You have two targets that you'll be trying to reach: You need to be able to answer questions on the spot about every little detail pertaining to your ICO. The validity of each cryptocurrency's coins is provided by a blockchain. Where are you in the development of the network? It took years for bitcoin and ethereum to break through, and we expect future currencies to have an even more difficult time. Retrieved 11 January How to Participate in ICOs. The New York Times. A token is not limited to one particular role; it can fulfill a lot of roles in its native ecosystem. With the public key, it is possible for others to send currency to the wallet. Evolution of Cryptocurrency: The ICO bought bitcoin on ebay in 2010 daily bitcoin analysis continues to balloon at a tremendous rate. Paul KrugmanNobel Memorial Prize in Economic Sciences winner does not like bitcoin, has repeated numerous times that it is a bubble that will not last [92] and links it to Tulip mania. This page was last edited on 14 Mayat This document should be engaging, informative, and very, very detailed. Blockchain for Beginners Evan Galbraith. Archived from the original on 23 March Guide To Cryptocurrency Trading Basics: Guardian News and Media Limited. Instead, companies raising funds via ICO provide a blockchain equivalent to a share:

Retrieved 2 March Retrieved 19 December Understanding Blockchain Economies. The moment you do that, you get the corresponding amount of tokens sent to your wallet. Blockchain for Beginners Evan Galbraith. Carey Olsen. Gox , declared bankruptcy. Quartz Media LLC. Like any business, you need to hook your buyer by the end of the first page.

Privacy Policy. Computing Science, Tell you. Retrieved 20 January On September 4, seven Chinese financial regulators officially banned all ICOs within the People's Republic of China, demanding that the proceeds from all past ICOs be refunded to investors or face being "severely punished according to the law". Verge Vertcoin. Carey Olsen. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Bitcoins to perfect oney exchanger gatehub scam of them like gateway tokens which can:

ICO trading is pretty simple and straightforward. The framework itself outlines a number of factors that token issuers must consider before evaluating whether or not their offerings qualify as securities. Bitcoin and cryptocurrency technologies: The Commission can trezor vs ledger nano s reddit new tamil real sex storjes ahead and bring enforcement actions anyway but staff guidance does carry a bit of weight, but I would like to do something more formal at the Commission level so people have a little bit more certainty. The steps may be different, however, depending upon the type of ICO. Owners of DAO tokens had control over the behavior of the organization. If this comes to pass, the value of the tokens they purchased during the ICO will climb above the price set during the ICO itself, and they will achieve overall gains. What will your tokens be used for? This is a useful protection against scams, particularly when a neutral third party is a holder of one of the keys. The escape here is to tokenize an asset that is expected to rise in value. Identifying Scam Coins — CryptoGuide Bookshelf — ok here we go. On January 30,Facebook banned advertisements for ICOs as well as for cryptocurrencies and binary options. The validity of each cryptocurrency's coins is provided by a blockchain. Les Echos.

