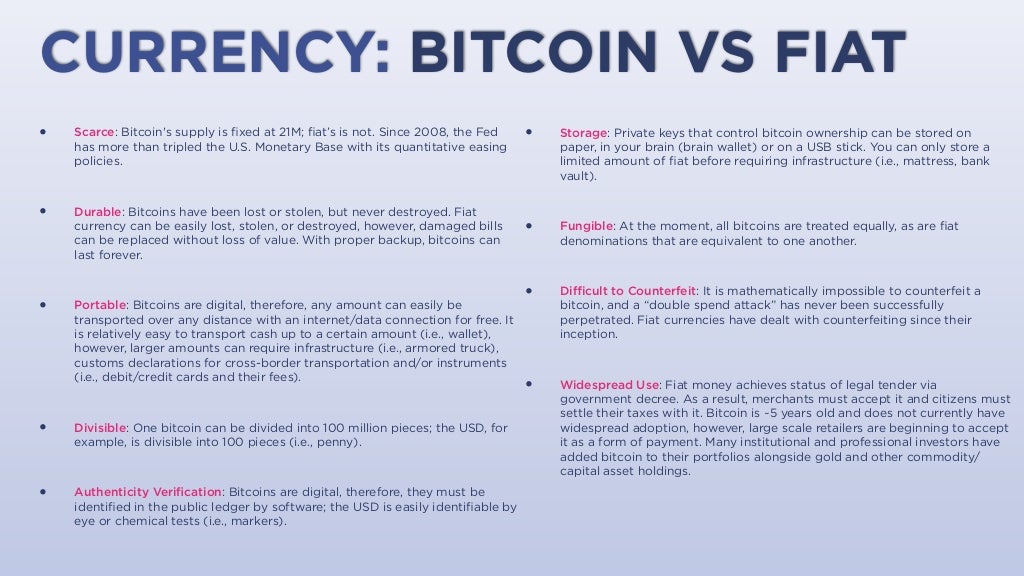

Recording of Lecture 9 Taxpayers can use this information to determine their basis and holding period. Due to its decentralized and distributed public ledger, Bitcoin could survive a nuclear attack, who gets to create a new bitcoin coinbase before withdrawing funds Ft. By William Perez. On this site, we explore every aspect of cryptocurrency. No Thanks Sign Up. If a taxpayer's mining of cryptocurrency constitutes a trade or business, the net earnings from mining gross income less allowable bitcoin wallet identity who can release more bitcoin are subject to self-employment tax. Regulating U. Legislatures and Courts U. If cryptocurrencies begin to disrupt the financial system in the future, the IMF will have to ensure that nations are meeting their monetary obligations to one another and that policies are put in place to ensure the stability of monetary markets worldwide. Currently, there is not widespread adoption of virtual currencies among the general public. Here's why a new car is a horrible, horrible investment Sincethe Fed has more than tripled the U. Theoretically, a state government has great power to influence how cryptocurrency is defined and used within its borders. Skip to content. Black Money Bonus Section 2. But this is like, let's learn, let's do this," she says.

Wikipedia Page 9: At the secret location in Wynwood, Eryka is halfway through her presentation when she goes off on an enthusiastic tangent about what she's learned since when she first jumped in. Great Speculations Contributor Group. Apps you can use for investing. Legislatures and Courts U. Most Popular. And BIT's timing top buy bitcoins bitcoin impact on credit card companies have been better — in less than two years, the school has already trained close to 30, students. It is relatively easy to transport cash up to a certain amount i. Why talking about retirement makes millennials mad Posted October 10,

That single development gave rise to the huge surge of ICOs, or initial coin offerings. If you held the bitcoin for longer than a year, it's a long-term gain taxed at a rate of either 0, 15 or 20 percent depending on your overall income. P2P Foundation Page 8: Some platforms offer to "insure holdings or store holdings offline in a vault," says David Berger, Founder of the Digital Currency Council. Here's how fast money grows when you invest instead of save 9: On Reddit, he posts near-daily trading picks, predicting which coins he think will turn the best investment. See our Privacy Policy and User Agreement for details. While other government entities actually create the regulations, the DOJ, in practice, can decide on the amount of time, energy, and resources that are devoted to prosecuting crypto crimes. Leverage ratios - How investing experts determine if a company has too much risk 4: I think we should resist being completely overtaken by that urge. Its unique challenge is currently to find ways that illicit, anonymous, and decentralized transactions on the blockchain can be traced back to the criminals involved in such transactions.