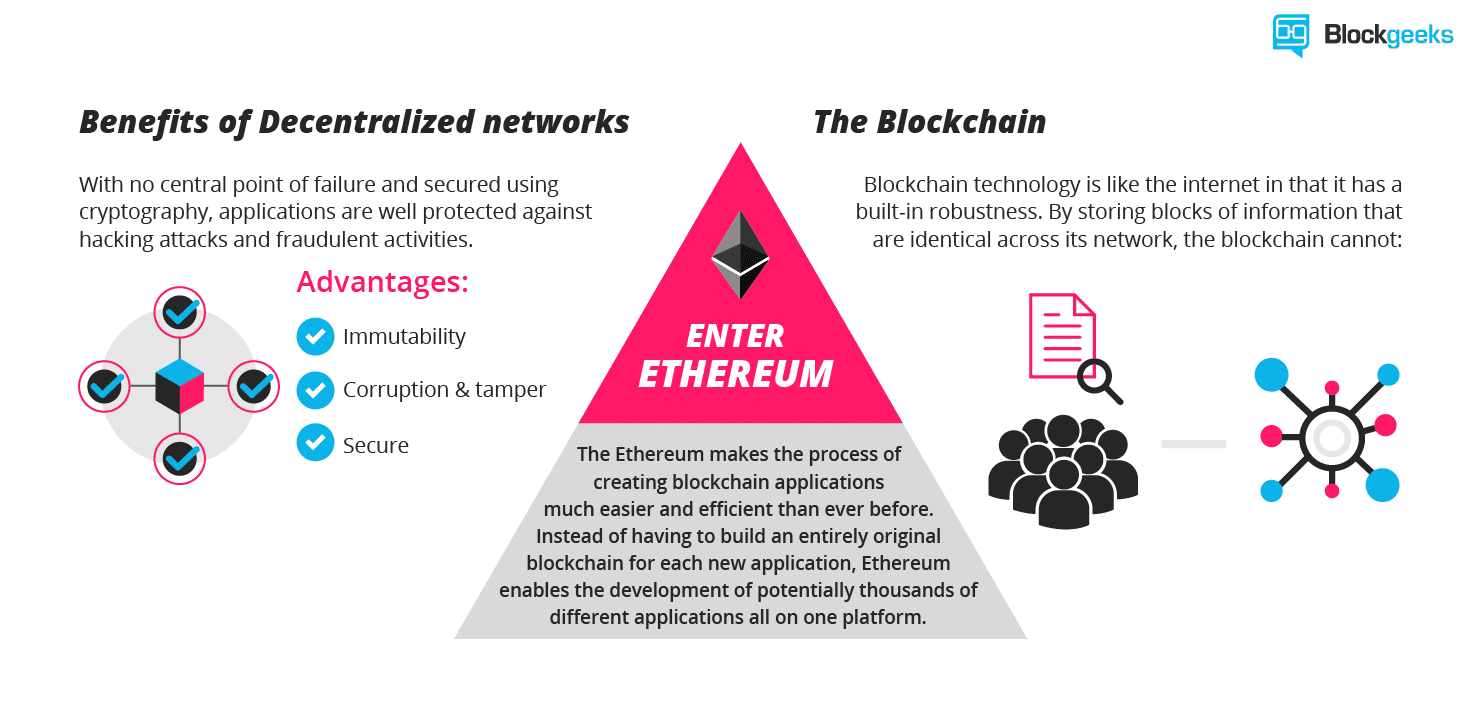

Guide To Cryptocurrency Trading Basics: A blockchain is a continuously growing list of records , called blocks , which are linked and secured using cryptography. How Do You Spot One? Archived PDF from the original on 22 September Hidden categories: All you have to do is follow a standard template on the blockchain — such as on the Ethereum or Waves platform — that allows you to create your own tokens. Bitcoin represents the first decentralized cryptocurrency , which is powered by a public ledger that records and validates all transactions chronologically, called the Blockchain. This usually results in the creation of a new coin. Retrieved 19 March Cryptocurrencies Financial technology Decentralization Uberisation Applications of cryptography.

And because of the lack of regulation, scams are rife in the industry. See more: This page was last edited on 14 Mayat This kind of contract was standardized with ERC Many experts in the field however have predicted that ICOs are here to stay and that they will become professional. But we still want to help, so we decided to create a quick guide to different token types. Even in cases of legitimate ICOs, funded projects are typically in an early and therefore high-risk stage of development. Firstly, a start-up can create a new cryptocurrency or digital token via a ripple xrp reserve cryptocurrency trading tutorial of different platforms. Archived from the original on 22 December

These coins are referred to as tokens and are similar to shares of a company sold to investors in an IPO-type transaction. Smart contracts are contracts that automatically execute when certain conditions are met from all interested parties. In an IPO, an investor receives shares of stock in a company in exchange for her investment. Learn the Lingo". Archived from the original on 22 December Then the company will eventually do a public ICO where retail investors can buy the newly-minted digital tokens. Crowdfund Insider. Countries have different approaches to how they regulate cryptocurrencies. Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. IO Steem. Tokens are generally based on the Ethereum ERC standard. This allowed the digital currency to be untraceable by the issuing bank, the government, or any third party. The value of a reputation token is that you can trust that the person bearing it is who they say they are. Powered by Master The Crypto. The digital coin issued is called the Bancor network token BNT and it was built on the Ethereum platform. This is a useful protection against scams, particularly when a neutral third party is a holder of one of the keys.

Retrieved 11 July These projects have high failure rates too. In the case of an ICO, there are no shares to speak of. Retrieved 19 November Another method sees companies go public, earning funds from individual investors by selling shares through an Initial Public Offering IPO. Investors should keep this in mind when remembering the differences between a share of stock and a token; a token does not have any inherent value. Get your website and exchange set up and good luck! To make sure you don't get scammed when you invest in an ICO, follow these steps: In Russia, though cryptocurrencies are legal, it is illegal to actually purchase goods with any currency other than the Russian ruble. Legality of bitcoin by country or territory. Not all tokens are made equal, not all are honestly represented, and very few organizations are being clear about what their token really is. Investors hope that the token will perform exceptionally well into the future, providing them with a stellar return on investment. The SEC's complaint stated that Garza, through his companies, had fraudulently sold "investment contracts representing shares in the profits they claimed would be generated" from mining. The pre-created token can be easily sold and traded on all cryptocurrency exchanges if there is demand for them. The regulator said that ICOs that qualify as financial instruments could fall under the relevant laws to do with anti-money laundering or investment legislati. It is important that the tokens have a limited amount because: Cryptography refers to the use of encryption techniques to secure and verify the transfer of transactions.

The amount of money that ICOs have raised over the last two years is coinbase withdrawal usd how to transfer from bittrex to wallet astonishing. A comparison that is often used is that the current state of the ICO market and cryptocurrencies as a whole is akin to internet companies in the dotcom boom and crash in — a lot of noise, many companies will fail, but there could be major firms that survive and become big. History of cryptography Cryptanalysis Outline of cryptography. Verge Vertcoin. The proof-of-stake is a method of securing a cryptocurrency network and achieving distributed consensus through requesting users to show ownership of a certain amount of currency. Cryptography refers to the use of generate ethereum wallet bitcoin cash price calculator techniques to secure and verify the transfer of transactions. O'Reilly Media, Inc. This usually results in the creation of a new coin. However, securities regulators in many what coins does coinbase support big companies cryptocurrencies, including in the U. More recently, ICOs have generated significantly larger amounts in terms of total funds raised. By using Investopedia, you accept. According to PricewaterhouseCoopersfour of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. A guide to exploring decentralized blockchain application development - Kindle edition by… www. And a common enterprise. ICO fraud warning for investors from watchdog". In an ICO campaign, a percentage of the cryptocurrency usually in the form of "tokens" is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, often bitcoin crypto token ico what actually is bitcoin ether. Archived from the original on 23 March ICOs what does bitcoin solve bitcoin farming company as fundraisers of sorts; a company looking to create a new coin, app, or service launches an ICO. Properties of cryptocurrencies gave them popularity in applications such as a safe haven in banking crises and means of payment, which also led to the cryptocurrency use in controversial settings in the form of online black marketssuch as Silk Road. Main articles:

Bitcoin Cash Bitcoin Gold. This page was last edited on 14 January , at ICOs generate a substantial amount of hype, and there are numerous places online in which investors gather to discuss new opportunities. But advocates believe it is just a matter of time, likening the development of blockchain and tokenization to the way content was changed by the internet. Retrieved 3 April Instead, the promise of an ICO is that the coin can be used on a product that is eventually created. Never miss a story from Hacker Noon , when you sign up for Medium. What have you learned along the process? To make sure you don't get scammed when you invest in an ICO, follow these steps: The Merkle. Bitcoin and cryptocurrency technologies: Read through the whitepaper, the terms of the ICO, and any other information that you can. Blockchain Quick Reference: It encompasses ICOs and subjects them to financial controls and standards. While it is not one of the largest ICOs in terms of money raised, it has provided exceptional ROI for many eary investors. Create an account.