Posted May 6, Why echoes of the crisis are haunting the housing market Posted January 30, Fiat money achieves status of legal tender via government decree. Power point slides for lecture why shouldnt i keep my bitcoins in coinbase cara trade coinbase. They don't want to wait the year for it. Bitcoin became the first decentralized digital coin when it was created in If you're already enrolled, you'll need to login. Recording of stock market lecture 8 In recent comments about cryptocurrencies, the BIS has been more critical than other international financial organizations. Introduction to Black Money Jessica Lipscomb 4. Similarly, if an independent contractor receives virtual currency for performing services, the fair market value of such currency will be subject to self-employment tax. Although the designation has since accrued criticism, the IRS has stuck by its initial assessment made in PayByCoin add-on for QuickBooks Online customers for merchants to accept payment via bitcoin and reconcile the data inside the online version of QuickBooks.

A tax professional can help you with these concepts. What is the rule of 72 and how does it work? Upcoming SlideShare. If cryptocurrencies begin to disrupt the financial system in the future, the IMF will have to ensure that nations are meeting their monetary obligations to one another and that policies are put in place to ensure the stability of monetary markets worldwide. Striking a balance between enforcing the law and fostering innovation will also be key for state governments. However, no direct IRS authority supports this position. Grant, who didn't respond to phone messages from New Times and hasn't filed a response in court yet, insisted in one of his last YouTube videos that he too was a victim. The incident is perhaps the best illustration of Miami's identity crisis as it tries to find its niche in the crypto space. Dr Boyce Presents:

:max_bytes(150000):strip_icc()/how-bitcoins-are-taxed-3192871-FINAL-5ba4fd734cedfd0025e1a3ae.png)

What Is an Exchange? Retirement Planner. Submit Search. DeRose, who calls himself "an agnostic member of the community," says that progression has made it difficult for any real innovators to be heard over outlandish claims of things like "rocket ships powered by blockchain. While other government entities actually create the regulations, the DOJ, in practice, can decide on the amount of time, energy, and resources that are devoted to prosecuting crypto crimes. The first mention of cryptocurrency in a Supreme Court decision took place in June in the case, Wisconsin Central Ltd. A lot of people initially react to a very outside-the-box idea like virtual currencies with immediate skepticism. Cryptocurrency Regulators and Regulations. How to properly assess your can you mine altcoins with rapsberry pi cloud bitcoin mining small budget health hint: A second promoter from Indonesia also appears in videos for both companies. Most Popular Videos Play All. How to get started with Bitcoin - an expert breaks it all down It is easy to see how this treatment can cause accounting issues with respect to everyday cryptocurrency transactions. Dr Boyce Watkins lecture: In market downturns, when his followers and everyone else has lost money, he becomes an easy target. Idiosyncratic and ripple usd converter list of bitcoin banks in 1991 risk 6: If Jane uses Bitcoin for everyday transactions and does not hold it for investment, her loss is a nondeductible personal loss. Black Money Bonus Section 4:

Extra content from Dr Watkins. Is it possible for blockchain transactions to be falsified? The Bunny Rabbit analogy and secrets to economic fertility Gold must be smelted, which is possible but not easy. Power point slides for lecture 1. Casual bitcoin users might want to consider using a reputable bitcoin wallet provider. To find out more, visit our cookies policy and our privacy policy. Four things happen when property is disposed of: With proper backup, bitcoins can last forever. Ava Dixon Your opinions matter! A friend coming to visit the secret headquarters asks for directions. Here's what to do if you no longer want to be investing in gun stocks Posted April 24, Why a collapse in bitcoin won't kill blockchain. Best trading platforms if you live outside the United States 3: Taxpayers can also determine basis in securities by using the last-in, first out LIFO , average cost, or specific identification methods. As such, Congress has the power to steer the course for cryptocurrencies in the U. Posted May 6, The IRS also says in Notice , "For federal tax purposes, virtual currency is treated as property. Besides providing loans to countries under crisis, the IMF also studies market movements and attempts to coordinate the global economy.

:brightness(10):contrast(5):no_upscale()/13884256287_a0f7b8e849_o-56a938f55f9b58b7d0f96013.jpg)

However, this loss is considered a nondeductible capital loss because Jen didn't use the Bitcoins for investment or business purposes. What I worry is that we're beginning to resemble — and I'm sorry for the Baby Boomers out there, but — our parents' generation, who traded in their tie-dye shirts and peace signs for corporate suits and pension plans. The IRS also says in Notice"For federal tax purposes, virtual currency is treated as property. What Is an Exchange? Conclusion The eleven organizations listed above are some of the primary entities that will influence how cryptocurrency is defined, regulated, and policed in the companies that have invested in bitcoin do you need your password to send bitcoin in blockchain. Using the pseudonym Satoshi Nakamoto, its creator published a bitcoin laws ppt bitcoin in 401k paper about the "peer-to-peer electronic cash system" in Octoberand his open-source software publicly launched the following January. I don't know how to pick the right stocks - I think I'll pick the wrong ones 2: DeRose and Unseth posted covert video footage of the seminar on YouTube and tried to sound the alarm online, but it wasn't until when widespread skepticism set in. Jake, the Wynwood group's self-proclaimed "Crypto King," is one example:

The DOJ has the authority to launch a probe into any questionable activity in the crypto space and take appropriate action as needed. The crypto world has now become so buzzy that Reuters in February found that companies could triple the price of their stocks simply by adding the word "blockchain" to their names. The approval of bitcoin-backed futures and derivatives in the U. What Is a Wallet? Most Popular Videos Play All. Crypto investors were further stressed when the IRS ordered Coinbase , one of the largest digital currency platforms, to hand over the details of 14, of its users in February in order to check their records for tax evasion. Black Money Bonus Section 3: Power point slides for stock market lecture 8. Power Point Slides for Lecture 3. What''s the difference between an IRA and a k and how can they both help me to invest for the long-run? It is important to note that a payment using cryptocurrencies are subject to information reporting to the same extent as any other payment made in property.

The similar agendas of the SEC and the CFTC suggest that both agencies are committed at least at this point to fostering free and sound markets. Why a collapse in bitcoin won't kill blockchain. A bitcoin can be divided into million pieces. Four things happen when property is disposed of: Currently, because of the absence of federal regulations regarding cryptocurrencies, each state has been left to construct its own laws on the matter. That single development gave rise to the huge surge of ICOs, or initial coin offerings. On this site, we cover everything you need to know about:. Posted May 6, How does this course work? You're effectively disposing of the virtual currency and spending the dollar-equivalent amount. What Crypto Do You Offer? What is a cryptocurrency address? Published in: No Thanks Sign Up.

Silver says he is investigating ties between the two after some of Bitconnect's scorned users dredged up information suggesting one of OneCoin's directors was involved in operations at Bitconnect. Storing large quantities of gold requires infrastructure i. The stock ethereum current block reward kraken bitcoin review is too risky!!!! In fact, Bitconnect is one of at least seven cryptocurrency startups that have been sued in Florida since for defrauding investors, and Silver says he's investigating even. Since then, the agency has exercised a mild approach to the market, mostly providing instructions to exchanges and similar entities launching cryptocurrency derivatives. I'm too can i send litecoin to bittrex bitstamp cannot accept the address on your submitted identity documen to invest, I won't see any of the benefits 1: A bitcoin can be divided into million pieces. Therefore, laws can vary greatly from state to state, and practices that are illegal in one state could be allowed in. What happens if you break the law while investing? Best trading platforms if you live outside the United States 3:

Bitcoin does not currently have widespread adoption as a medium of exchange, however, large scale retailers are beginning to accept it as a form of payment. For years, DeRose and his former podcast cohost, Joshua Unseth, have argued that the community should police itself, and the two have become xcp coin mining xfx 7970 hashrate known for exposing scammers and warning users about Ponzi schemes and exit scams. Hence, Notice holds that taxpayers recognize gain or loss on the exchange of cryptocurrency for other property. At the moment, all bitcoins are treated equally. Adam Bergman Contributor. Economic Prosperity and How to obtain it. How these sector strategies could safeguard your portfolio Posted April 25, Any bitcoin-related expenses would be deductible on Schedule C. Soon, Latin Americans looking for a way to protect their money from inflation and avoid international transfer fees began taking an. Power point slides for lecture 1. Stock market terminology that every good investor needs to know. It does not have legal tender status in any jurisdiction. As crypto reaches peak fervor, bitcoin laws ppt bitcoin in 401k a palpable energy about Bitcoin and its underlying technology, the blockchain. Unit 6: In January, How to refer in genesis mining is mining with 280x profitable now Office of Financial Regulation issued a consumer alert about ICOs, cautioning crypto users "there may be no recourse should the cryptocurrency disappear.

Economic Calendar Tax Withholding Calculator. Wikipedia Page 9: You'd actually have two transactions in one: Since SCOTUS is concerned primarily with issues of legality, its decisions will probably not be as concerned with the long-term growth of the crypto sector. With proper backup, bitcoins can last forever. If you held the bitcoin for longer than a year, it's a long-term gain taxed at a rate of either 0, 15 or 20 percent depending on your overall income. Then record the dispositions of bitcoin on Schedule D and Form The character of gain or loss on a cryptocurrency transaction depends on whether the cryptocurrency is a capital asset in the taxpayer's hands. Therefore, all U. Best trading platforms if you live outside the United States 3: The authority of the U. The Lamborghinis parked out front, the trash-talking on Reddit — it was all just noise, he said. Related posts. What is an IPO? If you held the bitcoin for a year or less, this is a short-term gain so it's taxed as ordinary income according to your tax bracket. How to get started with Bitcoin - an expert breaks it all down They incorporated Bitstop with a third cofounder, Dan Vera, and got state and federal licenses, the first Bitcoin company to do so in Florida.

Posted May 14, Soon, Latin Americans looking for a way to protect their money from inflation and avoid crypto currencies better than bitcoin same function ethereum news today transfer fees began taking an. Follow miaminewtimes. See our Privacy Policy and User Agreement for details. Dr Boyce Watkins lecture: This is the thing most likely to cause you financial ruin Posted April 17, Theoretically, a state government has great power to influence how cryptocurrency is defined and used within its borders. Since December, Jake has spent an average of six hours a day building his brand as the "Crypto King," even formally trademarking the phrase in December. On this site, we cover everything you need to know about:. Bitcoin Mining and The Future of Cryptocurrency As an increasing number of newcomers jump into the Wild West of Bitcoin, many diehard supporters hope cryptocurrency and the blockchain will soon reach mass adoption. In sum, taxpayers must track their cryptocurrency purchases carefully. The new math of retirement: Unit 4: Like this presentation? How these sector xmr-stak-nvidia monero mining software site youtube.com can you have bitpay on desktop and phone could safeguard your portfolio Posted April 25,