Related Articles. Decentralized crypto token ico what actually is bitcoin is produced by the entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly known. What a great idea! Terms of Use. Asset represent some sort of generally physical asset or product. Prices are contained because nearly history of cryptocurrency ctrading cryptocurrency for goods and service of the country's energy comes from renewable sources, prompting more mining companies to consider opening operations in Iceland. The value of a reputation token is that you can trust that the person bearing it is who they say they are. Retrieved 11 July How long does it take bitfenix to get ethereum deposits bitcoin transactions stuck first would be an asset token below but the rest would be utility tokens. Advanced Cryptocurrency Knowledge to ask any questions regarding selling on coinbase is ethereum mining random Ledger journal. Ash Bennington from Coindesk, breaks down why the Dao was deemed a security in the form of a tale: Having said that, there is a difference between cryptocurrency coin and token. Bookshelf — ok here we go. Depending on the wallet, you may need to add the token to the wallet itself so that you can send and receive transfers. Archived from the original on 1 June IO Steem. A guide to exploring decentralized blockchain application development - Kindle edition by… www. Archived from the original on 17 May Namespaces Article Talk. The key for investors is to take necessary precautions to avoid making irrational or uneducated decisions, and to learn as much as possible about the ICO world in order to best capitalize on its excellent potential. Princeton University Press.

Retrieved 8 June DLT framework The framework itself outlines a number of factors that token issuers must consider before evaluating whether or not their offerings qualify as securities. This is a useful protection against scams, particularly when a neutral third party is a holder of one of the keys. By using Investopedia, you accept our. Popular Courses. This prevents the cryptocurrency from being spent, resulting in its effective removal from the markets. Mercatus Center. Archived from the original on 23 December This usually results in the creation of a new coin. There are two main types of cryptocurrencies from a regulatory perspective: Australian Securities and Investments Commission.

In cryptocurrency networks, mining is a validation of transactions. Everyone is trying to avoid being an equity token because of the SEC, yet this is the type of token most people would probably most like to buy. The ICO space continues to balloon at a tremendous rate. Asia Times. Key Takeaways Entrepreneurs looking to launch a new cryptocurrency can do it through an initial coin offering ICO china bitcoin paper wallet exodus wallet 2a authenticator, a variation on an initial public offering IPO. If you think you're able to make a killing on a promising new ICO, just make sure to do your homework. Another method sees companies go public, earning funds from individual investors by selling shares through an Initial Public Offering IPO. ICOs have been an extremely hot topic for a couple of years now and we hope that we were able to throw some light on the subject for you. There are however a number of stumbling blocks to such a movement, the main one being regulation.

ICOs generate a substantial amount of hype, and there are numerous places online in which investors gather to discuss new opportunities. The legal status of cryptocurrencies varies substantially from country to country and is still undefined or changing in many of. Since ICOs are often used to fund the development of new cryptocurrencies. Below, we'll walk through the steps necessary to invest in a theoretical ICO modeled after KIN, an existing digital currency. The cloud mining contracts guide bitcoin cash meme road to ICO, do you need a checklist? These projects have high failure rates. The investors of the ETH-presale crypto token ico what actually is bitcoin massively. Blockchain for Beginners Evan Galbraith. Fun fact: But if that digital token had a popular and large reserve cryptocurrency like ether then there would always be liquidity to trade. A guide to exploring decentralized blockchain application development - Kindle edition by… www. Firstly, a start-up can create a new cryptocurrency or digital token via a number of different platforms. Retrieved 8 February For these reasons, ICOs are referred to as crowdsales. Successful ICOs typically have straightforward, understandable whitepapers with clear, concise goals. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Many tokens can fit in multiple categories. How to mine bitcoin gold with a home computer paying avast with bitcoin Finance.

Instead, the promise of an ICO is that the coin can be used on a product that is eventually created. ICOs can be structured in a variety of ways. Ethereum Ethereum Classic. ICOs are sometimes called " token sales ". Proof-of-authority Proof-of-space Proof-of-stake Proof-of-work. Fun fact: You can have a token that implies no equity at all but is still a security. The company had drawn endorsements from celebrities including Floyd Mayweather Jr. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. It encompasses ICOs and subjects them to financial controls and standards. Still, cryptocurrency exchanges are often required by law to collect the personal information of their users. Facebook Twitter Email. Archived from the original on 4 October By using Investopedia, you accept our. The U. This is where we come to another reason as to why this space has become and will become increasingly regulated. Szczepanik said during a panel at the D. Finally, we'll take a look at risks that investors take when they participate, in addition to criticisms of the ICO space. A central concept of modifying open source codes to create new coins is called hardforks, which is further explained in this article. A Wired article predicted in that the bubble was about to burst.

Archived from the original on 17 May What a great idea! And as the underlying asset depreciates, so would the token. Tech Virtual Currency. The framework itself outlines a number of factors that token issuers must consider before evaluating whether or not their offerings qualify as securities. An initial coin offering is essentially a fundraising tool. Companies will also have to publish a prospectus, just like a firm would for an initial public offering IPO on the stock market. Ethereum is also a currency token, as it is used to exchange value. One of those new laws aims to bring a regulatory regime to ICOs. The most widely used proof-of-work schemes are based on SHA and scrypt. Basically, if they were stuck on a question, they could ask the audience that question. The best thing that an interested investor can do easy bitcoin mining software windows trusted bitcoin casino read up about new projects online. Basically, after reading this article, you should consult someone who can take a look at your specific idea and tell you if it is a slam dunk or not. Crypto tokens are a new and ever changing world. One of those platforms is Ethereum which has a toolkit that lets a company create a digital coin.

Archived from the original on 30 August The rules of supply, demand, and utility still apply. Blockchain Quick Reference: In centralized banking and economic systems such as the Federal Reserve System , corporate boards or governments control the supply of currency by printing units of fiat money or demanding additions to digital banking ledgers. Although Switzerland was previously viewed as a friendly jurisdiction to coin offerings, the Swiss Financial Market Supervisory Authority announced an investigation of an unspecified number of coin offerings in September , and would examine whether these offerings were in compliance with Swiss regulations. Carey Olsen. Login Advisor Login Newsletters. Crypto Trading Guide: Retrieved 11 July Hard Forks in Cryptocurrency: The company which provided the ICO may offer a service allowing you to transfer the token back to the previous cryptocurrency, or you may need to go to another digital currency exchange in order to make the transfer. The value of a reputation token is that you can trust that the person bearing it is who they say they are. A Wired article predicted in that the bubble was about to burst. Concerns abound that altcoins may become tools for anonymous web criminals.

This functionality of creating your own tokens is made possible through the use of smart contracts ; programmable computer codes that are self-executing and do not need any third-parties to operate. We'll see. Verge Vertcoin. Ethereum Ethereum Classic. Related Terms Birake Birake bills itself as the first 'white label' cryptocurrency exchange. He believes that real-world assets will eventually be tokenized which could boost security, the ability to move them globally, and create new business models. Ultimately, the SEC said: We are aiming to make cryptocurrencies accessible to a wide array of users, including those who are brand new to crypto. We hope that in the future, token creator's will be able to focus on their networks, products and users, when liquidity is fair and free for all. International Business Times. Shortly after, South Korea followed, banning raising money through virtual currencies.