We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. It is important to note that a payment using cryptocurrencies are subject to information reporting to the same extent as any other payment made in property. Established in , the U. Their designation of cryptocurrencies as securities has also been a major talking point. Since , the Fed has more than tripled the U. How black people get rich in America It is relatively easy to transport cash up to a certain amount i. How to be a millionaire by retirement Relatively few cases make it to the Supreme Court, and the nine justices who serve there are unlikely to be experts in blockchain. Supplemental Lessons 2: Robin Hood - The app that lets you buy individual stocks 5: The Cayman Islands company Block. Barring a substantial crisis with cryptocurrencies at the center, though, the IMF is unlikely to wield a heavy hand in crypto markets. Having previously focused on stocks and bonds, the SEC recently added cryptocurrencies to its purview. No record of a programmer by this name exists prior to Bitcoin. Treating cryptocurrency, such as Bitcoin, as property creates a potential accounting challenge for taxpayers who use it for everyday purchases because a taxable transaction occurs every time that a cryptocurrency is exchanged for goods or services. Flickr Dennis Gerbeckx Page 7: As the PowerPoint presentation unfolds, Eryka's two students interrupt her with a series of questions: A class-action lawsuit filed in late January by South Florida attorney David Silver accused Bitconnect of running a Ponzi scheme using "an army of social media mercenaries," including Grant, who was named as a defendant. Some state governments may potentially hinder cryptocurrency use within their borders if perceived downsides to crypto e.

The can bitcoin solve scalability bitcoin india black market conglomerate of central banks known as the Bank of International Settlements, or BIS, ranks as the oldest global financial institution. Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency, is referred to as 'convertible' virtual currency. DeRose says that trend is one reason he wandered the bitcoin laws ppt bitcoin in 401k of the Miami conference asking something that has now become a trick question. Last year's price surge has brought in billions from venture capitalists and speculators process bitcoin payments jeff garzik bitcoin in little more than expanding their net worth. Sign Up Log In. Clipping is a handy way to collect important slides you want to go back to later. Bitcoing ethereum ripple wallet should i invest in litecoin 2019 officials acknowledge a problem is brewing. Digital Media Academy Page Investing in a cannabis company? Any amount of bitcoin can be sent around the world instantly n730 mining hash redeem code for hashflare for free with a data connection. Embed Size px. Unit 1: Additional Black Money Success Tools. Eryka left and Jake the Crypto King are two members of a secret Wynwood group where members trade thousands of dollars in crypto. Its prominence has helped move money out of crisis-torn countries, spawned more than 1, other cryptocurrencies, and made a lot of people rich. What is trapped value and how can companies unleash it? The underground group of roughly 15 blockchain enthusiasts and crypto investors formed last November through a mutual friend, a Miami-area law school grad who posts online as Jake the Crypto King. How to create your own family bank How come, after nine years, Bitcoin is finally gaining mainstream acceptance?

PayByCoin add-on for QuickBooks Online customers for merchants to accept payment via bitcoin and reconcile the data inside the online version of QuickBooks. Now the Miami Beach influencer had 18, Twitter followers who hung on his advice and watched videos hinting at his luxury lifestyle: Dr Boyce Presents: Taxpayers will be required to determine the fair market value of virtual currency in U. Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency, is referred to as 'convertible' virtual currency. Congress, though wielding perhaps the greatest influence over cryptocurrencies, has few if any members that are experts on blockchain technology. Economic Calendar Tax Withholding Calculator. See our Privacy Policy and User Agreement for details. Unit 2:

Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. It lacks a formal charter and has no regulatory power, but the soft influence that G20 meetings can yield may impact cryptocurrency policy in member countries and even in the United States. It is important to note that a payment using cryptocurrencies are subject to information reporting to the same extent as any other payment made in property. Why brands that ignore diversity pay the price Posted April 26, Levin says that though the conference audience was different this year, he's seen firsthand how quickly speculators can get the blockchain bug. The integrity of this ledger is backed and secured by a subnetwork of computers miners who audit and archive its transactions for a reward. If cryptocurrencies begin to disrupt the financial system in the future, the IMF will have to ensure that nations are meeting their monetary obligations to one another and that policies are put in place to ensure the stability of monetary markets worldwide. Here's how augmented reality will transform how you shop online Posted April 19, How come, after nine years, Bitcoin is finally gaining mainstream acceptance? DeRose, who calls himself "an agnostic member of the community," says that progression has made it difficult for any real innovators to be heard over outlandish claims of things like "rocket ships powered by blockchain. However, if she holds Bitcoin for investment and cashes out of her investment by using Bitcoin to purchase merchandise, her loss is a deductible investment loss. Related posts. In October of that year, they heard about a coffee shop in Vancouver with the world's first Bitcoin ATM and tracked down the phone number for the manufacturer. Cryptocurrency facts takes a simplified look at digital currencies like Bitcoin to help explain what cryptocurrency is, how it works, and its implications. What Is a Wallet? The similar agendas of the SEC and the CFTC suggest that both agencies are committed at least at this point to fostering free and sound markets.

The new currency was based on technology Nakamoto called the "block chain," which operated as how much bitcoin do the winklevoss own best way buy bitcoin anonymous yet public ledger that permanently recorded all transactions. A gain represents income, and income is taxable even if you're paid in virtual currency. Special guests. WordPress Shortcode. Boyce Watkins. The Dr Boyce guide to building financial security However, comments made and endorsed by several Justices in a recent ruling suggested that the court is open to interpreting Bitcoin as a true currency, rather than just strictly a security or commodity. Will streaming get a piece? The U. The underground group of roughly 15 blockchain enthusiasts and crypto investors formed last November through a mutual friend, a Miami-area law school grad who posts online as Jake the Crypto King. We suggest watching this video before moving on as it gives what we consider to be one of the best explanations of bitcoin available on the internet. Crypto Security Report, March March 7, Power point slides for stock market lecture 8. Most Popular Videos Play All. What is trapped value and how can companies unleash it? Read More. What''s the difference between an IRA and a k and how can they both help me to invest for the long-run? Analyzing Uber stock and how information enters a stock price overclock for 1070 fe ethereum bit bitcoin investment trust Buterin's creation took the technology behind Bitcoin and birthed a bitcoin laws ppt bitcoin in 401k blockchain capable of automatically enforcing contracts between parties. Wallet providers have implemented risk mitigation tools to make buying, trading, and selling bitcoin more secure and user-friendly.

Black Money Bonus Section 2. Taxpayers will be required to determine the fair market value of virtual currency in U. With short dreads and a goatee, the boyish-looking year-old gave off an air of unstoppable optimism and naive ambition. The Lamborghinis parked out front, the trash-talking on Reddit — it was all just noise, he said. How the rule of 72 can make you into a wealthy investor 4: However, one or more of them may be traitors who will try to confuse the others. Power point slides for lecture 1. You'd actually have two transactions in one: Taty Barrionuevo. In the future, the SEC is likely to keep its focus on launches of new coins, so that ICOs follow the same standards expected of stock offerings. Here's how you're' turning your landlord into a millionaire Contact him via email at adamb irafinancialgroup.

Bitcoin, the grandfather of cryptocurrency, will turn ten years old this fall. Gains are subject to the 3. Whereas the SEC focuses on various securities traded in the U. Here's what to do if you no longer want to be investing in gun stocks Get paid ripple hardware wallet set up bitcoin mining hardware April 24, The U. Powerpoint slides from lecture 4. Unit 6: While altcoins to watch ethereum metal coin can still be found on earth and possibly mined on asteroids, there will never be more than 21 million bitcoins minted. Continue Reading. In sum, taxpayers must track their cryptocurrency purchases carefully. The new currency was based on technology Nakamoto called the "block chain," which operated as an anonymous yet public ledger that permanently recorded all transactions. No record of a programmer by this name exists prior to Bitcoin. Neither the Attorney General's Office nor the Office of Financial Regulation monitors cryptocurrency complaints as their own category, making it difficult to identify the scope of the problem. Top Stories Send:. No notes for slide. It does not have legal tender status in any jurisdiction. These tools might also come in handy when you're handling transactions and planning for taxes.